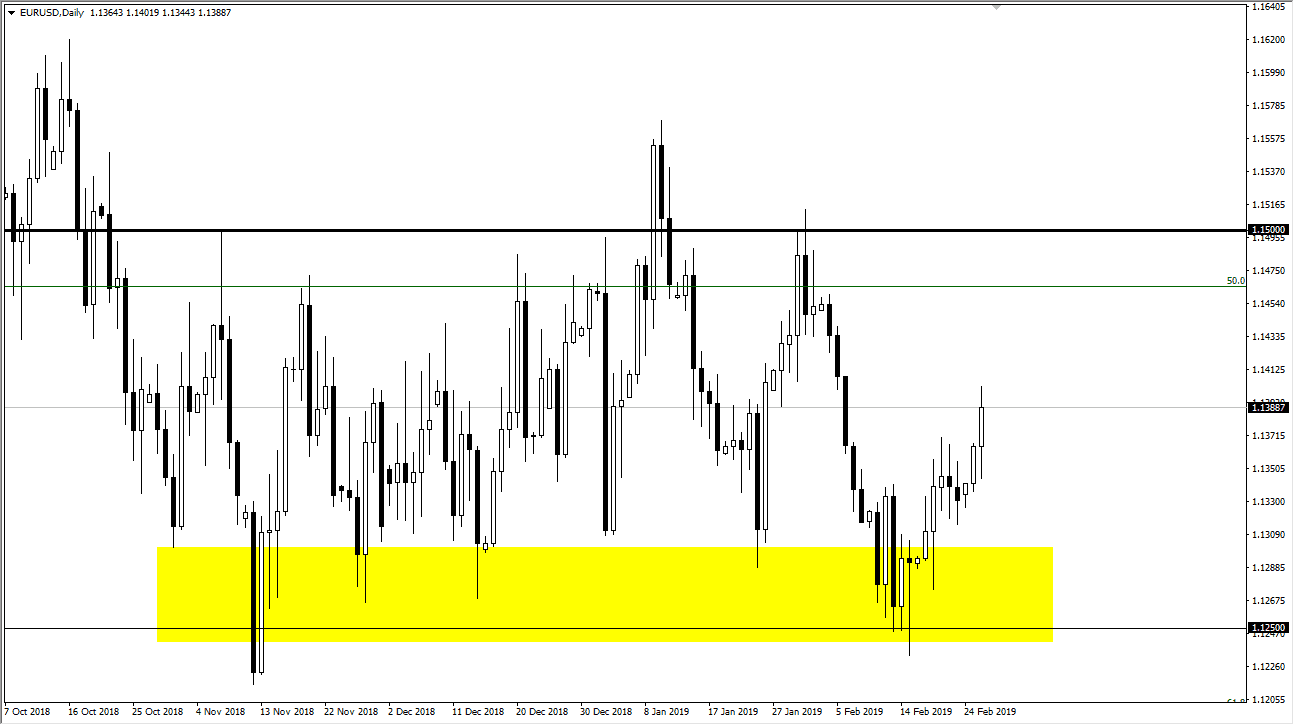

EUR/USD

The Euro initially pulled back during the trading session on Tuesday, but then bounced enough to break above the 1.1350 level handily. By doing so, it looks as if the Euro is ready to continue going higher, and you can even make an argument that we just broke the top of a micro bull flag. Either way, and it doesn’t make any difference to me, Jerome Powell was talking in front of Congress during the day on Tuesday and will continue today - offering a dovish attitude. This should continue to drive the value of the greenback lower, meaning that we should be able to reach the top of the overall consolidation. At this point, I suspect that the 1.1450 level above should continue to be significant resistance that extends to the 1.15 handle. I do not expect to break out, but a simple return to where we had been.

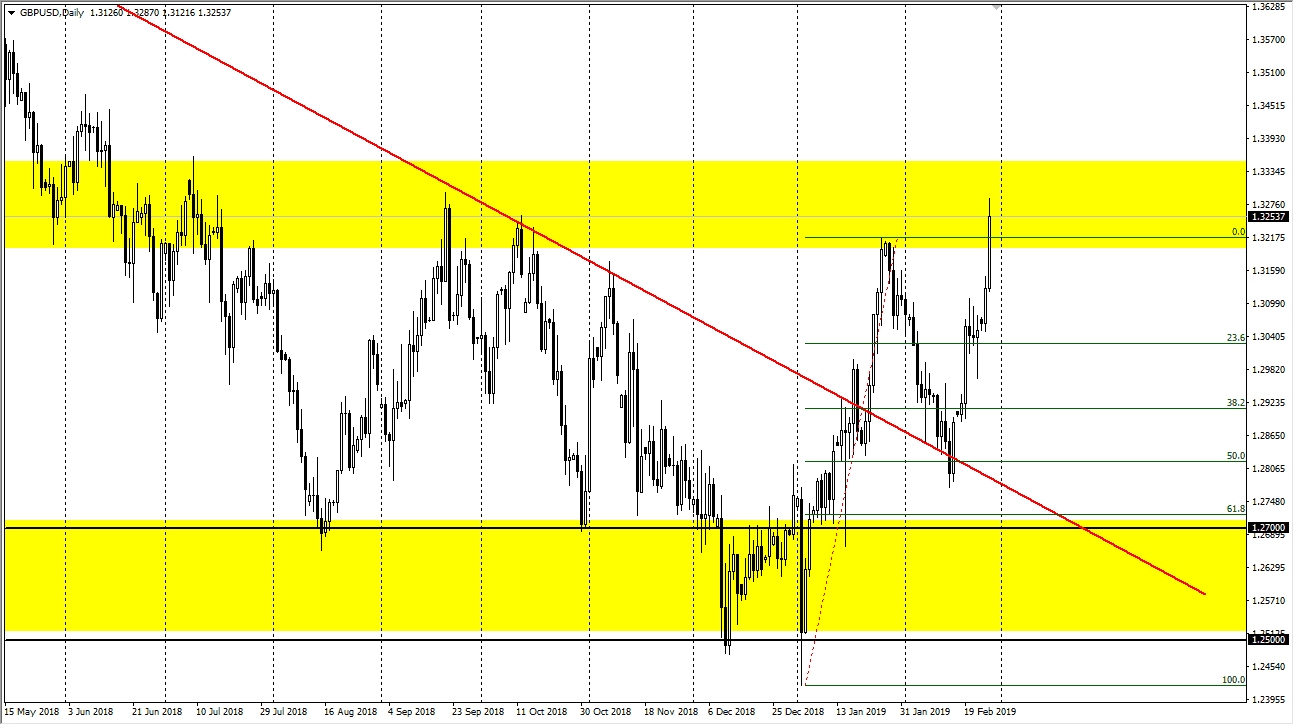

GBP/USD

The British pound continues to defy gravity as we have now cleared the 1.32 handle. I like buying short-term pullbacks as they offer value. The British pound continues to get a bit of a boost due to Teresa May willing to step back and perhaps delay the Brexit. This of course makes it less likely that there will be a “no deal Brexit”, at least that’s what the market thinks. If that’s going to be the case, it should help the British pound and we should have already seen the absolute lows.

Regardless, there will be headlines occasionally that sends the market lower. I simply look for pullbacks that are sharp and quick, but then offers stability. That stability is something I’m willing to buy. I have nothing in my plans to short this market and believe that all things being equal we have already seen the absolute bottom. The next longer-term target is 1.35 above.