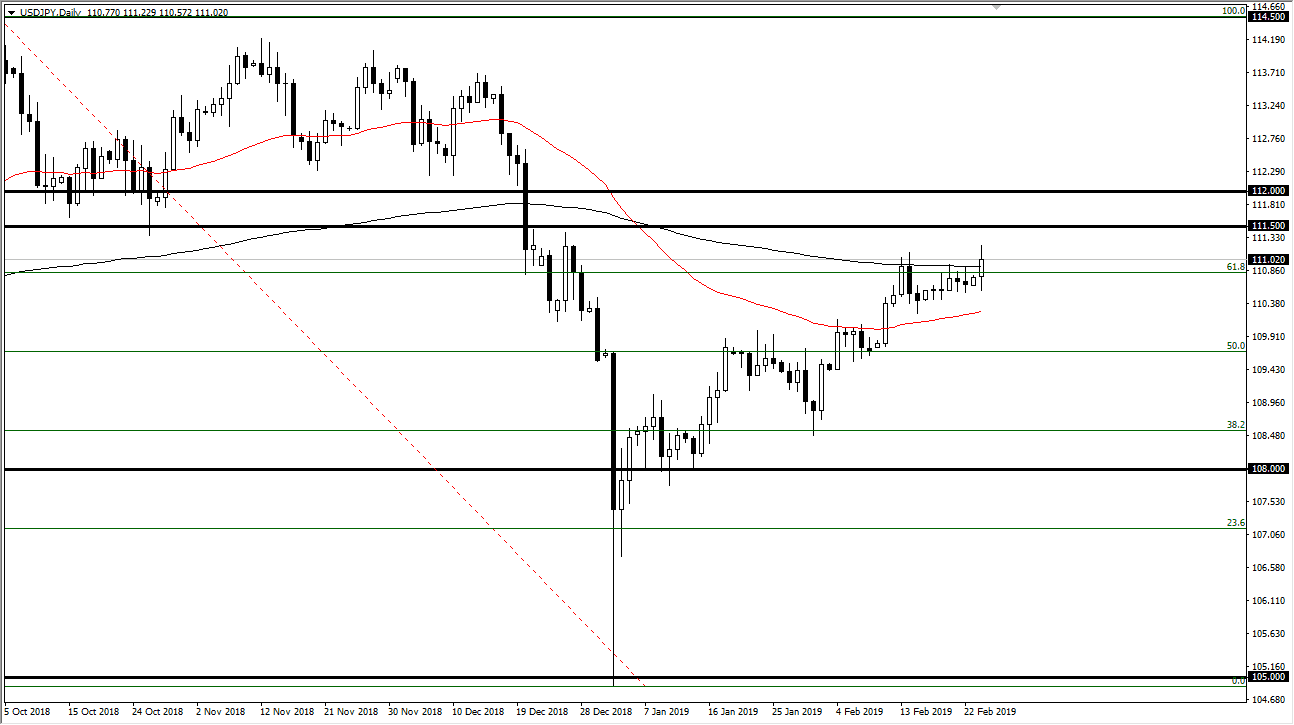

USD/JPY

The US dollar rallied during the trading session against the Japanese yen on Monday, the kick off the week as we sliced through the 200 day EMA. However, we have a lot of resistance just above, namely in the form of the ¥111.50 level. Ultimately, the market does look like it’s running into a bit of an oversold situation, and a lot of the “risk off” attitude probably has been priced into the market to begin with. It will be interesting to see what happens next, but I think that the ¥111 level is going to bring in new sellers. At this point though, it’s very likely that the market be more sideways than anything else right now. This was a good day though, so expect plenty of volatility. As far as stock markets are concerned, it tends to make me think this market is overdone.

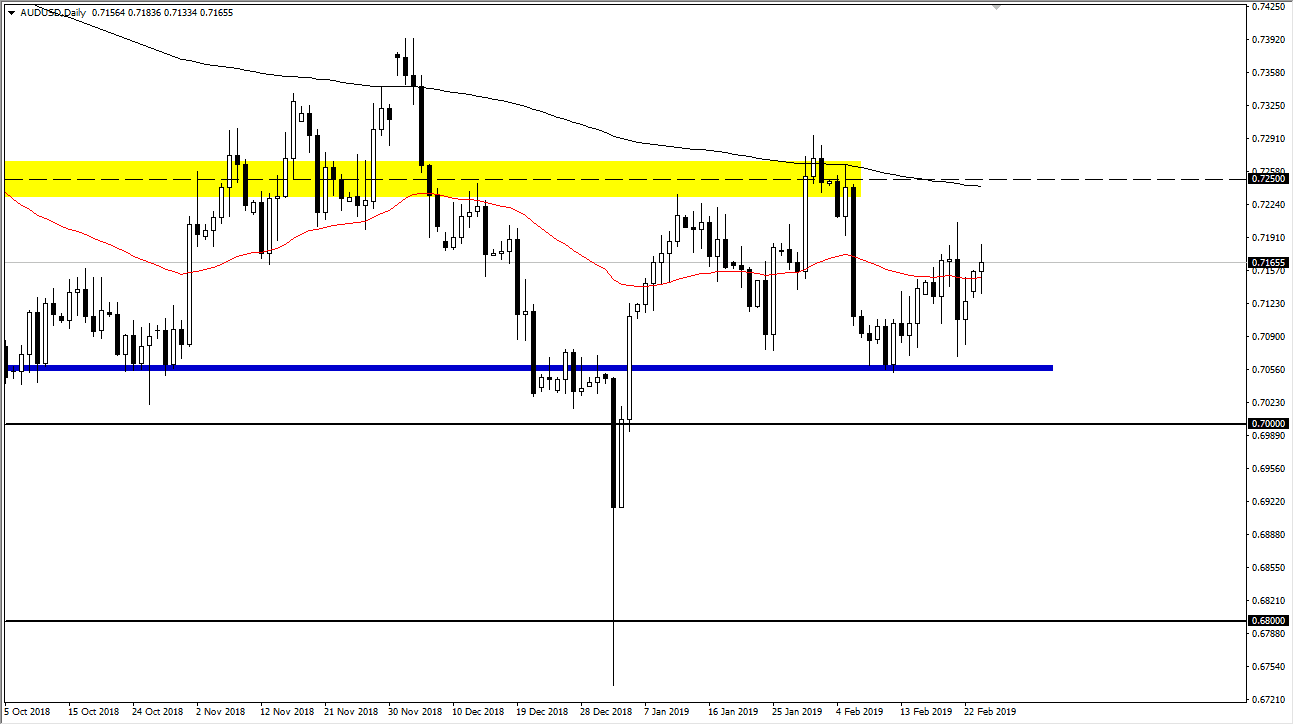

AUD/USD

The Australian dollar rallied a bit during the trading session but looks as if the upside is probably limited. The 0.7250 level also has the 200 day EMA hanging about, so it’s very likely that we will see sellers jump in somewhere in that area and push this market back down. The 0.70 level underneath is massive support and at this point I think that the monthly timeframe suggests that the market has bottomed in the short term, and perhaps even the longer-term. I like buying dips and will take advantage of value when it comes back.

If we were to break out above the 200 day EMA, I am more than willing to buy and hang on to the 0.75 handle above which I think is the next target. Overall, the US dollar is probably going to be very soft, so that should drive the Aussie higher.