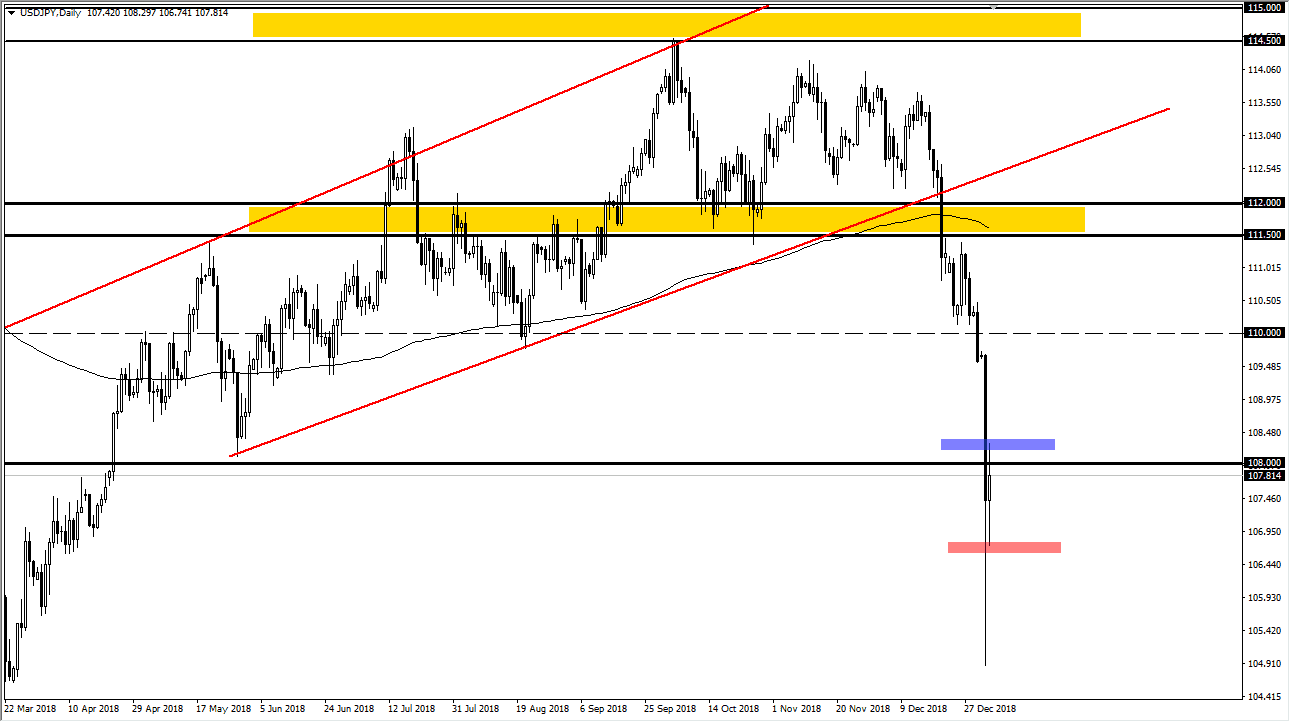

USD/JPY

The US dollar has been very noisy against the Japanese yen during the trading session on both Wednesday and Thursday, and we are now hanging about just below the ¥108 level. Based upon the candlestick that formed for the Thursday session, I believe that the market is looking for some time directionality on short-term charts from the jobs number coming out. If we do get a break above the top of the candle stick, I think that somewhere near the ¥110 level we will see sellers jump in and start pounding this pair again. Alternately, if we break down below the bottom of the candle stick for the session on Thursday, then the market will unfold and roll over towards the ¥105 level. I don’t have any interest in trying to buy this pair, I do not think that the trajectory is going to change based upon the jobs figures.

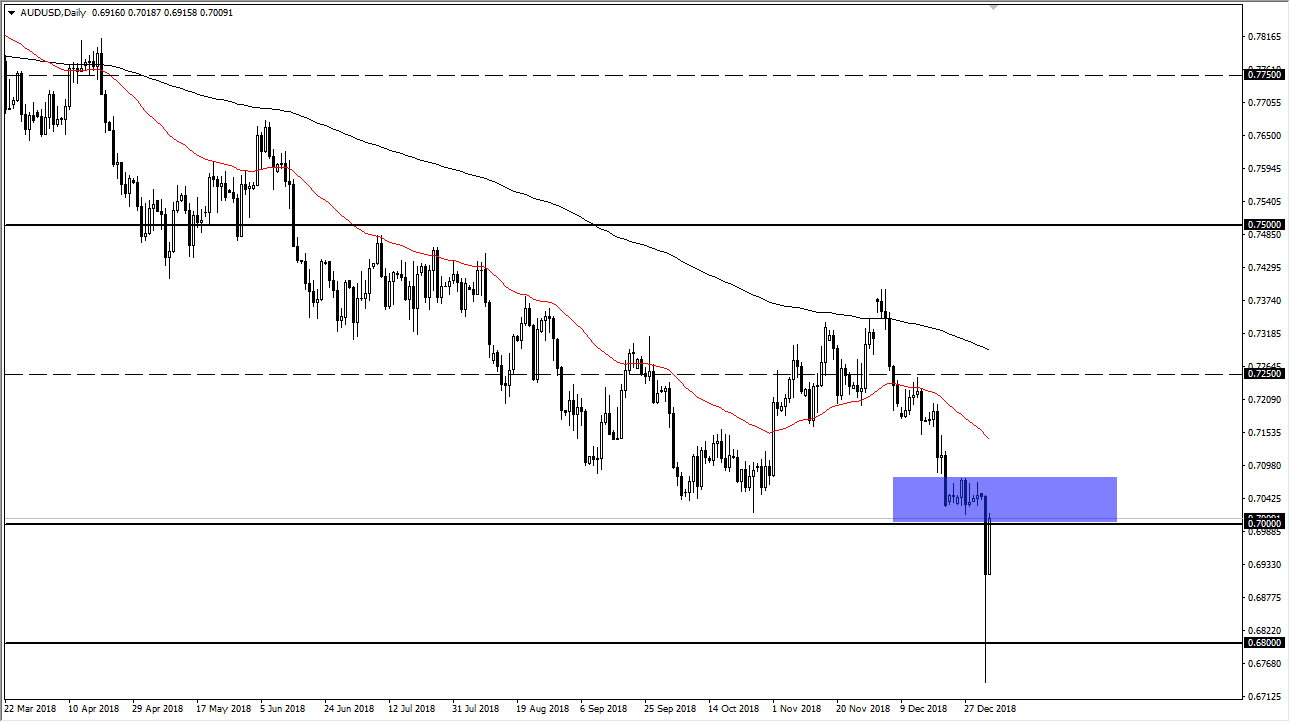

AUD/USD

The Australian dollar has rallied a bit during the session on Thursday, breaking above the 0.70 level, an area that had previously been support. The area is now resistance, so I think is very likely that this market may fade a bit, reaching down towards the 0.68 level at the first hints of trouble. If we can break above the 0.71 handle, then I think the market could go a bit higher, perhaps reaching towards the 50 day EMA. Any signs of exhaustion in this area should be a nice selling opportunity, perhaps reaching down towards the 0.68 level which not only has offered a nice bounce from that level in the last 24 hours, but it’s also an area that was very supportive on longer-term charts. At this point, is very likely that the sellers will return but breaking below the 0.68 level is not going to be easy.