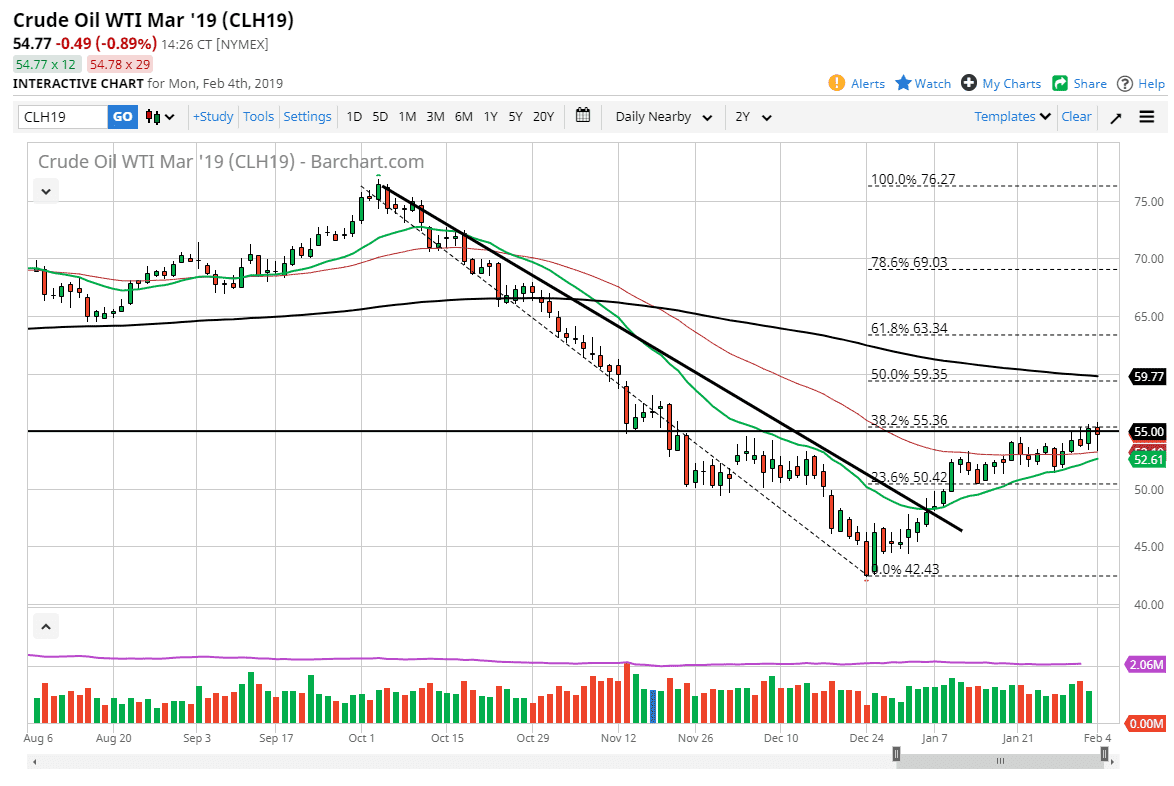

WTI Crude Oil

The WTI Crude Oil market initially fell during the trading session on Monday, testing the 50 day EMA. We have turned around to form a massive hammer now, and it looks as if we continue to try to build a significant amount of pressure to finally break out for a bigger move. At this point, if we pull back, it should be thought of as a buying opportunity. It looks as if we are trying to build major momentum, perhaps firing off a “beach ball trade”, which is when a trade breaks out to the upside after being held down for too long. This is a lot like holding a ball under the water, when you finally let it go it shoot straight up in the air. I think we may be looking at a move like that in the crude oil market eventually. Nonetheless, every time we pull back it seems as if buyers are willing to step in somewhere near the $53 region, so I am a buyer of those dips.

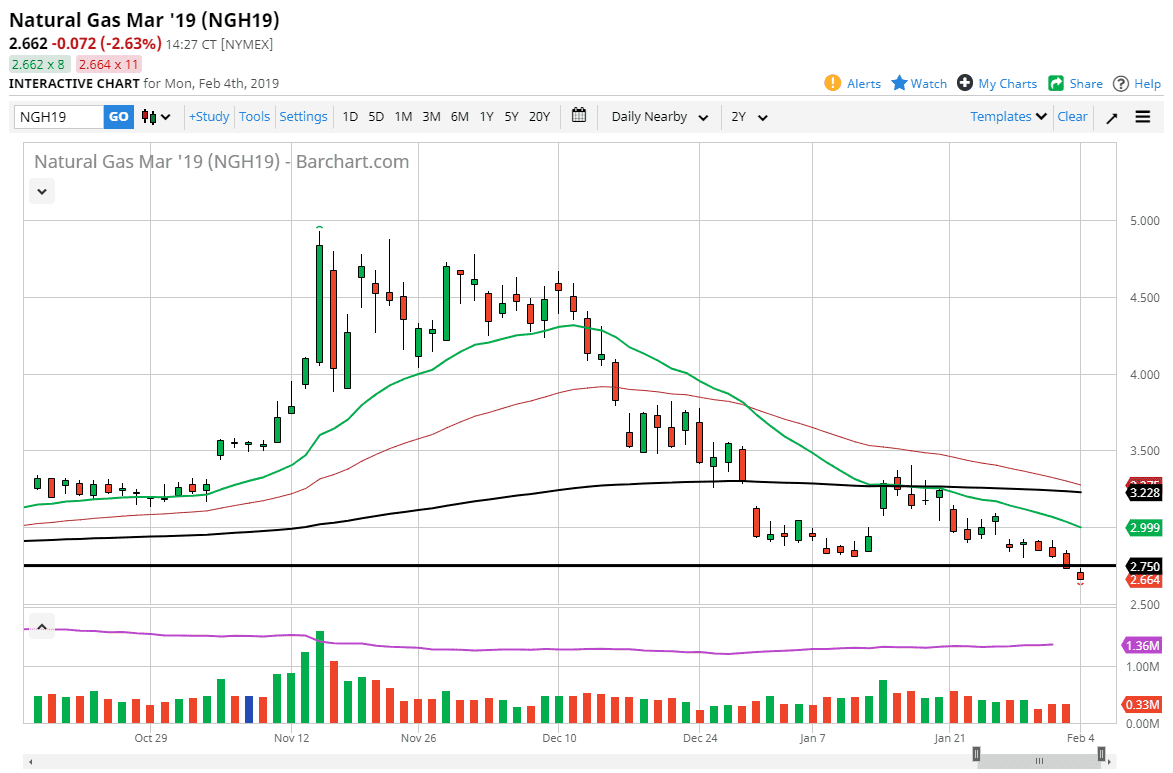

Natural Gas

Natural gas markets broke down below the $2.75 level, gapping below there right off the bat. We continue to see sellers in this market as we tried to turn things back around and break above that level. At this point, I suspect that we are probably going to go looking towards the $2.50 level underneath which is massive support on the longer-term chart. At this point, it looks as if the market is completely broken but I think it is much easier to sell rallies as they occur. Given enough time I do think that we will get a bit of a relief rally, but that should only be an opportunity to take advantage of the massive downtrend.