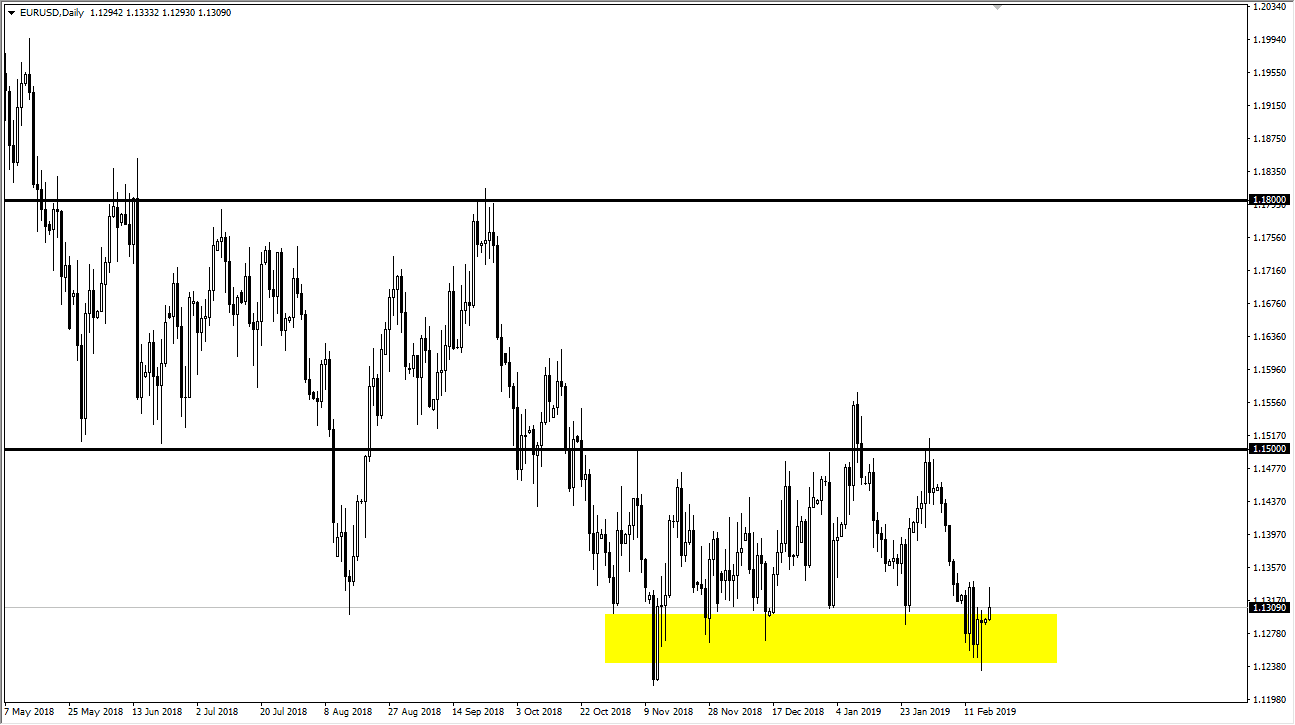

EUR USD

The Euro rallied significantly during the trading session on Monday to send the market higher but has failed at the recent resistance in the neighborhood of 1.1350, which has been short-term resistance. With that in mind, I believe that this pullback will be bought again as there is massive support just below. That doesn’t mean that it’s going to be easy to break out, because quite frankly neither one of these currencies are overly strong. However, we are at the bottom of an overall consolidation, and I think at this point we already know that the 1.12 level looks to be very supportive due to the fact that it was not only previous support and resistance, but it is also the 61.8% Fibonacci retracement level. Overall, a lot of this is going to come down to whether the Federal Reserve continues to sound dovish during the FOMC Meeting Minutes on Wednesday.

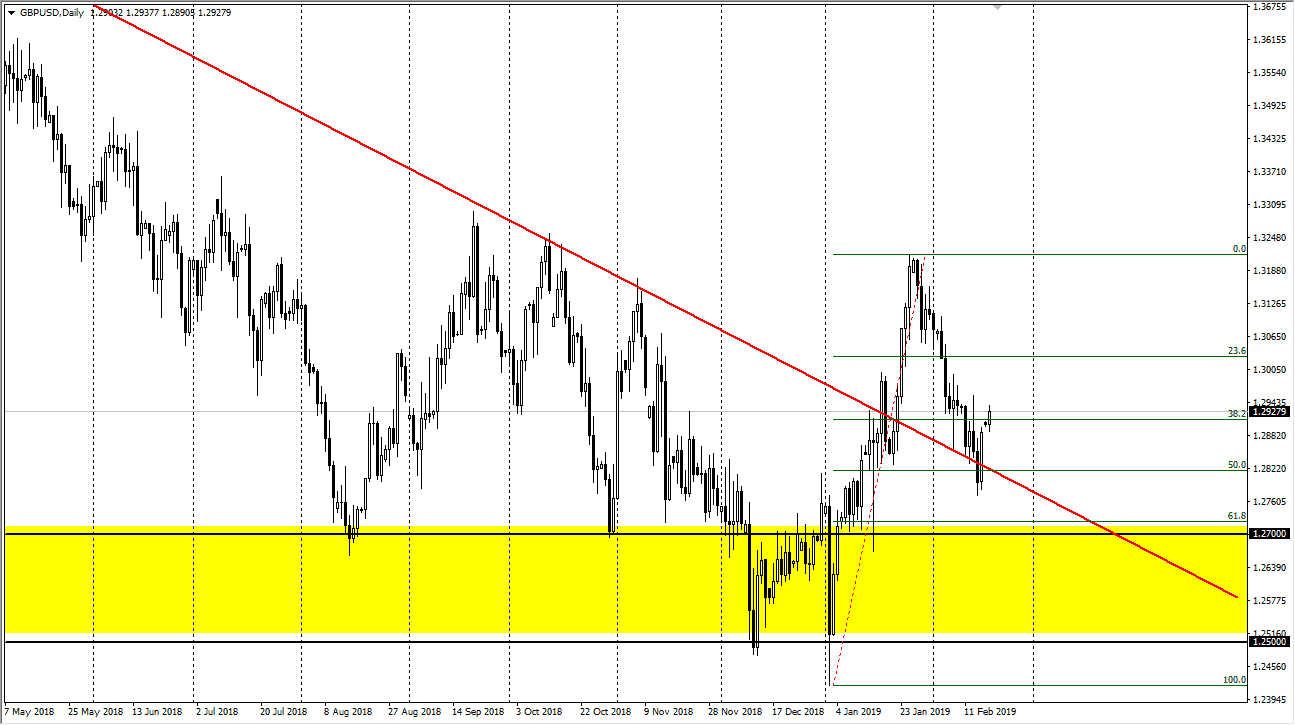

GBP/USD

The British pound rallied a bit during the day as well, reaching towards the 1.2950 level before struggling. We gapped higher to kick off the week, which of course is a good sign but we also have a lot of resistance just above. We have recently found support at the downtrend line, and of course the 50% Fibonacci retracement level. If we can break above the 1.30 level above, then I think that the British pound can continue to go much higher. Overall, I believe that we will go looking towards the 1.32 level again, but we need to build a bit of a base in this area. Even if we break down a bit lower, the 1.27 level is even more supportive, as it not only features a lot of previous action but also the 61.8% Fibonacci retracement level.