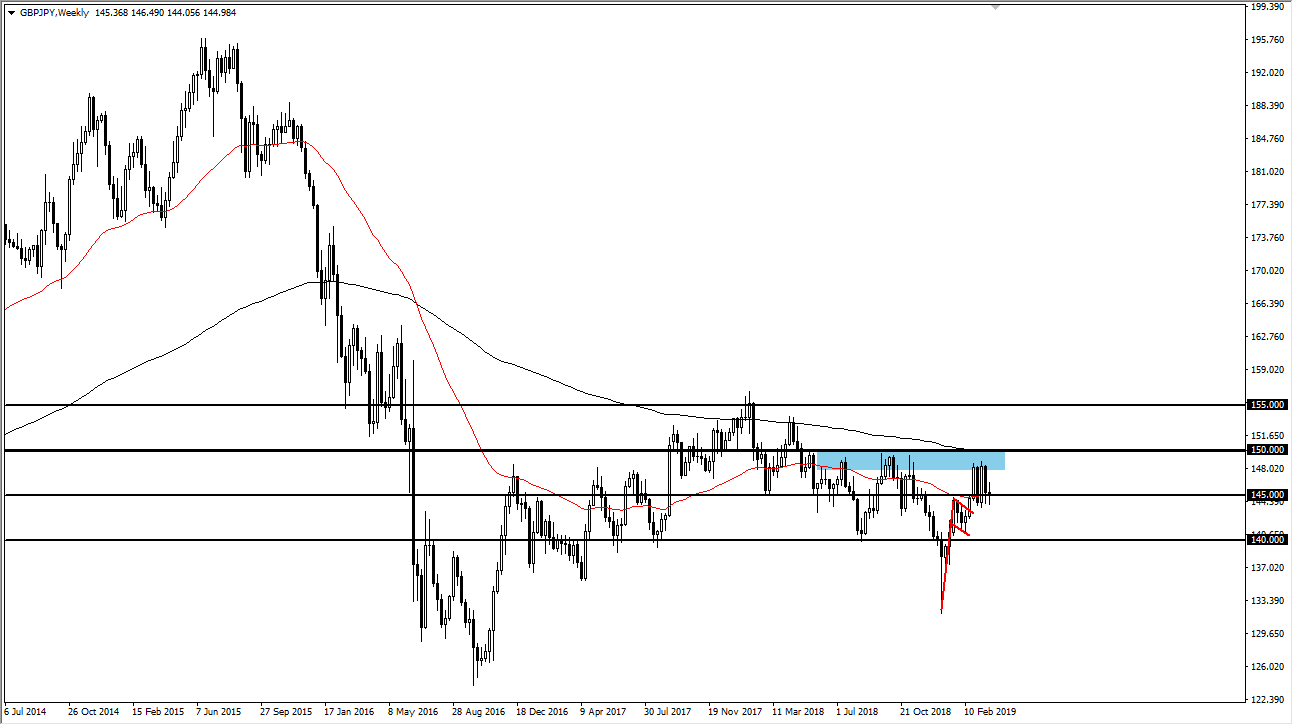

The British pound has gone back and forth during the course of the month for March, as the ¥144 level has offered a major support, while the 148 level has caused a significant amount of resistance. Ultimately, this is a market that I think is simply waiting for some type of resolution to the Brexit situation. That won’t be much of a surprise, but we do have some technical levels to pay attention to that could give us some clues.

Ultimately, I do think this pair breaks out to the upside. As you can see on the chart I have a bullish flag drawn, and we have in fact broken above it. That flag measures for a potential move to the ¥155 level, but obviously we have a lot of trouble picking up the pace as the Brexit situation continues to be very noisy and of course very troublesome. I think at this point the market is simply waiting for some type of resolution to start buying the British pound because it’s historically cheap.

If we break down below the ¥144 level, then it’s possible that we could break down. At that point, we could go down to the ¥140 level, and of course invalidate the bullish flag. However, I think that most of what we will see during the month of April will be back and forth choppiness as we struggle to find some type of clarity. Eventually though, based upon the technical pattern I think that we will try to break above the ¥150 level, and once we do that should open the door to the ¥155 level eventually. I don’t know if we get that during the month of April, but I certainly believe that the buyers are much more aggressive than the sellers.