USD/MXN

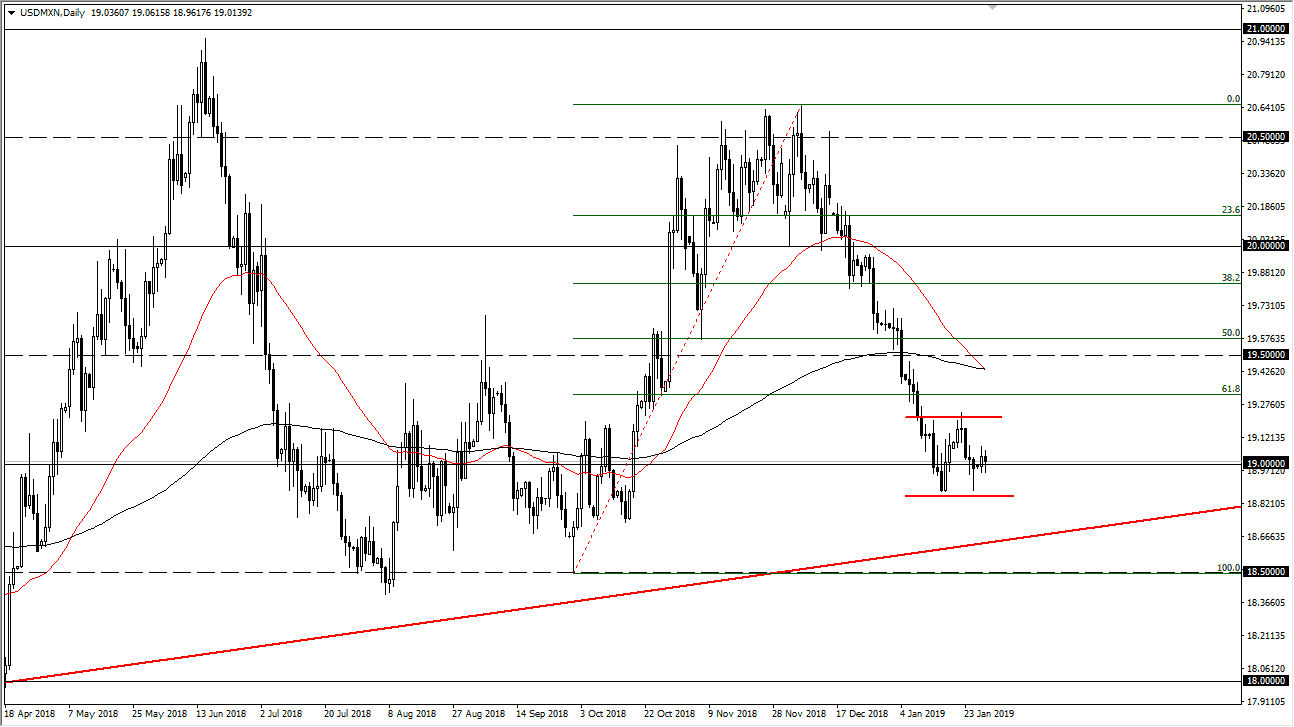

The US dollar fell slightly against the Mexican peso during the session on Tuesday as we continue to dance around the 19 handle. As you can see on the chart, I have a couple of small lines drawn, and I think we are simply consolidating right now, trying to figure out the next move so the question then becomes “When will we get our answer?” I think that answer is coming on both Wednesday and Friday. This is because of the FOMC statement will be parsed closely by traders trying to glean whether or not the Federal Reserve is going to remain on the path of raising interest rates or not. The most recent statements have been a bit more dovish, and if that continues to be the case I think the US dollar will fall. Below there, you can see that there is a significant uptrend line so breaking through that opens the door to much lower pricing. The alternate scenario is of course that we break above this little consolidation area and rally towards the 19.50 pesos level. Beyond that, we also have the jobs number coming out on Friday and I would point out that there is a “death cross” forming during the day on Wednesday. With all of that noise, I think this market is going to be extraordinarily choppy, but we should get a massive move in one direction or the other rather quickly.

I think this is less about oil now and more about emerging market currencies in general. What I mean by this is that if the Federal Reserve remains somewhat dovish or at least neutral, that makes higher yielding currency such as a Mexican peso much more attractive to traders and could be exactly what breaks the uptrend line underneath.