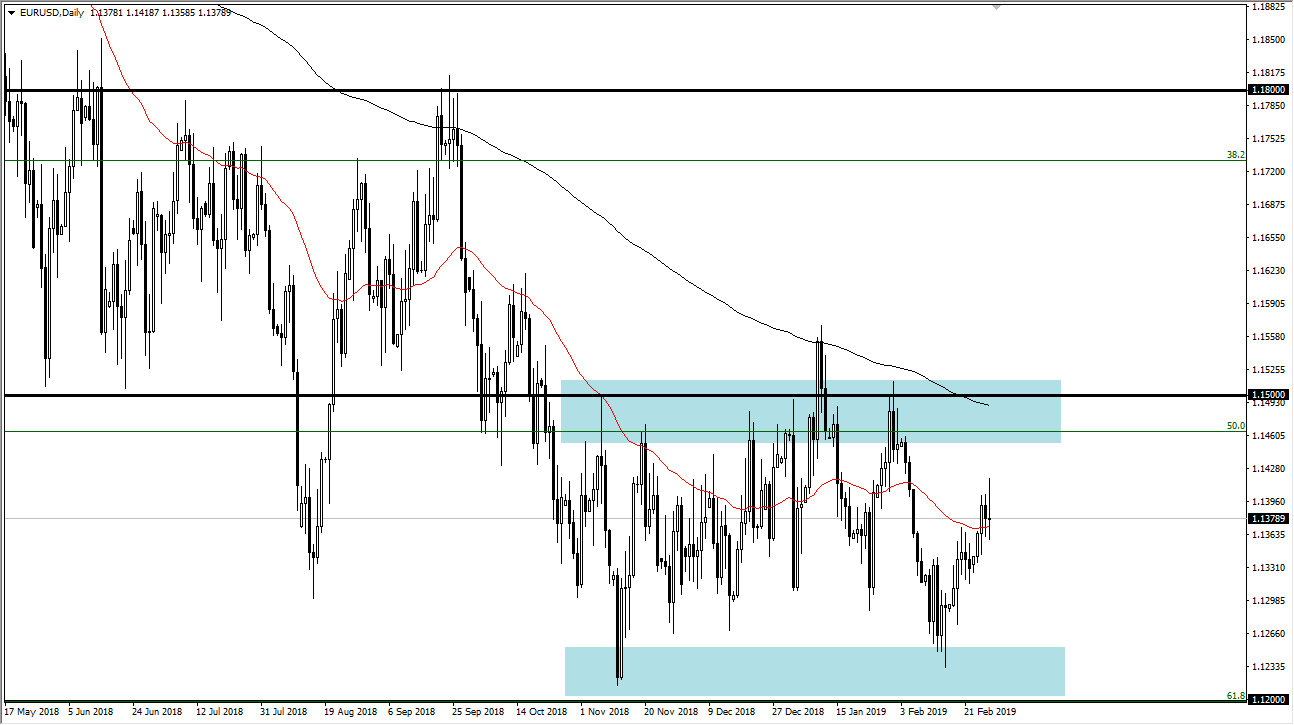

EUR/USD

The Euro went back and forth during the trading session on Thursday, as we continue to see a lot of noise. The 1.14 level has caused a bit of selling, and now we find ourselves hanging about the 50 day EMA. The market is right in the middle of the overall consolidation region, which I think it extends from the 1.12 level on the bottom and the 1.15 level above. At this point, I think that the market may pull back slightly, but buyers should be more than willing to pick up value. The 1.12 level underneath features the 61.8% Fibonacci retracement level which is a huge demand level by institutions on the weekly and monthly charts as well. Because of this, I like buying this pair on dips and we may get one here.

GBP/USD

The British pound fell slightly during the trading session on Thursday, as the 1.3350 level has caused resistance. By pulling back just a bit, it looks as if we will remain somewhat contained, but I believe that containment is an opportunity to pick up the British pound at lower levels. I think that the 1.30 level underneath should be a nice buying opportunity, and I believe that we could continue to go to the upside. We have broken above the downtrend line that I have marked on the chart, tested it, and then reached to the upside.

Looking at this chart, I do believe that the entire trend has change, and I think that it’s only a matter of time before buyers pick this market up. I have no interest whatsoever in shorting the British pound, and what I’m hoping for is some type of headline that as the machines selling. At that point I more than willing to pick up a bit of value.