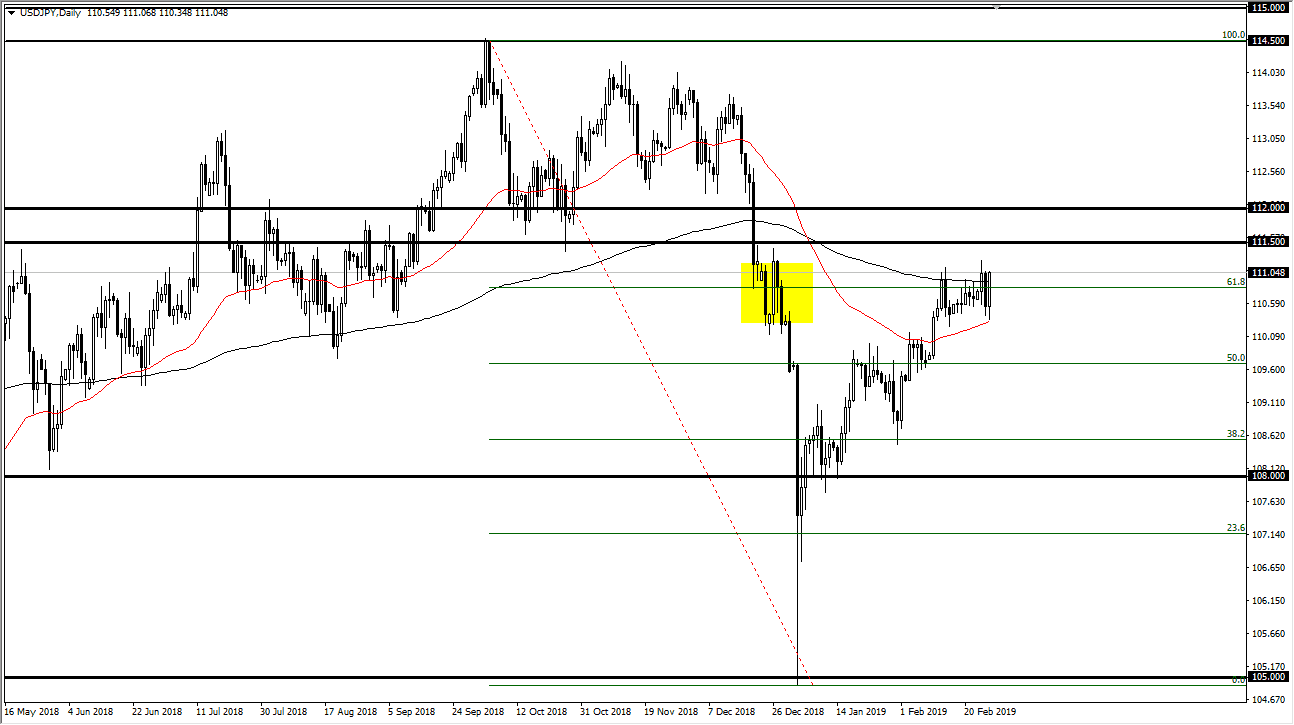

USD/JPY

The US dollar initially dipped during trading on Wednesday, touching the 50 day EMA. However, we found enough buyers underneath the turn things around and grind towards the ¥111 level. This is the top of the overall consolidation area that we have been in, so therefore it’s difficult to imagine putting money to work at this point, unless you are looking for signs of exhaustion. With Jerome Powell talking in front of Congress today, that could have been one of the drivers of the US dollar lifting here, but at this point I think that we continue more of the same grinding that we have seen. However, if we can break above the ¥111.50 level, then it’s possible that we may continue to go a little bit higher. As far as selling is concerned, I need to see a break below the red 50 day EMA.

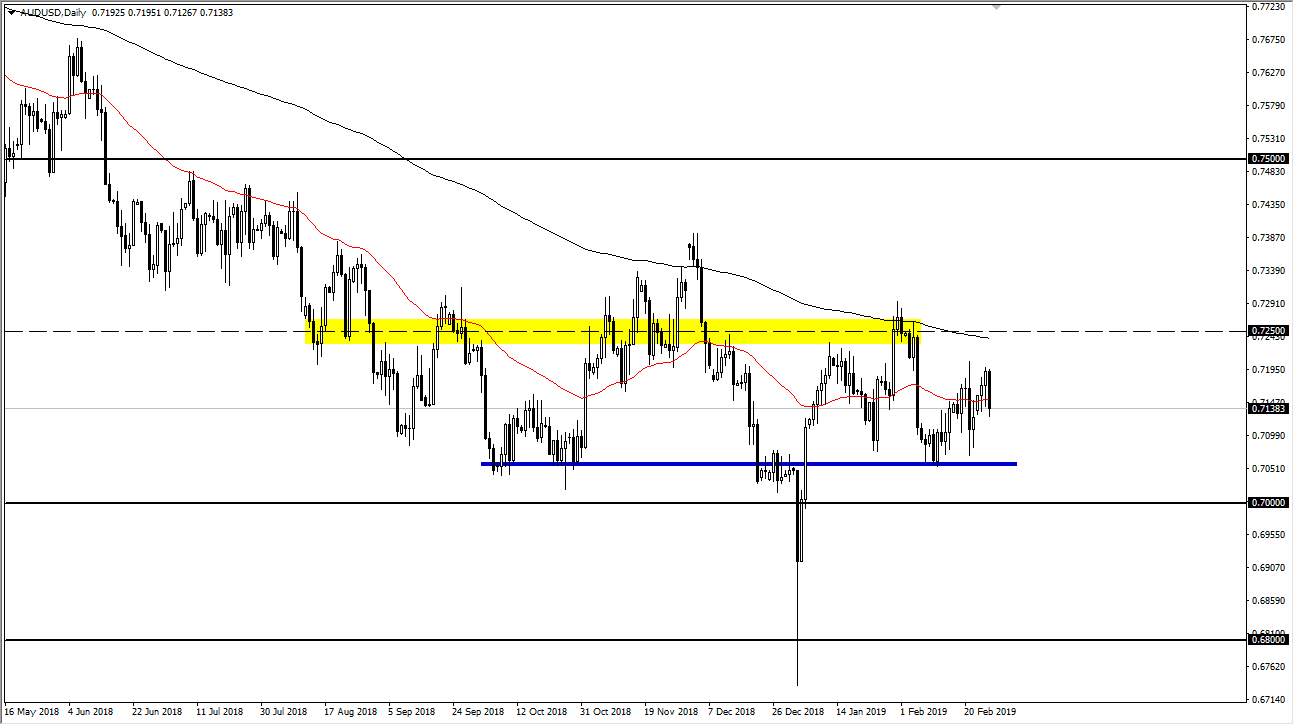

AUD/USD

The Australian dollar broke down significantly during the trading session on Wednesday, as we continue to bounce around the 50 day EMA. The market looks likely to continue to pull back slightly though, but I also believe that the 0.7050 handle is the beginning of major support. I think that support extends all the way down to the 0.68 handle. With that being the case, I like buying dips in this pair, and I do believe that the US dollar loses a little bit of strength on pullbacks. Beyond that, we have a gold market that is grinding higher, and that could eventually lift the Aussie as well. Overall, this is a market that has a lot of resistance above near the 0.7250 level which coincides nicely with the 200 day EMA. I still believe in buying pullbacks in this market as the support level underneath is a major floor on the monthly chart.