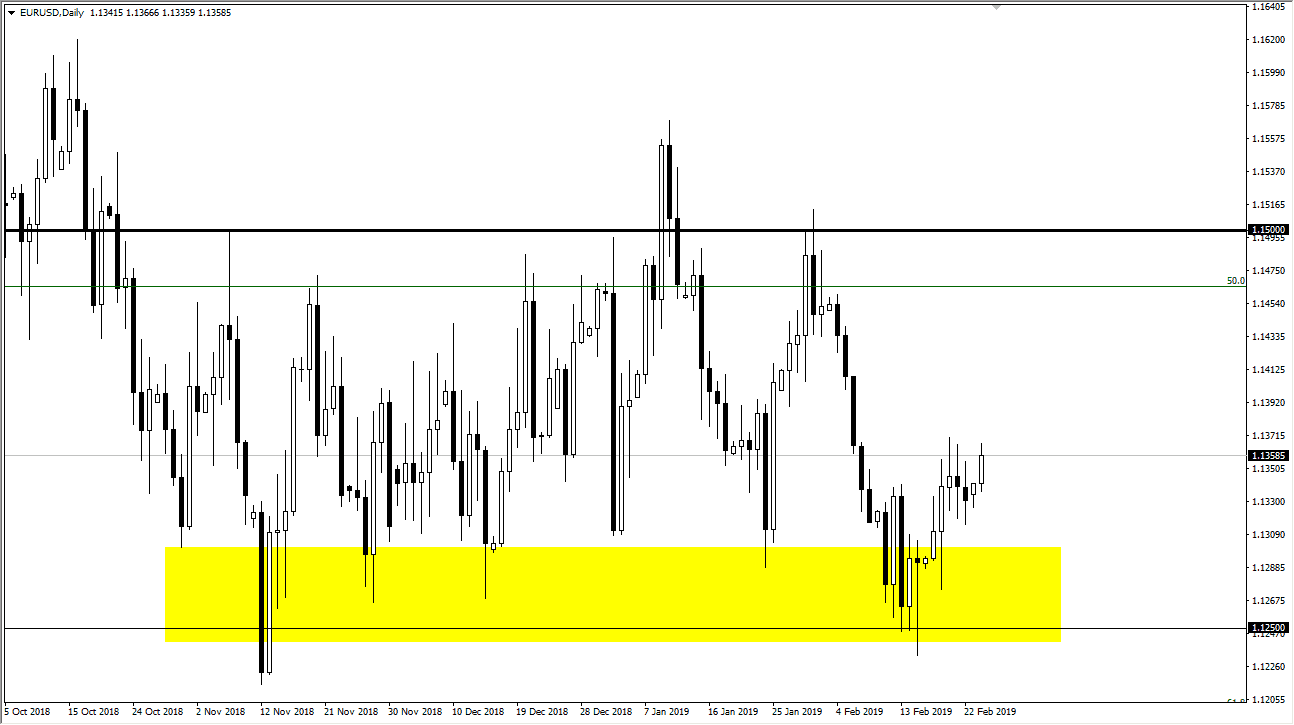

EUR/USD

The Euro rallied significantly during the trading session on Monday, showing signs of perhaps a bullish flag breaking out to the upside. It’s a minor one, so I wouldn’t get overly excited but I think at this point we are very likely to go looking towards 1.1450 level above. At that point, you start to see significant resistance all the way to the 1.15 level. Add in the fact that the Federal Reserve chairman Jerome Powell is speaking in front of Congress over the next couple of days, it’s very likely he will trying to do something to reiterate dovish expectations, and that could weigh upon the US dollar. I don’t think we break out significantly, I think we just continue to bounce around in this overall consolidation.

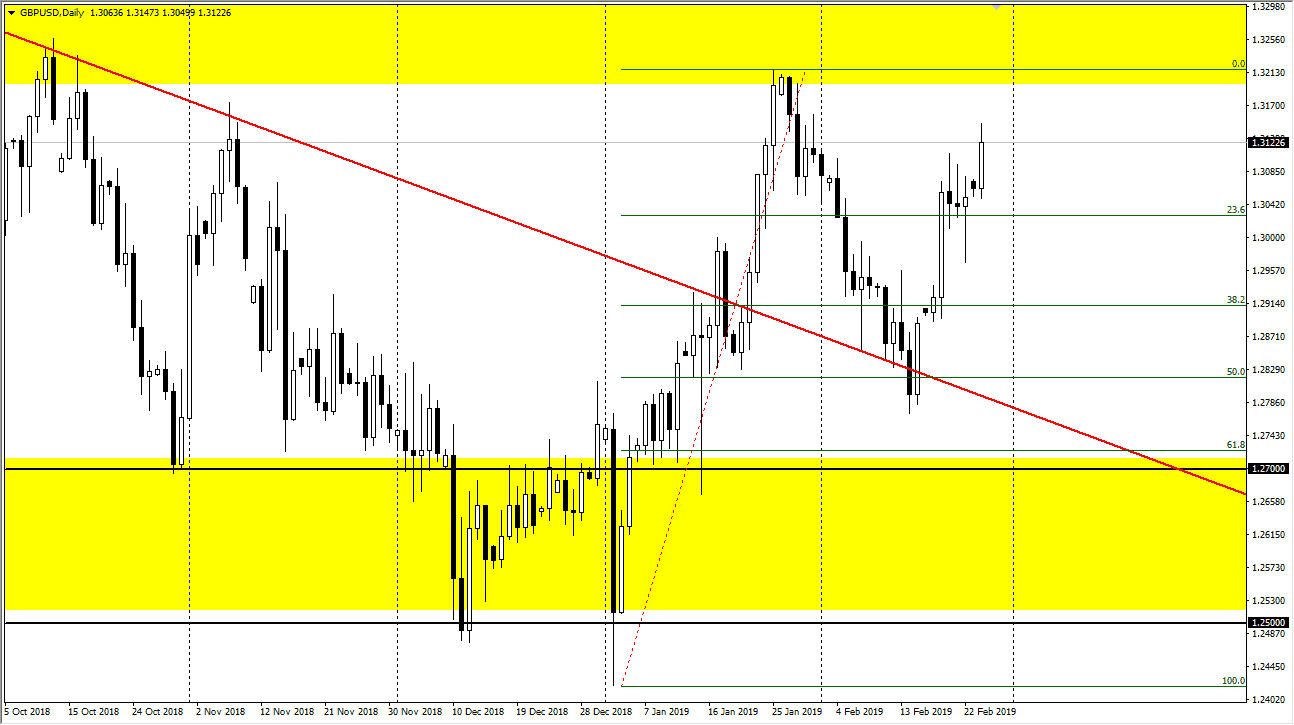

GBP/USD

The British pound had a good session on Monday as traders came back, and we continue to see the US dollar soften a bit. There are signs that perhaps the Brexit won’t be a no deal Brexit, and that of course continues to drive the expectation of the British pound higher. Short-term pullbacks continue to offer buying opportunities and people are more than willing to step in.

In the short term, it looks as if the 1.30 level is going to be a bit of a floor in the market, and now that we are above the 1.31 handle, then I think the market is probably going to test the 1.32 level after that. The hammer that formed on Friday of course was a very bullish sign, and the fact that we have cleared a couple of shooting star from last week also says the same thing. I like buying the British pound on short-term dips and believe that value hunters will continue to come back.