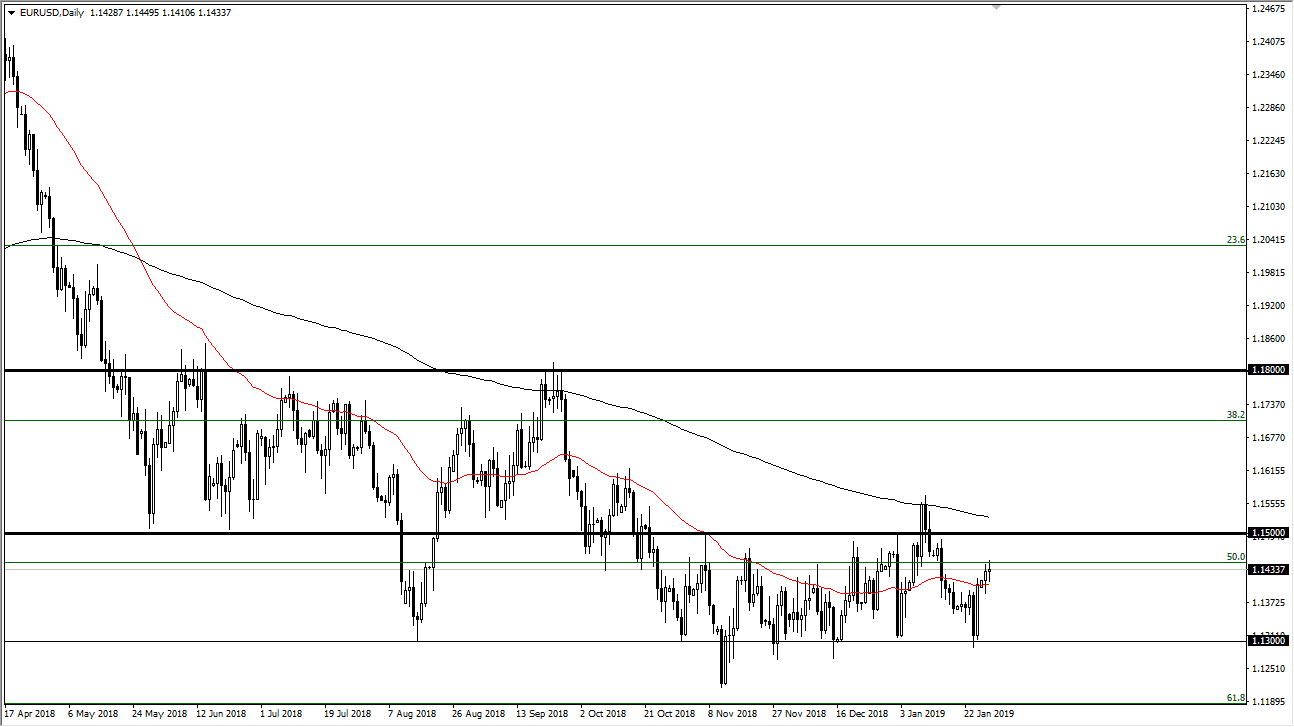

EUR/USD

The Euro went back and forth during the trading session on Tuesday, as the 1.1450 level looks to be offering resistance. There is a lot of noise between here and the $15.00 level, so it’s not surprising all to see the market stagnate a bit. Beyond that, we have the FOMC meeting and press conference going on, so the Wednesday press conference coming from the Federal Reserve will be crucial. Traders are trying to figure out whether or not the Federal Reserve is becoming more dovish or are still looking to raise interest rates, so obviously the next 24 hours could be very volatile. I do think that we will try to get to the 1.15 level, but it might take several attempts. If we can break above the 200 day EMA, pictured in black on the chart, then the market could continue to go much higher over the longer-term. I see a massive support at the 1.13 level underneath.

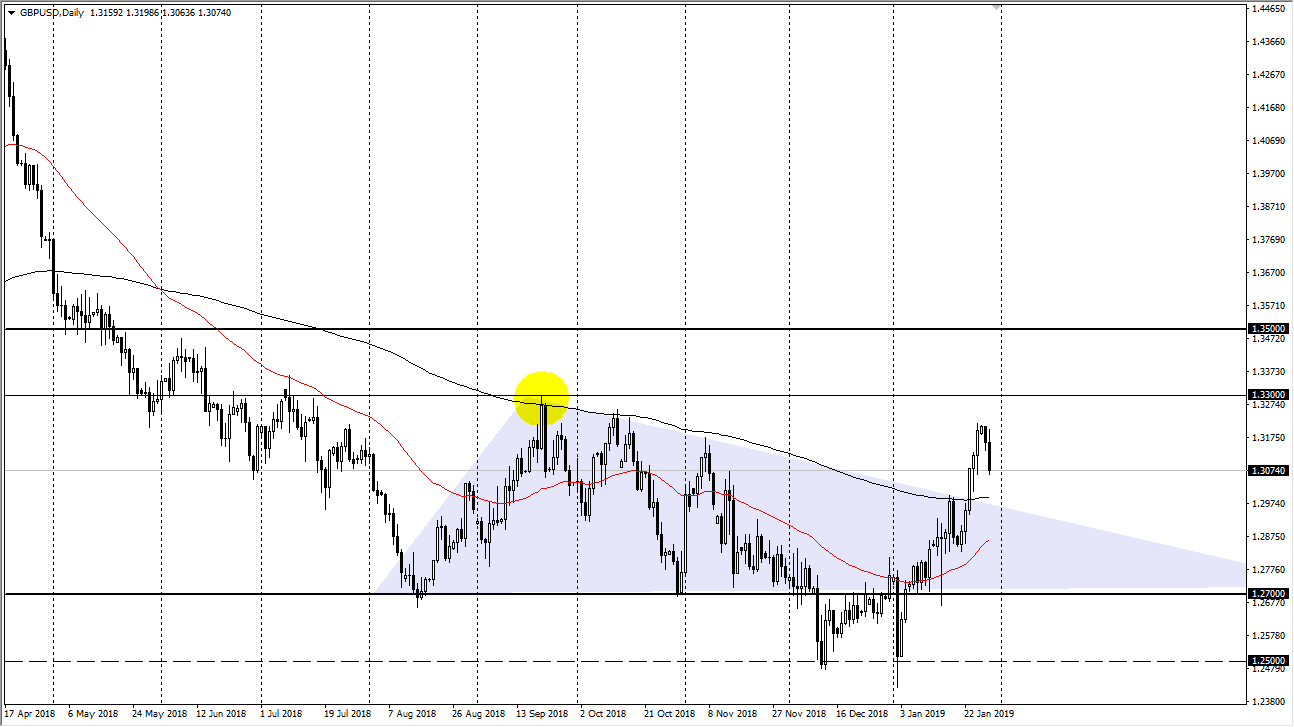

GBP/USD

The British pound pulled back a bit during the trading session on Tuesday as several amendments to the potential Brexit deal were voted down in the United Kingdom Parliament. Ultimately, I think that there are probably buyers underneath, especially near the 200 day EMA which is painted in black on the chart. I think that finding a bit of support in that area might be a nice buying opportunity as we have broken out so strongly. I think that we had gotten a bit ahead of ourselves, so it makes sense that we get a pullback anyway and quite frankly we need a catalyst to make that happen. That being said, I do think that there is enough support below to have interested parties get involved near the 1.30 handle/200 day EMA.