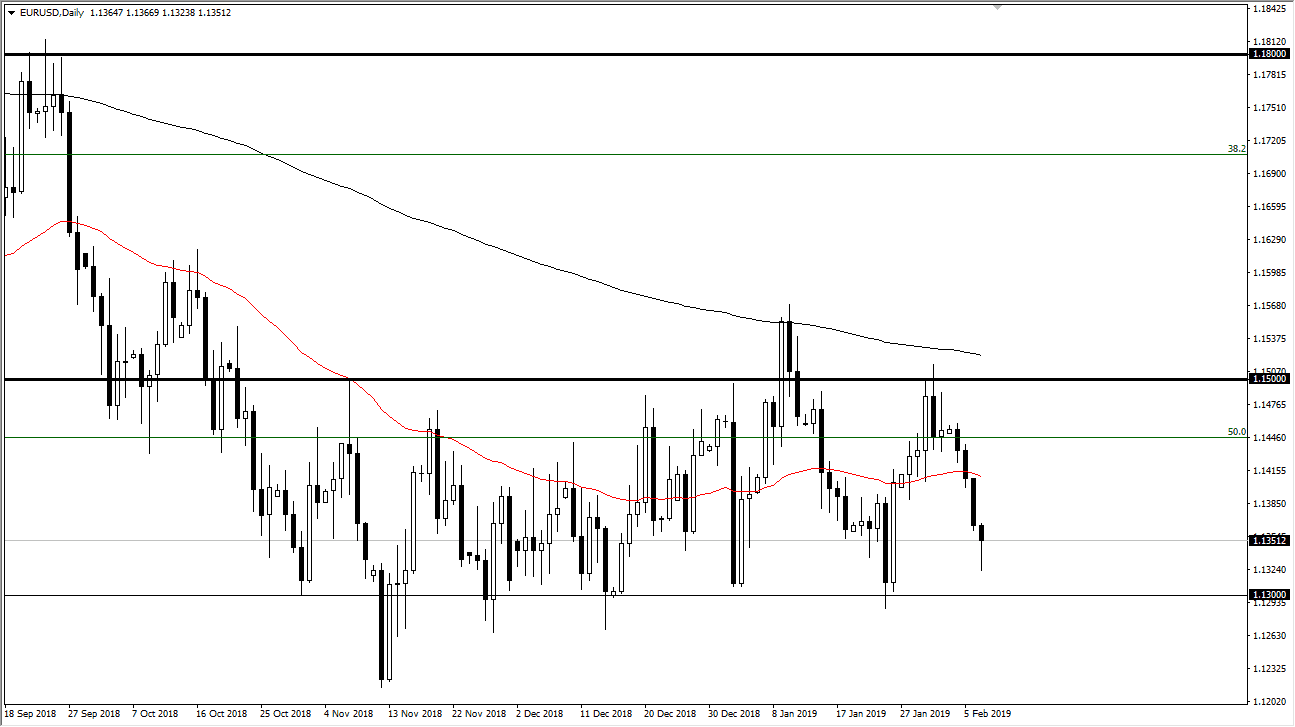

EUR/USD

The Euro initially fell during trading on Thursday but found enough support near the 1.1325 level to turn around and bounce. This ended up forming a bit of a hammer like candle, and that of course is a good sign. We are getting close to the bottom of the overall consolidation area which has a bottom near the 1.13 handle. Beyond that, we also have the 1.15 level above that could cause a significant amount of resistance. Overall, this is a market that continues to chop back and forth as the Federal Reserve is looking very soft, but at the same time the European Union has very little in the way of good news either, so I think we are going to continue to go back and forth in this range for the short term. Meaning that there’s probably more of a risk to the upside than there is the down.

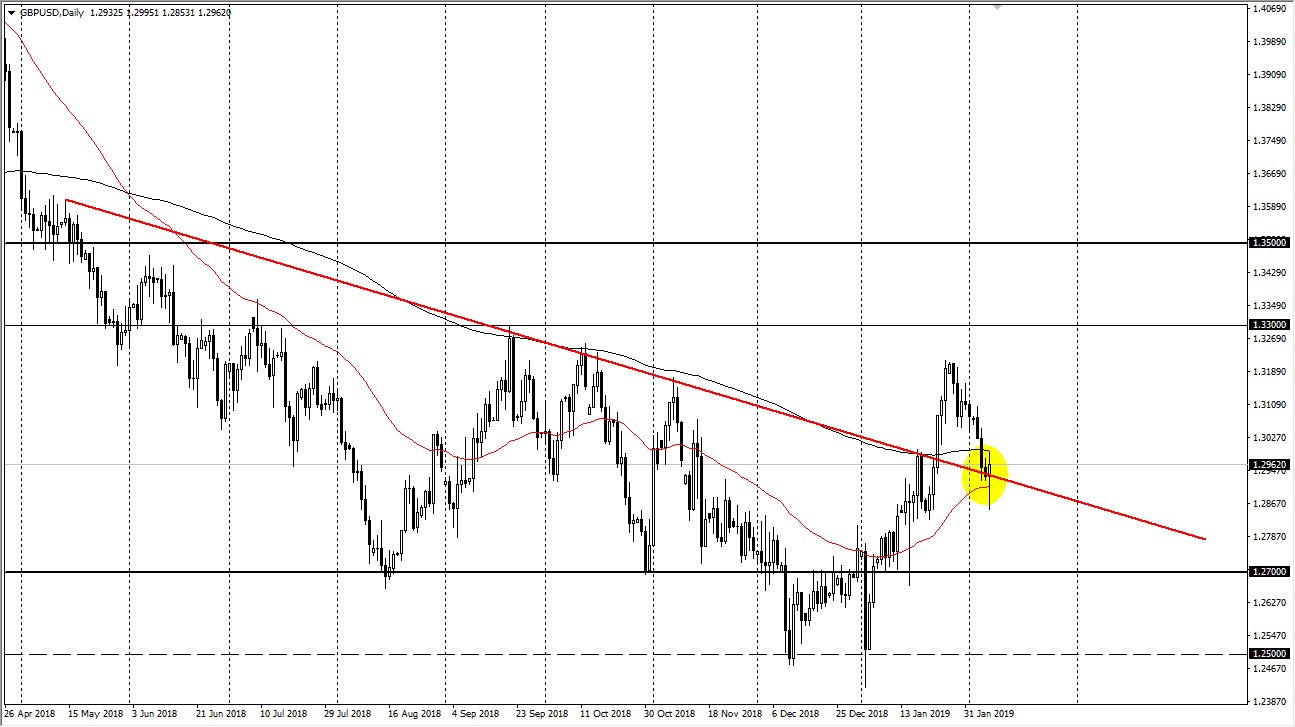

GBP/USD

The British pound had a wild ride during the trading session on Thursday, breaking down significantly but then turning around near the 1.28 level. By doing so, we have formed a bit of a hammer just below the 200 day EMA, but we are hanging above the previous downtrend line that had been so resistive in the past. In other words, I think that we are probably going to see this market try to build up a bit of momentum to the upside.

I think the British pound has bottomed near the 1.22 level several months ago, and that this is the next impulsive move to the upside just waiting to happen. Obviously there will be concerns with the Brexit going on, but I think that the Federal Reserve being soft will cause a bit of a corrective move to the upside and the first good sign of cooperation in the Brexit that we get, the British pound will probably explode to the upside.