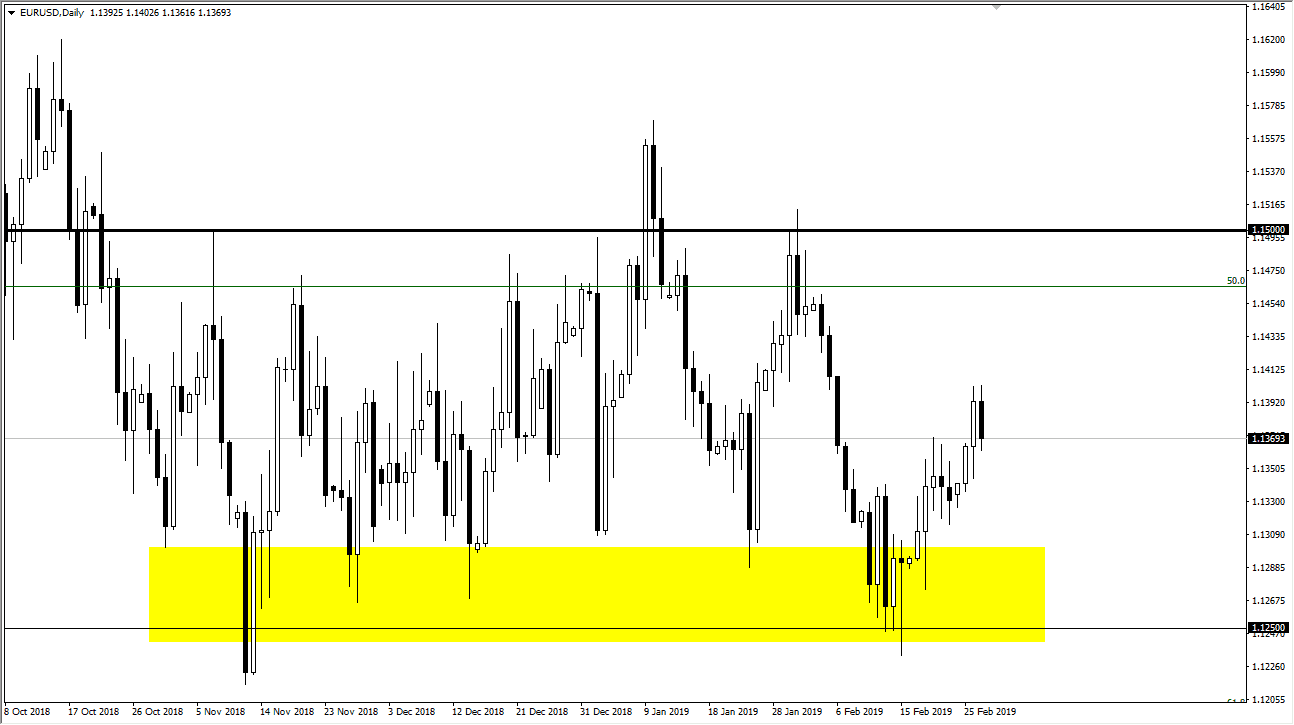

EUR/USD

The Euro pulled back during the trading session on Wednesday, as Jerome Powell spoke in front of Congress. I believe that there might have been a bit of disappointment by the market that he didn’t talk down the US dollar further than he did, but we are currently in a short-term uptrend that should continue to push this market towards the top of the overall consolidation area. Looking at the chart, the 1.1250 level underneath should be support, just as the 1.15 level above is resistance. Pullbacks should offer buying opportunities for those who are short-term traders. At this point, it’s very likely that the market will continue to go back and forth, but with an upward slant until we get to the top of what has been a very huge basing pattern.

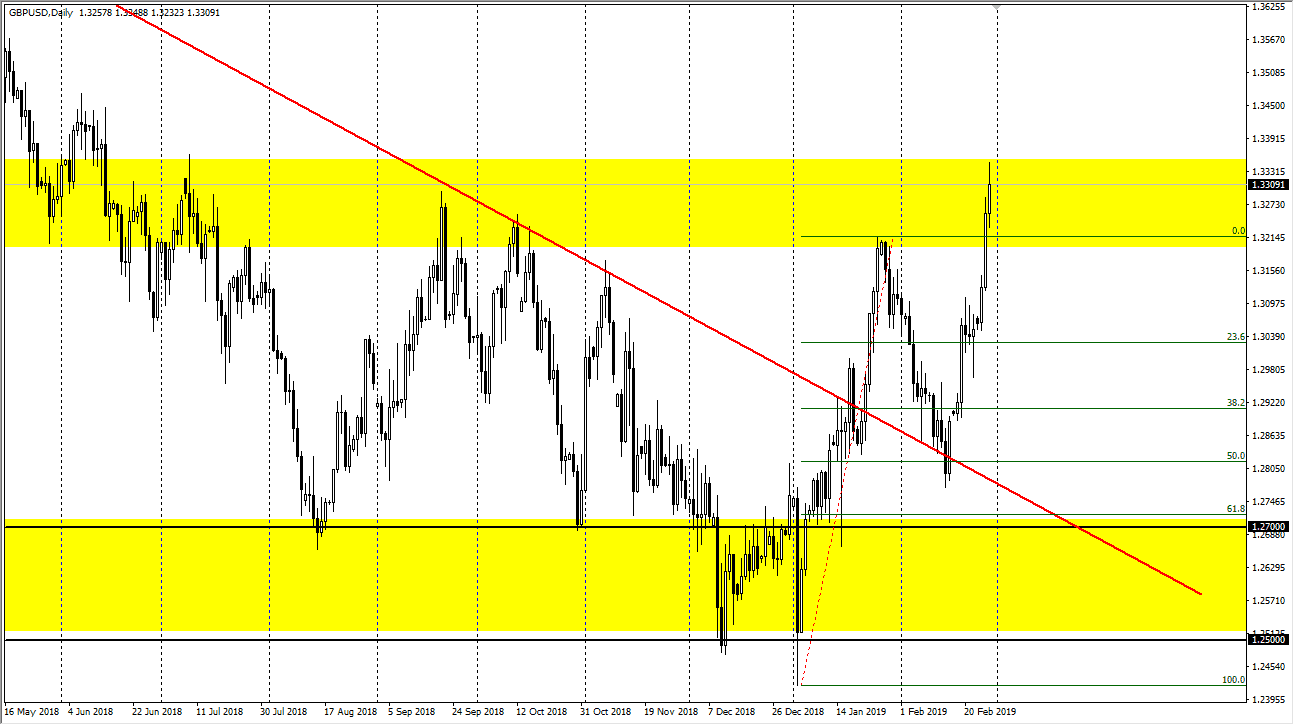

GBP/USD

The British pound has rallied significantly yet again during the day on Wednesday, reaching towards the 1.3350 level. We have pulled back just a bit though, and at this point it looks as if we are getting a bit overbought. That being said, I have no interest in trying to short this market, I believe it means that we simply will get value underneath it we can take advantage of.

I believe the 1.30 level underneath is massive as far as importance is concerned, and I suggest that it’s probably where we can pick up a little bit of value. I have no interest in shorting this market, as we have clearly shown signs of strength. However, buying the British pound at these extraordinarily high levels is a great way to lose money over the next several days. Looking for pullbacks that offer value will continue to be the best way to play this market.