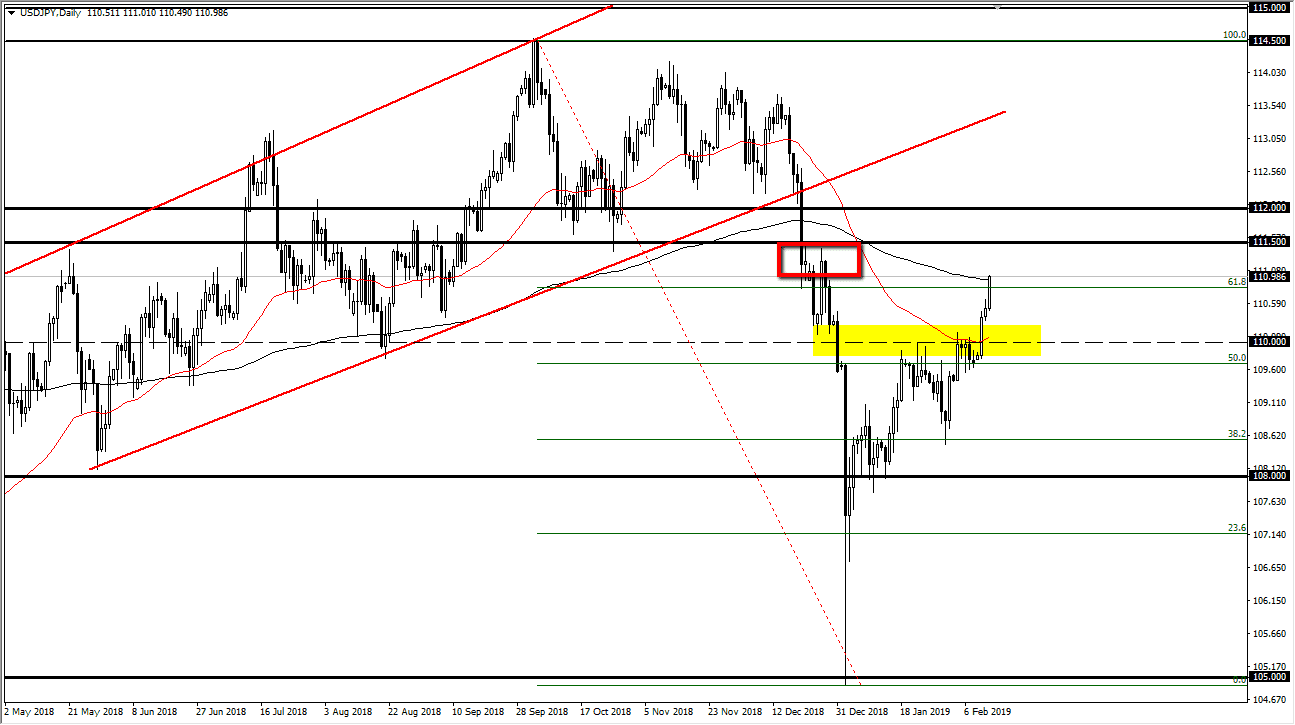

USD/JPY

The US dollar continues to shoot straight up against the Japanese yen and basically defy gravity. We are testing the 200 day EMA, which is pictured in black on my chart. This is an area that should cause some resistance, but we are closing towards the top of the candle stick for the day so that of course is a very bullish sign. Ultimately, I think that we will eventually get sellers in this market, but obviously it’s going to be dangerous to step in front of this market right now. This is an area that has seen a lot of resistance, and of course the ¥111.50 level above should offer resistance as well based upon previous action. While I do think that selling is ultimately what we will be doing here, the reality is there’s no sign of this market rolling over quite yet. That being said, it’s far too overbought at this point to start buying.

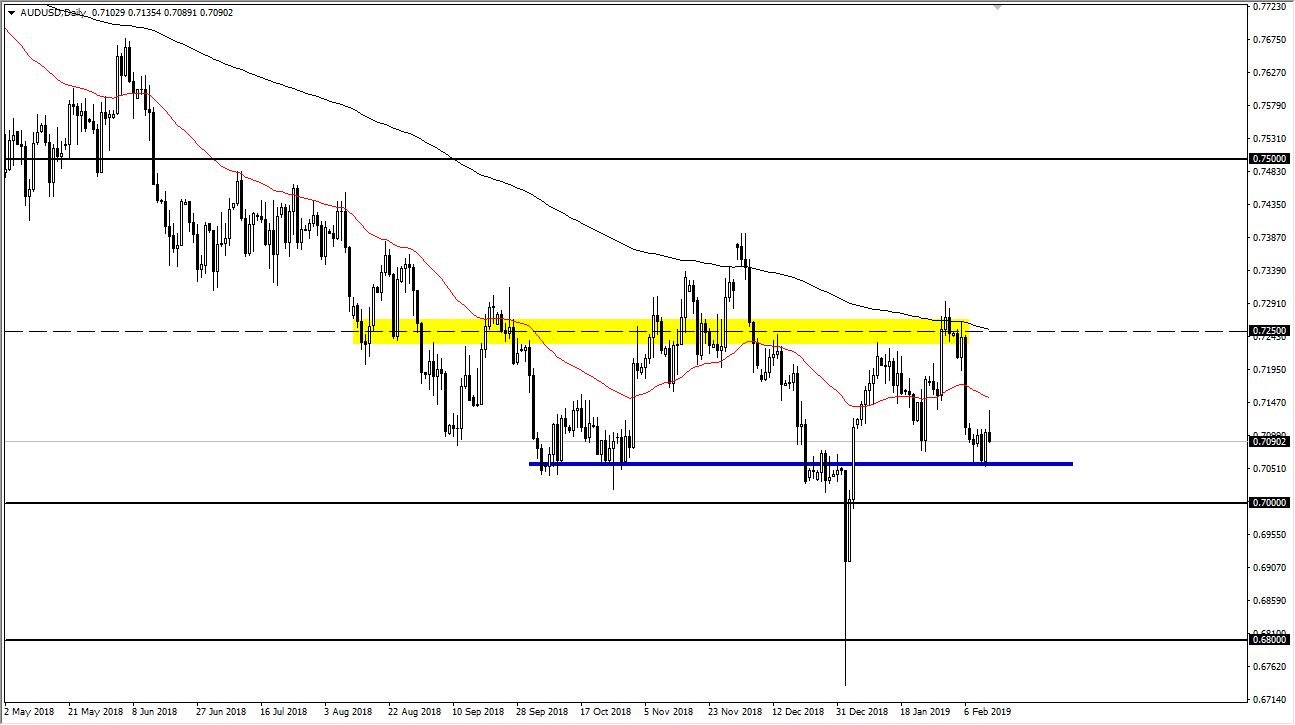

AUD/USD

The Australian dollar initially rallied during the day and broke out on Wednesday but turned around to show signs of weakness again. I think we are about to see a lot of consolidation in this area, so it’s quite frankly not overly surprising to see that we are turning around. I believe that the 0.7050 level underneath is the beginning of massive support down to the 0.70 handle, which should continue to find plenty of buyers all the way down to the 0.68 handle based upon the monthly charts. In other words, all we need is the slightest bit of positivity in this market to start going long and taking advantage of what is a monthly support level from what I see on the longer-term charts. With a little bit of luck, we’ll get good words out of China when it comes to the US/China trade situation.