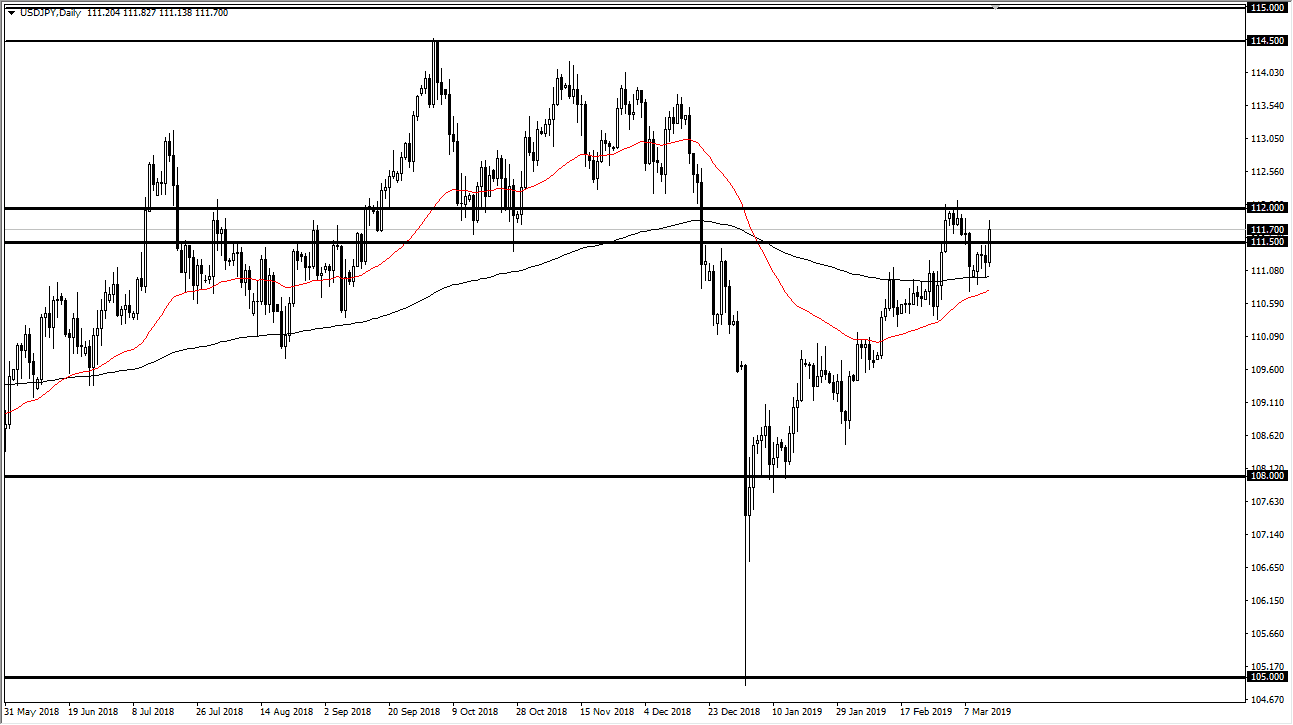

USD/JPY

The US dollar has rallied significantly during the trading session on Thursday, breaking above the ¥111.50 level, an area that extends all the way to the ¥112 level. In other words, we are running into a bit of a brick wall, and I think it’s going to be difficult to crack above the ¥112 level, an area that has been very reliable so far. If we do get above there, the market then goes to the ¥113.50 level next. That is the next major barrier that I see on the charts. On the other hand, we break down below the 200 day EMA, then I think the market probably goes down to the ¥110 level. Ultimately, this is a market that will make a serious decision eventually, but right now it is just going back and forth.

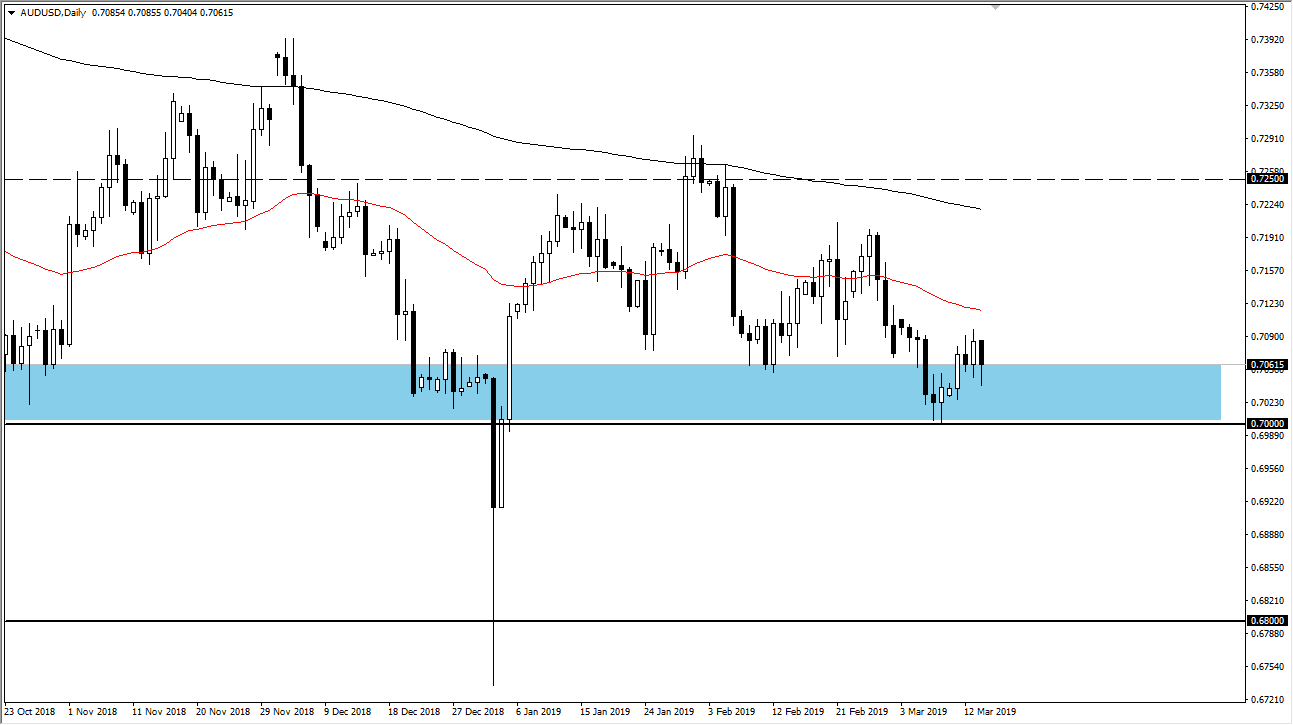

AUD/USD

The Australian dollar has pulled back a bit during the trading session again, but as you can see we have bounced from the lows yet again. This is a market that continues to find plenty of support underneath, and it extends down to the 0.68 handle. Because of this, the market finds itself well supported on a monthly timeframe in this area. With that in the case it’s likely that we will continue to see buying every time we did. If we can break above the 0.7250 level eventually, that would be a trend change that should send this market much higher.

Ultimately, I am a buyer of the Aussie and have no interest in shorting because I think we are in the process of trying to change the overall trend for higher time frames. These moves are almost always very noisy, which is exactly what we have been seen as of late.