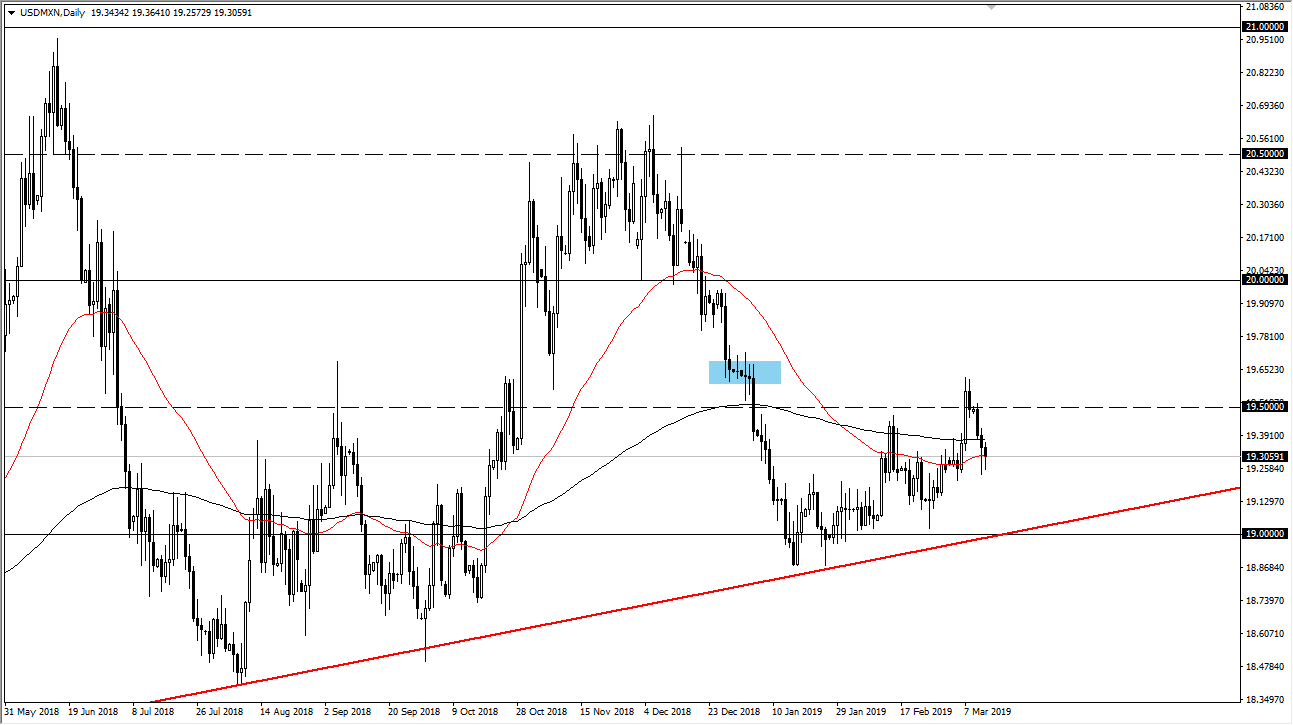

The US dollar initially fell against the Mexican peso during trading on Wednesday, as we continue to test the 19.25 pesos level. This is an area that has been important a couple of times, in the scene of a recent surge higher. We have made a complete round-trip now, so it’s very interesting to see what’s going to happen next.

Currently, the 50 day EMA is slicing through what looks to be a hammer forming on the daily chart. If that’s going to be the case, then it’s obvious that the buyers are willing to defend this area. I think at this point the buyers are still very much in control, a lease based upon the uptrend line that has held against such stringent selling. Beyond that, you have to worry about the idea of emerging markets struggling a bit, as there are a lot of concerns around the world when it comes to global growth. If that’s going to be the case, then places like Mexico are going to suffer at the hands of the financial markets.

With the uptrend line underneath slicing through roughly 19 pesos, I think there is a lot of psychological importance right around that area. I also see major clustering between here and there, and the fact that the buyers have been stepping in at basically 19.25 pesos tells me that the next move could very well be to the upside. I think we will probably make another attempt at the 19.50 pesos level, which is where we had seen some selling. This is a short-term move, but it certainly looks as if it’s a very possible move. If we were to break down below the 19.25 pesos level though, I think we would “reset” closer to the 19.15 pesos level.