WTI Crude Oil

The WTI Crude Oil market initially fell hard during the trading session on Monday, but we have seen support below the $52 level yet again. Because of this, I think we continue to grind in this general vicinity and I anticipate that the market may very well rally towards the $55 level again. That’s an area that has seen a lot of resistance, so I think we will continue to struggle overall. That being the case, I anticipate that we are essentially stuck in this range, and that it’s going to take a lot of momentum to finally break out of it. Essentially, I assume that this market is going to stay within the trading range as long as we are above the $50 level, and below the $55.25 level. Overall, I think we are simply just killing time in this area and trying to figure out where to go next.

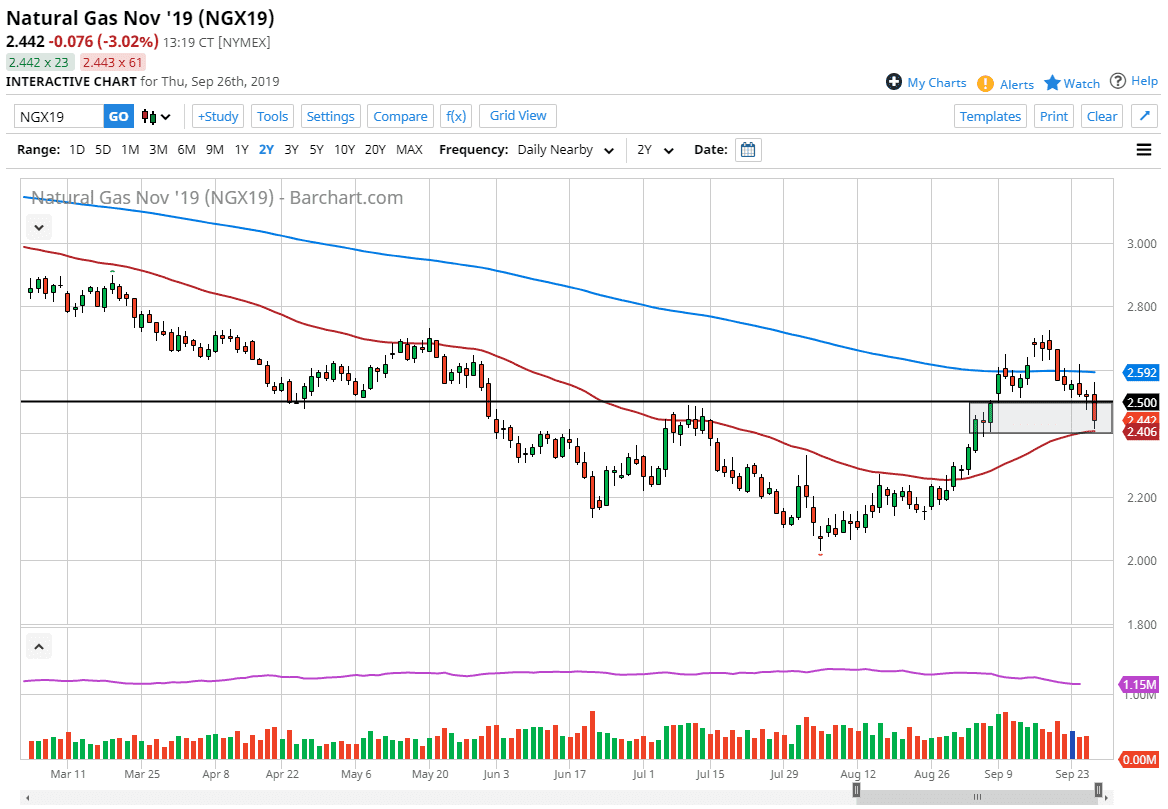

Natural Gas

Natural gas markets initially gapped higher to kick off the week, and then reached towards the $2.75 level. This is an area that has been important more than once, so it’s not a huge surprise that we sold off from there. We ended up forming a bit of a shooting star, and because of this it looks as if the buyers have failed yet again. At this point, I think it’s only a matter time before the sellers come back in on rallies and that’s how I’m approaching this market. I have no interest in buying at, and quite frankly I would rather see the market reached towards the $3 level and show signs of failure to start selling than try to do it here. At this point, we have a massive amount of support at $2.50.