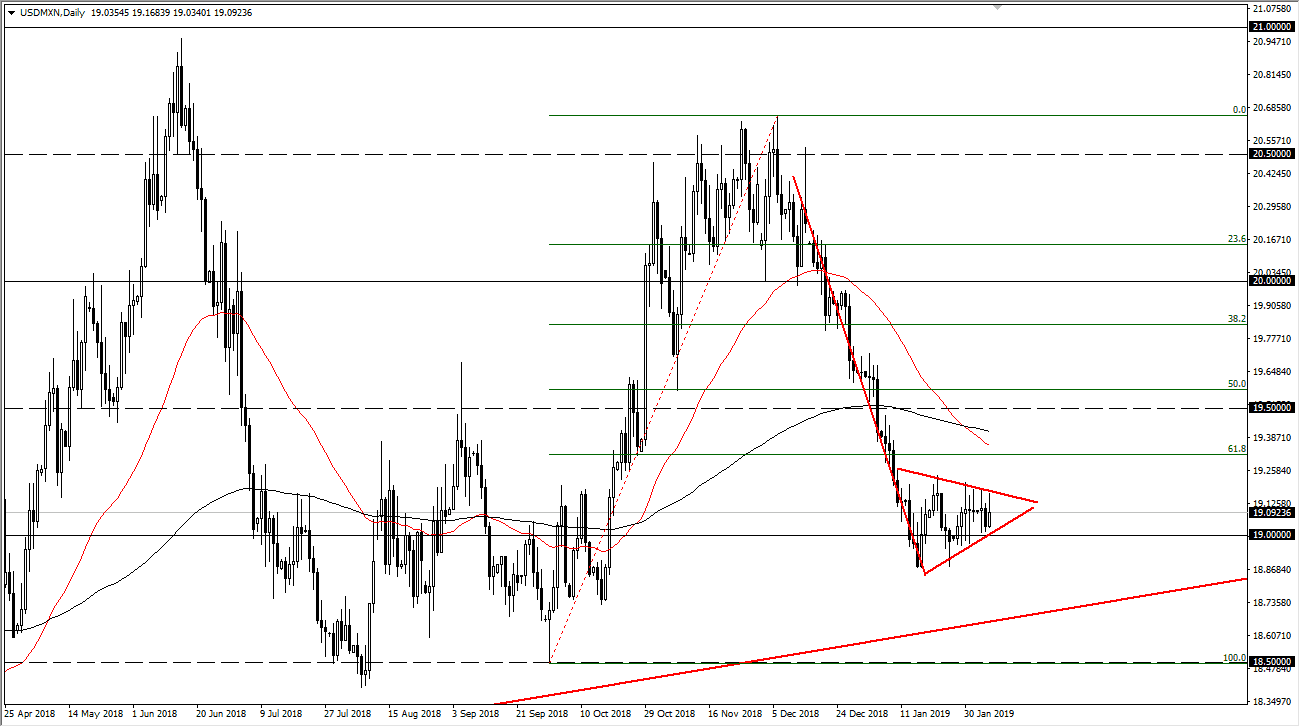

The US dollar has found a bit of strength during the trading session on Wednesday, against not only the Mexican peso but many of the other currencies around the world. However, the US dollar has fallen against the Mexican peso quicker than it did many of the other currencies later in the day, and I am now starting to envision a potential bearish pennant. There is a major uptrend line just below, but if this pennant does in fact kick off, we could go much lower.

I think the Federal Reserve has a lot to do with what’s going on here, and the potential breakout of crude oil that has been feverishly pressing against major resistance. In fact, this could be a bit of a “double whammy” for this market, sending the greenback much lower. Keep in mind this pair does tend to grind a lot, so looking for quick gains probably isn’t the way to go.

In a world where the Federal Reserve looks dovish again, people were going to start looking out into emerging markets for yield. Mexico is a great place to do that as the interest rate is currently over 8%, and therefore it’s a bit of a carry trade play. If the Federal Reserve keeps interest rates artificially low in the United States further, it will in fact force people into risk appetite based positions.

The WTI and the Brent crude oil markets both continue to show signs of resiliency, slamming into a major neck line on an inverse head and shoulders. This would obviously help the peso as well, as Mexico has a large oil producing industry. Because of this, I think that we have a likelihood of a movement to much lower levels, perhaps to the 17.50 pesos level longer-term. Obviously, we need to break down below the pennant, and then the uptrend line so this isn’t going to be easy. We have just formed a death cross, so that of course is very negative as well.