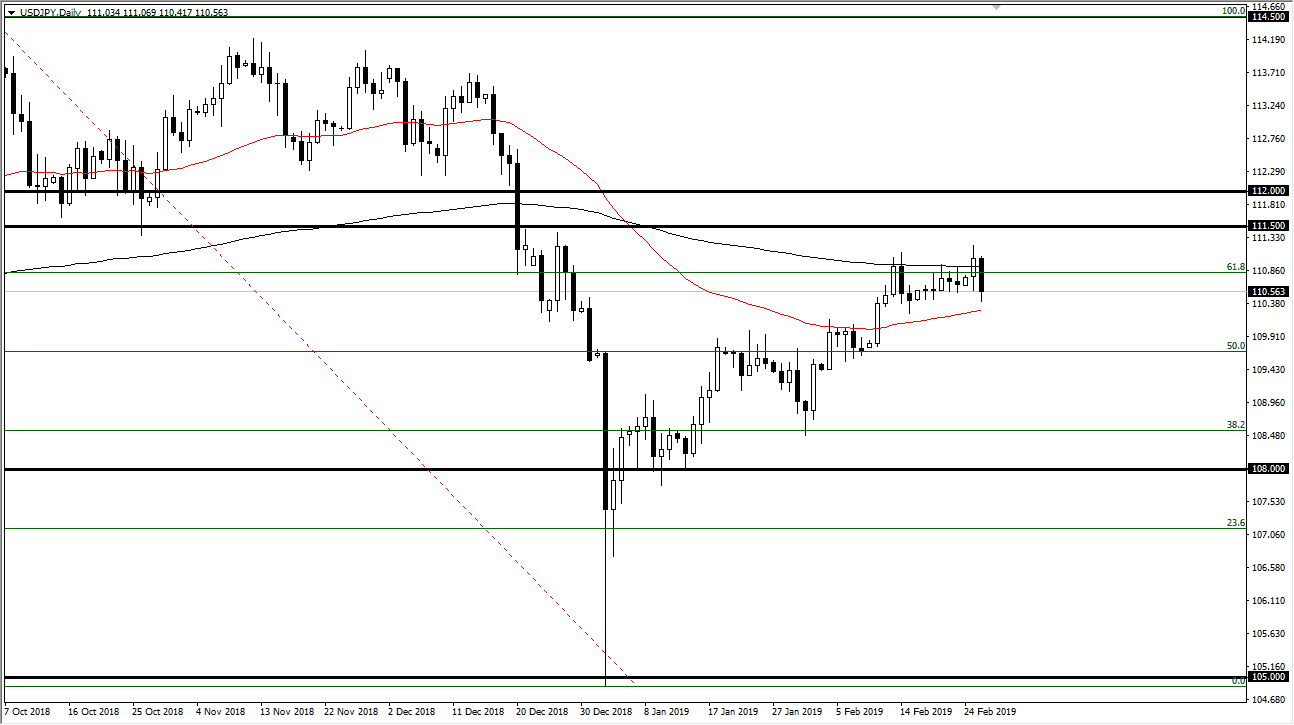

USD/JPY

The US dollar fell during the trading session on Tuesday as Jerome Powell continues to signify the Federal Reserve willing to be dovish. If that’s going to continue to be the case, it’s very likely that this pair will eventually fall. However, one thing that I am paying the most attention to is that the 200 day EMA seems to be offering significant resistance, just as the 50 day EMA seems to be offering support. With that being the case, it’s likely that we continue to go back and forth but it does look like the sellers are starting to get a bit more aggressive. If we can break down below the 50 day EMA, it’s very likely that we will take out the ¥110 level, sending this market down to the ¥108.50 level. At this point, it looks like short-term rallies will probably continue to be sold.

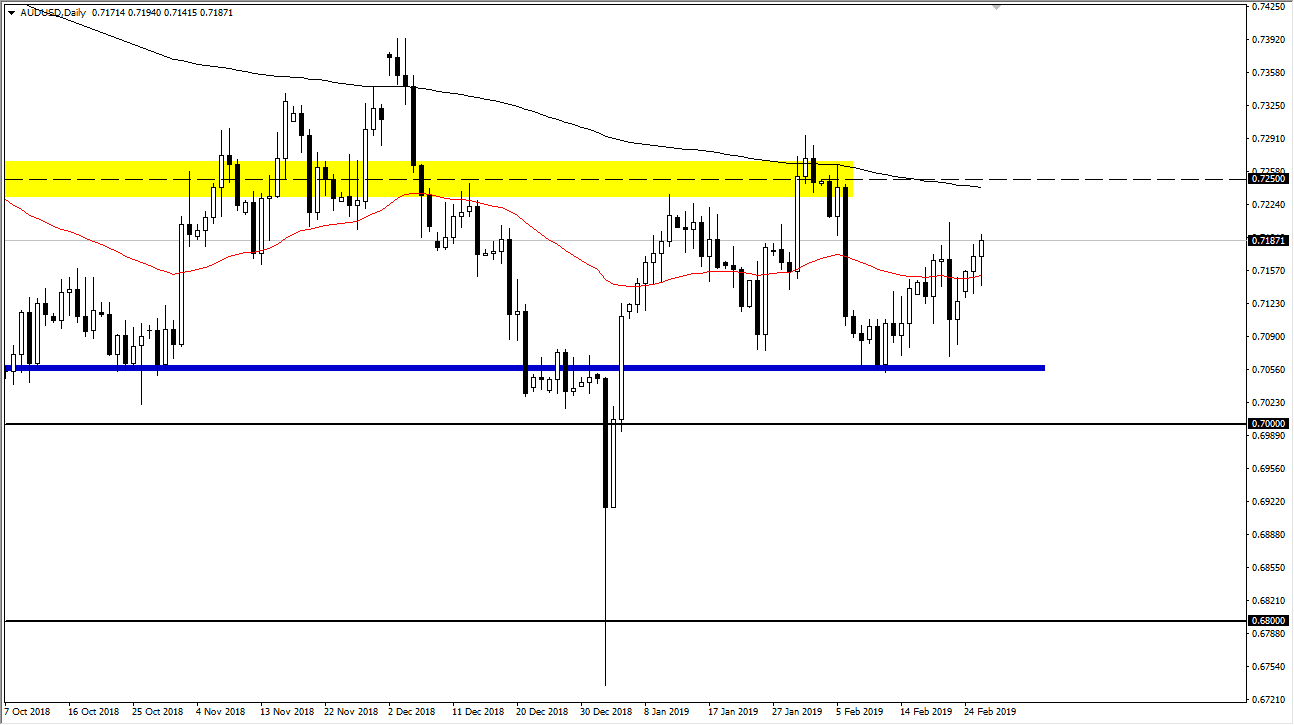

AUD/USD

The Australian dollar initially fell during the trading session, but we started to see US dollar show signs of weakness as Jerome Powell reiterated the dovish monetary policy in front of Congress. The 50 day EMA has offered significant support, and it now looks as if we are going to go towards the 200 day EMA above, which coincides quite nicely with the 0.7250 level. That’s an area that has been resistance in the past, and it more than likely will be going forward. However, if we can get a close above the 0.73 level, then that area will be taken out and we will probably go looking towards the 0.75 level above, which is resistive as well. Remember, this pair is a bit of a proxy for the Chinese situation as well. This of course will coincide with trading talks and rumors.