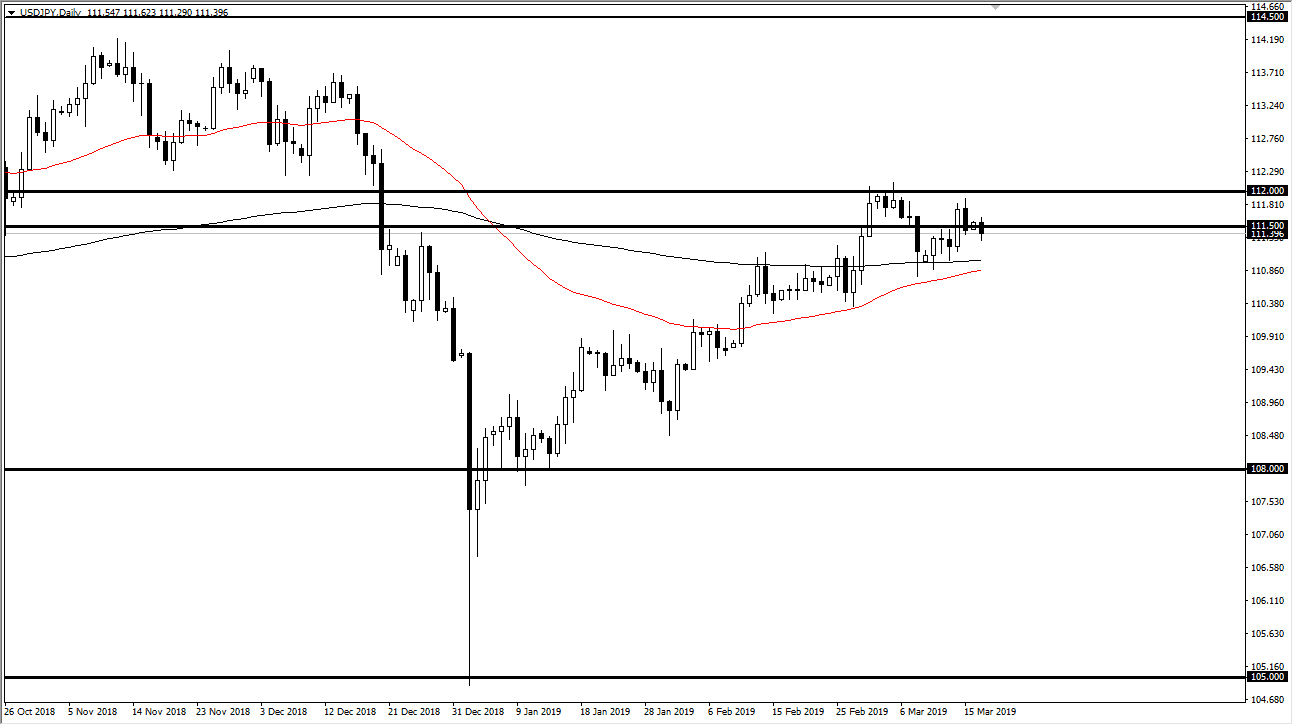

USD/JPY

The US dollar fell during the trading session on Monday, reaching below the 100 level ¥0.50 level. At this point, the market has plenty of support underneath though, and I think that it’s likely that even if we break down below, it’s very likely that the 200 day EMA will offer support as well, which is currently sitting at the ¥111 level. On the upside, the ¥112 level of course is massive resistance, so in this area we continue to see a lot of noise, and I think that we need some type of impulsive candle that breaks out of this range to start trading. Otherwise, you are looking at short-term scalping back and forth, at best on short-term charts at best. Overall, if we do break the ¥112 level, then we go to the ¥113.50 level. On the downside, if we break down below the 200 day EMA, then it’s very likely that we go down to the ¥110 level, and then the ¥108 level.

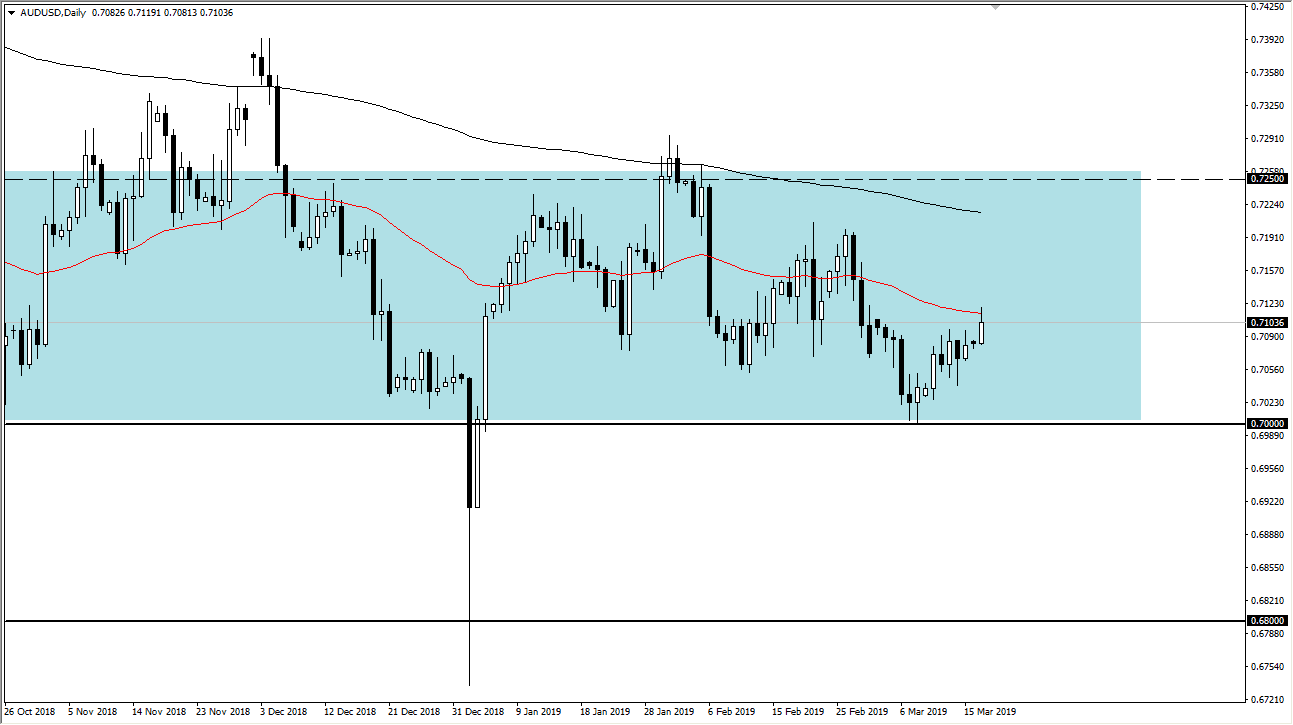

AUD/USD

The Australian dollar rallied significantly during the trading session on Monday, reaching above the 50 day EMA before pulling back a bit. However, we could find a bit of selling in this general vicinity as we are hanging about the psychologically important 0.71 handle. For me, a pullback at this point is going to be a nice buying opportunity as the 0.70 level has been massive support and extends down to the 0.68 level underneath. That is an area that appears on the monthly charts, so it’s a situation where I continue to buy this market on the dips, as the Australian dollar is in the process of bottoming longer-term from everything that I see. Longer-term, I believe we go looking towards the 0.7250 level.