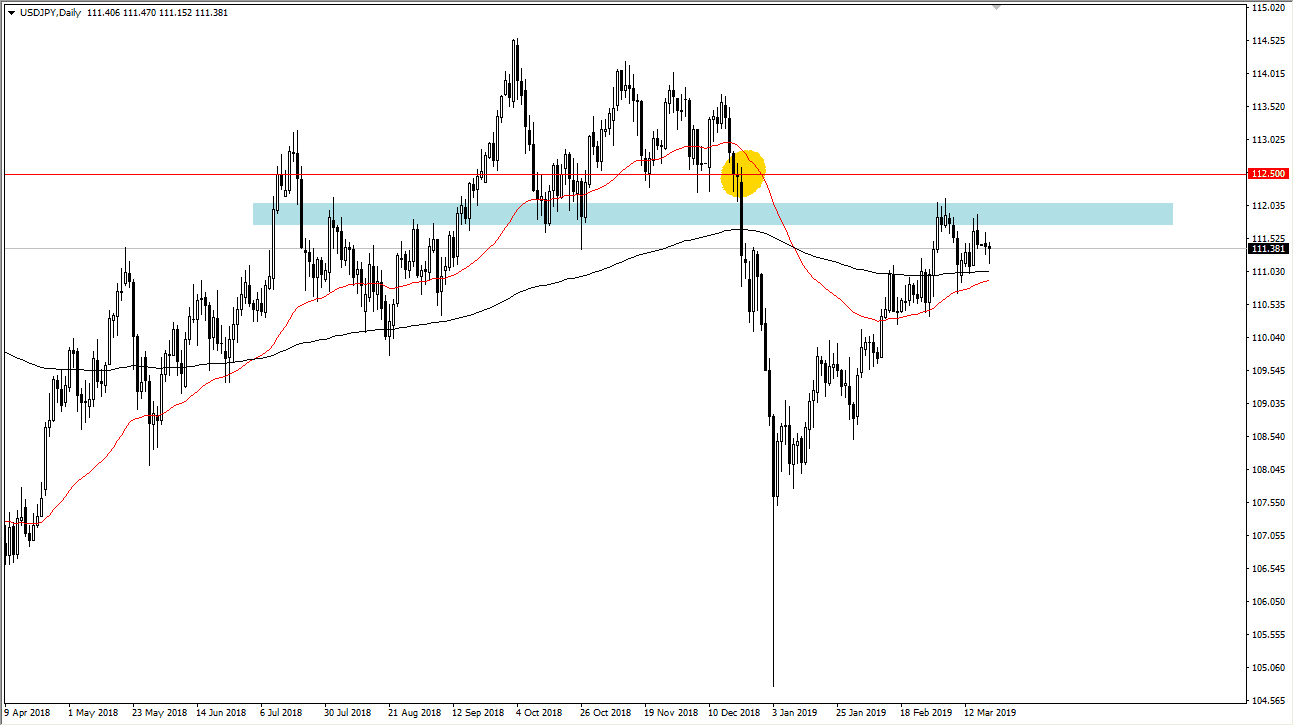

USD/JPY

The US dollar pulled back initially during the trading session on Tuesday against the Japanese yen but found enough support just above the 200 day EMA to turn around of form a bit of a hammer. That’s a very bullish sign, but we also have a certain amount of resistance just above as well. That being the case, it does look like we are trying to grind higher, and if the stock market can finally break out and go much higher, it’s very likely that the USD/JPY pair will follow right along with it. On the other hand, if we break down below the ¥111 level, that could send this market down to the ¥110.50 level, followed by the ¥110 level, and possibly even the ¥108 level. In the short term, this looks like a market that is going to chop sideways overall.

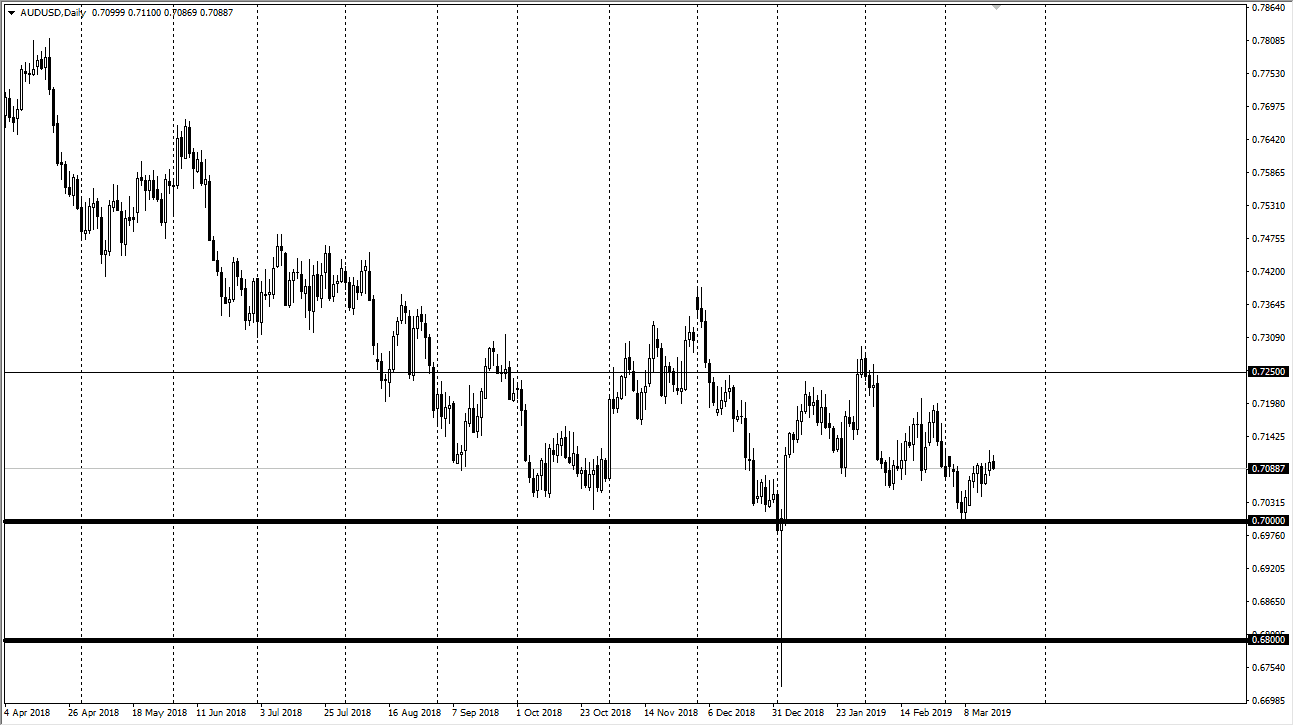

AUD/USD

The Australian dollar fell a bit during the trading session on Tuesday, as the 0.71 level has offered a bit too much in the way of resistance. However, we have a massive amount of support below starting at the 0.70 level, which extends all the way down to the 0.68 level based upon longer-term monthly charts. With that in mind, and the possibility of Chinese stimulus helping the Chinese economy, I believe that the Australian dollar is quietly being accumulated by institutions in this area.

I have been a buyer of dips, taking small profits along the way. I do plan on building a bit of a core position given enough time and recognize that if we can clear the 0.7250 level, it’s very likely that the market will have changed the trend or have at the very least made massive strides in doing so. I have no interest in selling right now.