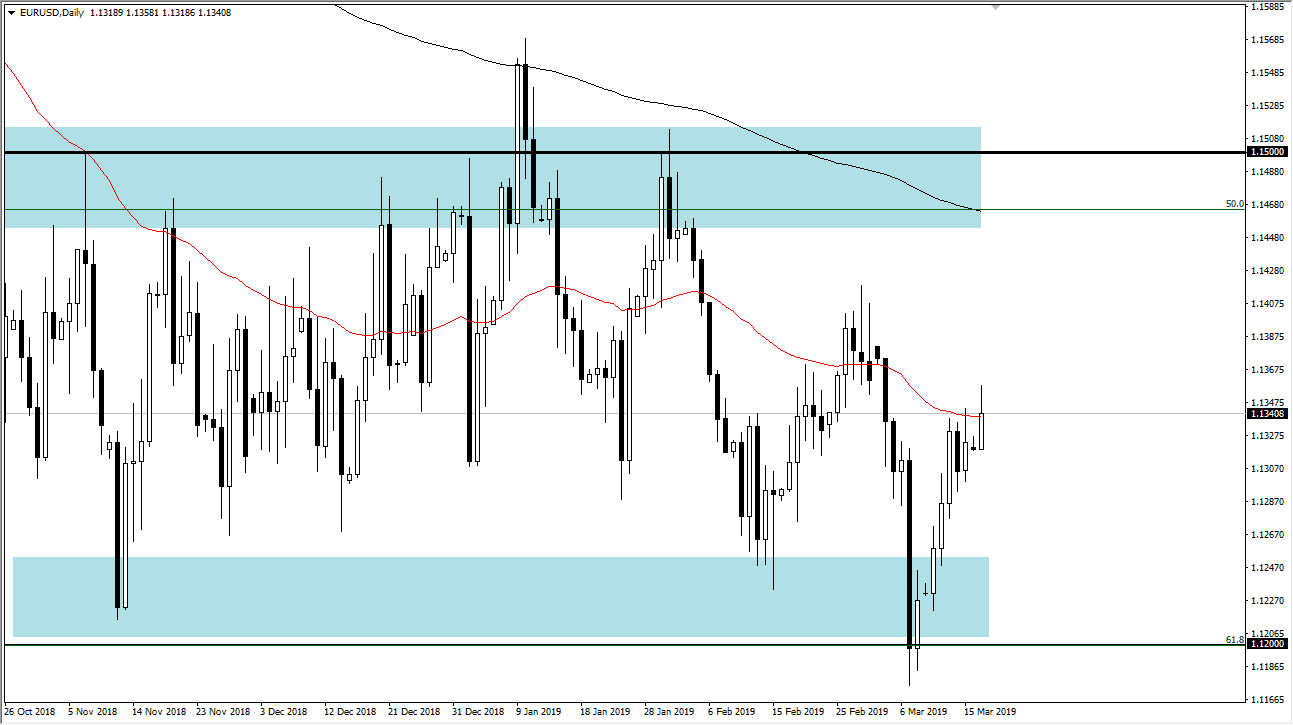

EUR/USD

The Euro rallied during most of the session on Monday, breaking above the 1.1350 level and the 50 day EMA in the process. However, we have given back a bit of the gains and it looks like we may possibly roll back just a bit. Longer-term though, the biggest fight that we have right now is the fact that we are in the middle of the overall consolidation which starts at the 1.12 level on the bottom, with the 1.15 level above being massive resistance. I believe that if we can break above the top of the candle stick for the Monday session, we will probably go looking towards the 1.14 handle. Otherwise, we will probably find buyers closer to the 1.1250 level which should be the beginning of significant support.

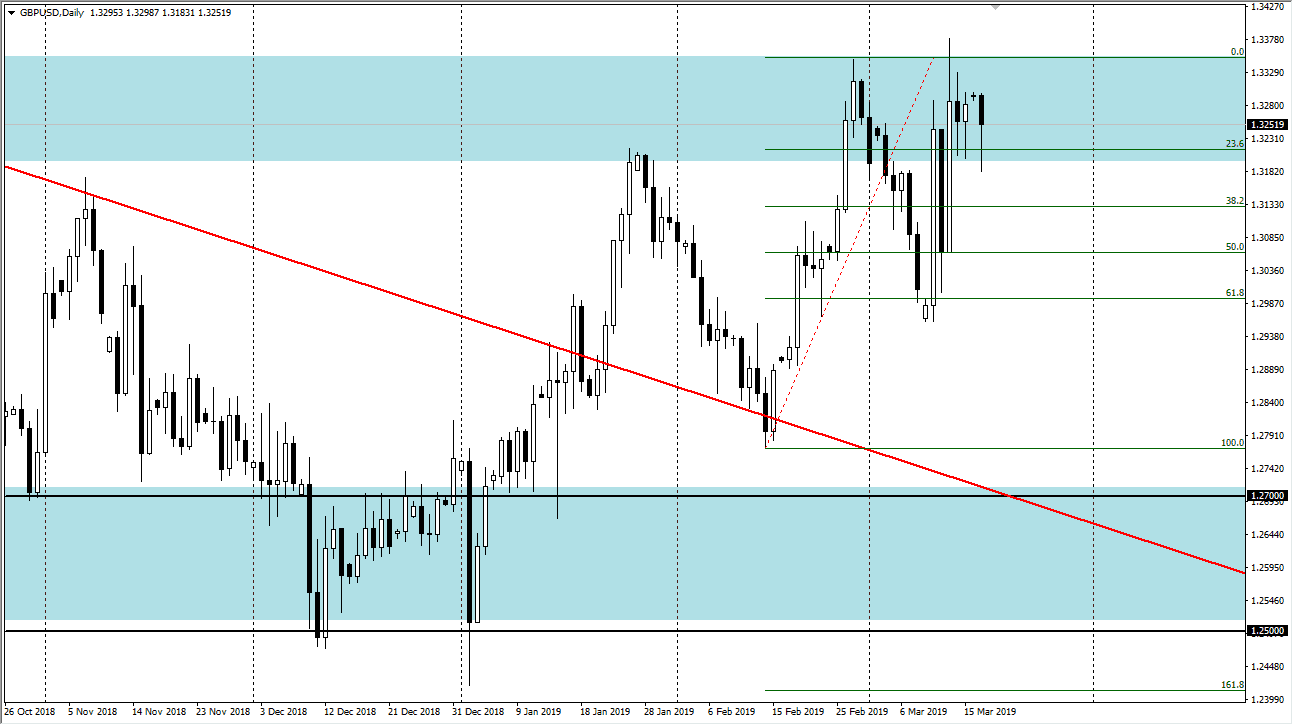

GBP/USD

The British pound pulled back during most of the trading session on Monday, finding support near the 1.32 handle, reaching towards an area that has begun a significant amount of consolidation. To the upside, the 1.3350 level above is resistance, and breaking that level could send this market looking towards the 1.35 handle. With that in mind, I do like the British pound but with all of the noise coming from the Brexit it’s likely that we will continue to see a lot of back-and-forth trading.

The candle stick from the last couple of sessions have all look like cameras though, so this tells me we are more than likely going to break out eventually. I like the idea of doing so and as the markets are probably going to focus on the Federal Reserve this week, it’s likely that if they are dovish enough that will send the greenback lower against most currencies, with Sterling included.