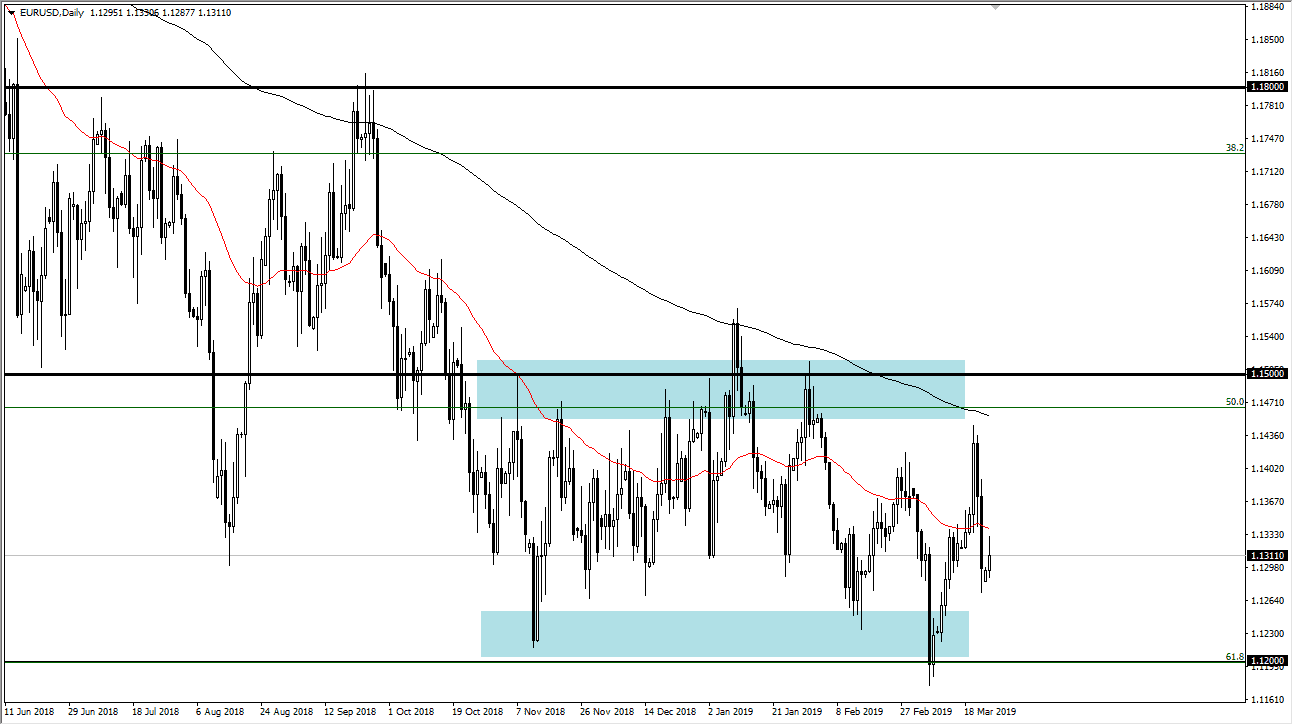

EUR/USD

The Euro rallied a bit during the trading session on Monday after initially gapping lower at the open. However, we have given back quite a bit of the gains as the markets seem a bit confused. Right now, we are still very much in the middle of a larger consolidation area, with the 1.12 level underneath being massive support, while the 1.15 level above is massive resistance. We have recently been drifting a bit lower, but at the end of the day we still have a lot of buyers underneath.

It is because of this that I find myself on the sidelines in this pair, simply waiting for some type of signal to either buy or sell based upon the longer-term support and resistance barriers. It is not until we break out of this area that I would put on a longer-term trade.

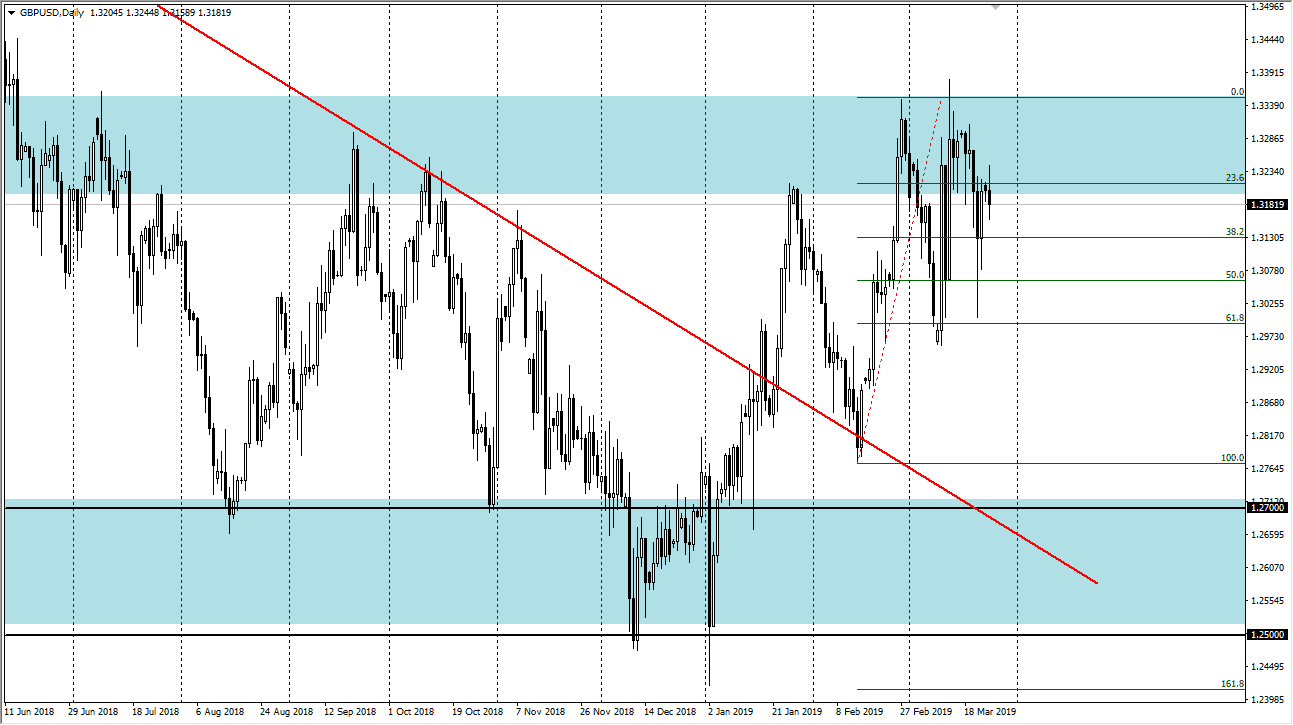

GBP/USD

The British pound had a very volatile day as the drama with Theresa May continues. At this point, the markets are very confused, as machines trade headlines back and forth. That being the case I believe that the analysis is still the same: we continue to find buyers every time we did. The 1.30 level underneath is massive support, just as the 1.3350 level above is resistance. Ultimately, it looks as if we are trying to build up enough pressure to finally break out to the upside. However, if we break down lower, then it’s likely that we could go down to the 1.28 level underneath.

Volatility will of course continue to be a major part of trading the British pound, but we already know that the Federal Reserve is on the sidelines, saw the US dollar should only have a limited amount of support.