USD/MXN

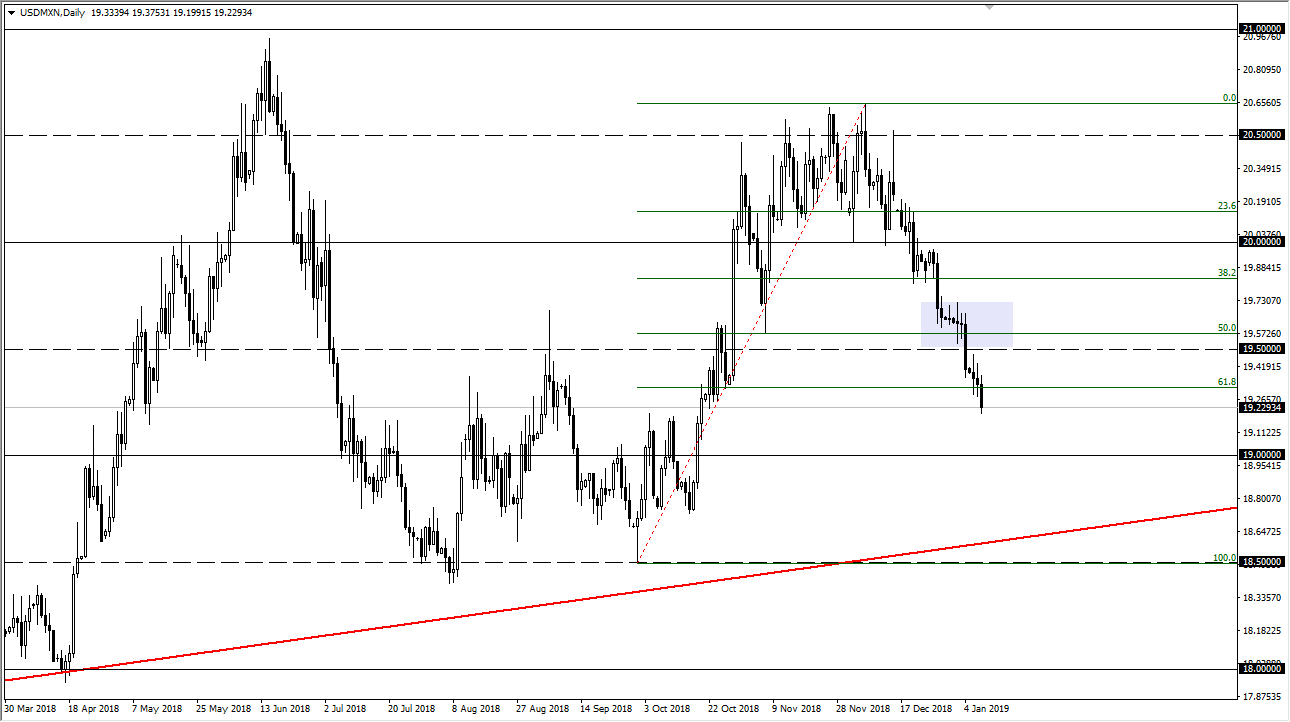

The US dollar initially tried to rally against the Mexican peso, as we had been hanging about the 61.8% Fibonacci retracement level. However, as the meeting minutes came out from the Federal Reserve later on in the day, the US dollar was beaten up quite a bit, and against the Mexican peso things would be no different. With that being the case, we have left the 61.8% Fibonacci retracement level in the background, which of course is a very negative sign.

Beyond that, crude oil has rallied quite nicely and broke above the $50 handle, at least in the West Texas Intermediate grade, as we finally have seen energy markets show some resiliency. With this being the case, it makes sense that money flows into the Mexican peso as there are so many petroleum producers in that country. As you can see on the chart, we have fallen rather drastically, and now that we are below the 61.8% Fibonacci retracement level, I believe that we will probably reach towards the 19 pesos level, then perhaps the uptrend line that I have marked on the chart. Quite typically, when you break through the 61.8% Fibonacci retracement level, you will often more than not wipe out the entirety of the move, meaning we could even go a little bit lower than the uptrend line, perhaps reaching towards the 18.50 peso handle.

I expect volatility, but I would anticipate that the 19.60 pesos level should now cause significant resistance, so rallies up until that point I think are to be sold as soon as we show signs of failure or weakness. I do believe that you can lineup the USD/CAD chart right along with this one and see how they will move in somewhat lockstep. Keep that in mind, and pay attention to the oil markets.