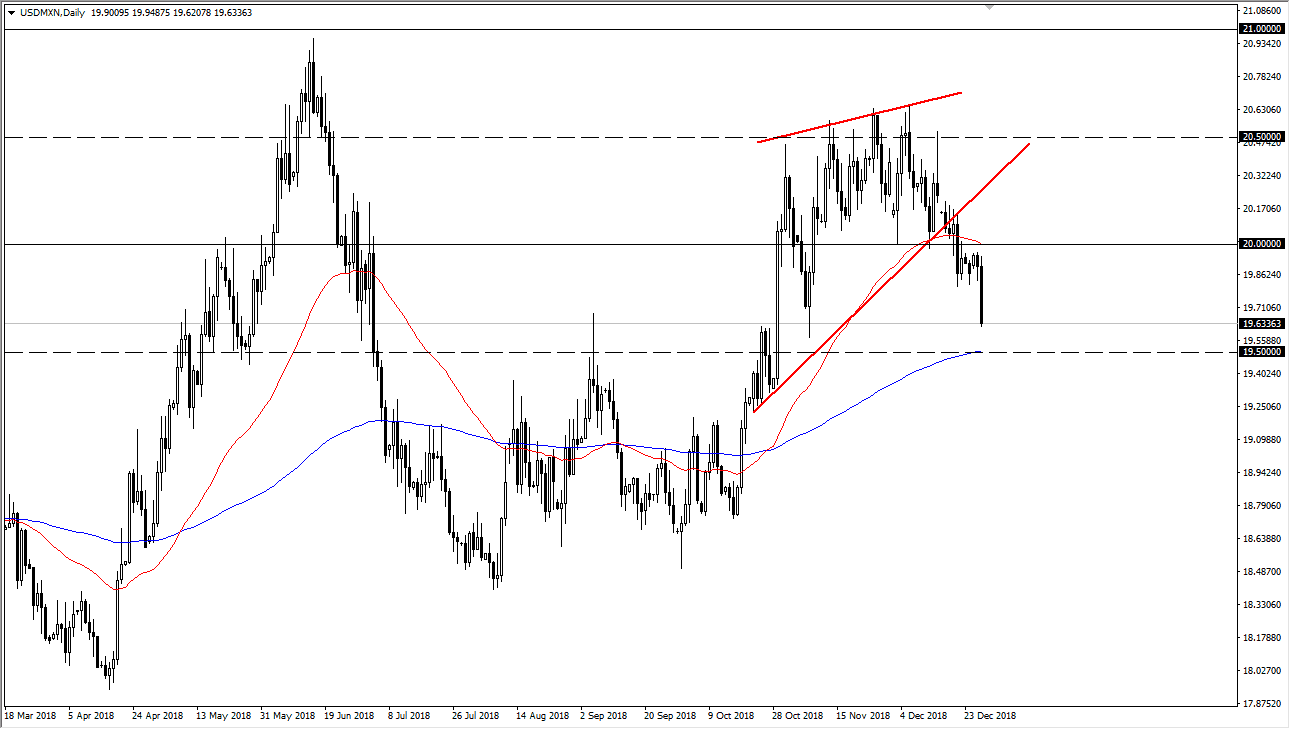

USD/MXN

The US dollar collapsed against the Mexican peso during the trading session on Thursday, breaking below the 19.75 handle. Honestly, there’s no real reason for the move other than perhaps a bit of profit taking ahead of the year end it, as the crude oil markets fell almost 3%, which certainly didn’t help the Mexican peso in general. because of this, it looks as if we are going to race towards the 200 day exponential moving average below, at the 19.50 level that I had been talking about recently.

Now that we are pulling back towards the 200 day EMA, I would anticipate some type of psychological bounce from the 19.50 level, but if we do break down below there, the next target will probably be closer to the 19.25 level, the beginning of the rising wedge that I still have marked on the chart.

Liquidity is only going to become more of a problem, so I think at this point this is a market that is going to become extraordinarily dangerous to trade over the next couple of days. With that in mind, I would be cautious about putting too much money to work, or any of it over the next couple of days. The markets have been extraordinarily choppy, and of course we continue to see a lot of concerns out there.

To the upside, the 20 pesos level seems to be massive resistance, and I think it will be very difficult to break above there anytime soon. Ultimately, I would expect a lot of volatility but if we break down below the 200 day exponential moving average, we could drop a bit. I think that the market will be choppy at best over the next couple of sessions.