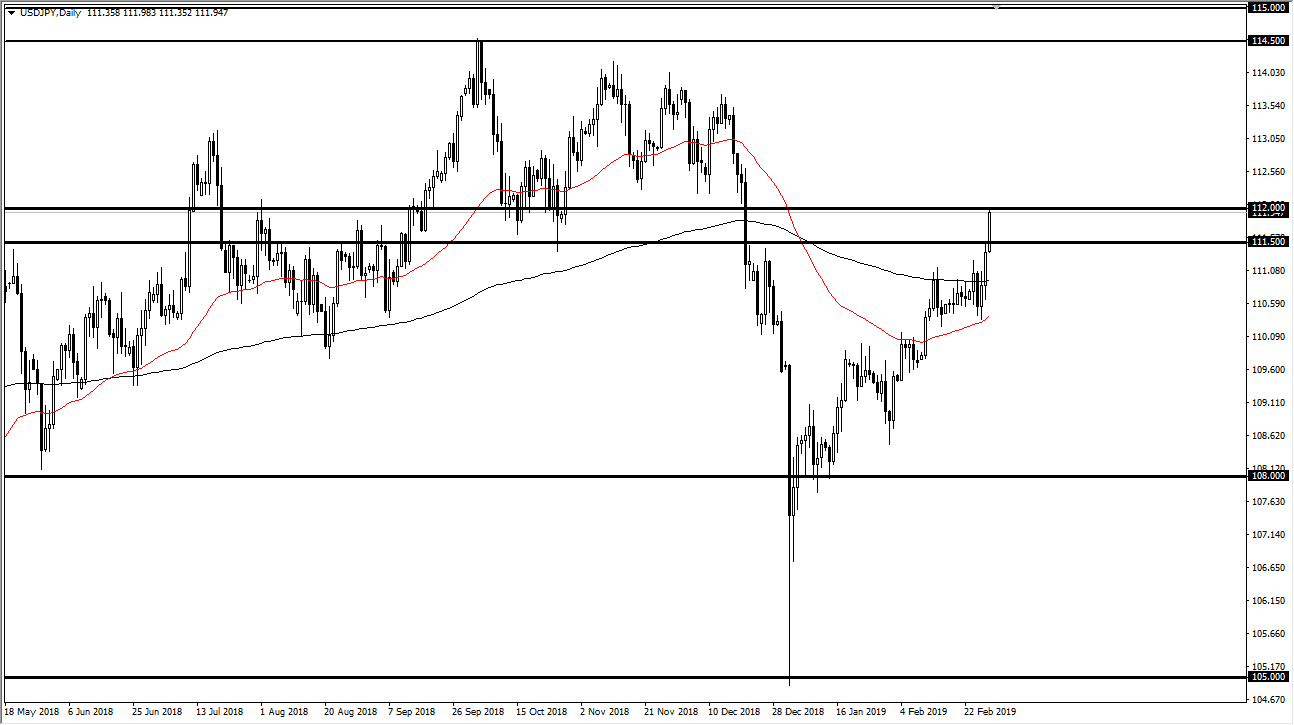

USD/JPY

The US dollar has rallied significantly during the trading session on Friday, slamming into the ¥112 level. That’s an area that has been important in the past, as we have seen a massive bearish candlestick that kicked off a major meltdown at this level. We have essentially done a “round-trip”, and that of course is a very strong sign. The question now is whether or not we can continue to go higher, and of course it certainly looks as if we are going to have a go at it, but these nosebleed levels are really difficult to get excited about. Beyond that, you should also pay attention to the S&P 500, which seems to be moving right along with this pair over all. If we can break out over there, then I think this pair probably takes off. However, if we were to break below the ¥111 level, then I think will reach towards ¥110 underneath, and break down significantly from there. We desperately need to pull back a bit to pick up more buyers.

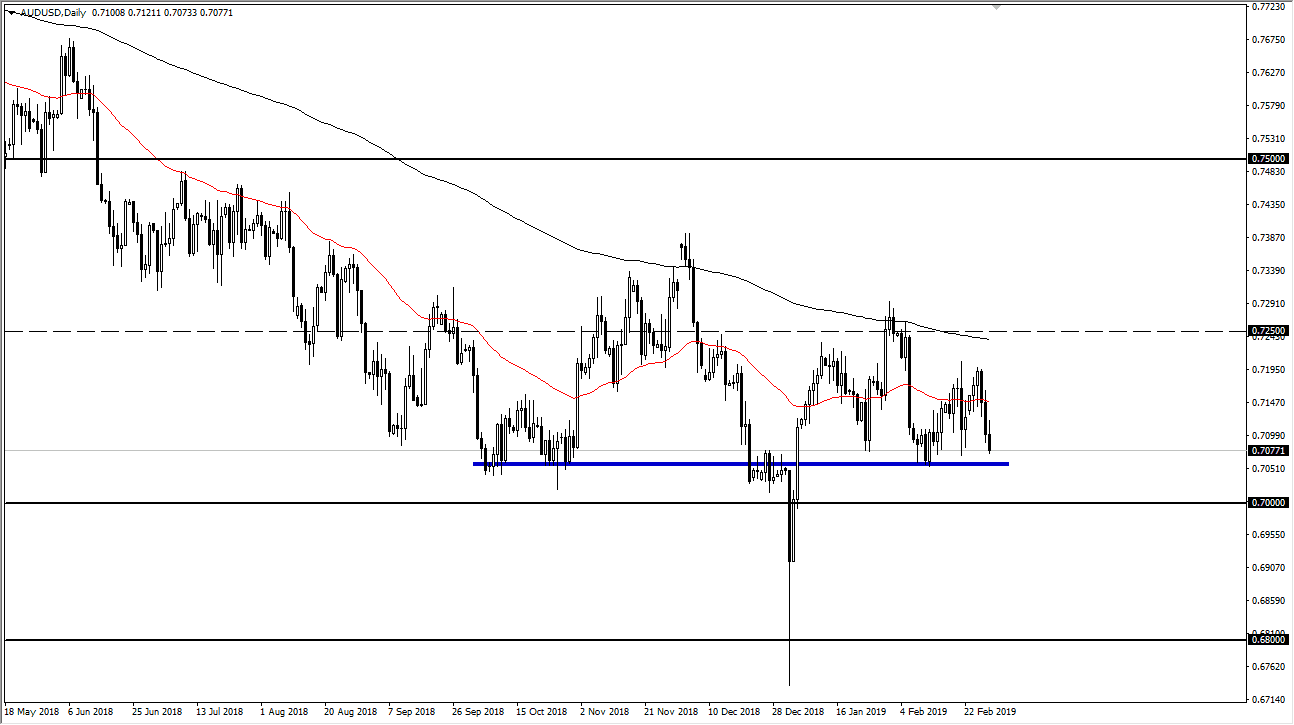

AUD/USD

The Australian dollar initially rallied during the trading session on Friday but then turned around to fall apart as the US dollar strengthened. However, we are getting very close to some major supportive areas, starting at the 0.7050 level, and extending down to the 0.68 level. At this point, I am buying the Australian dollar on these dips, as this support shows up on charts going back years on the monthly timeframe. With that being the case, I think that we will eventually find buyers rather soon, and if we get any type of good news coming out of Asia or on the trade front, this pair will bounce hard. Because of this, I am not a seller, rather I am a buyer of dips as we are seeing right now.