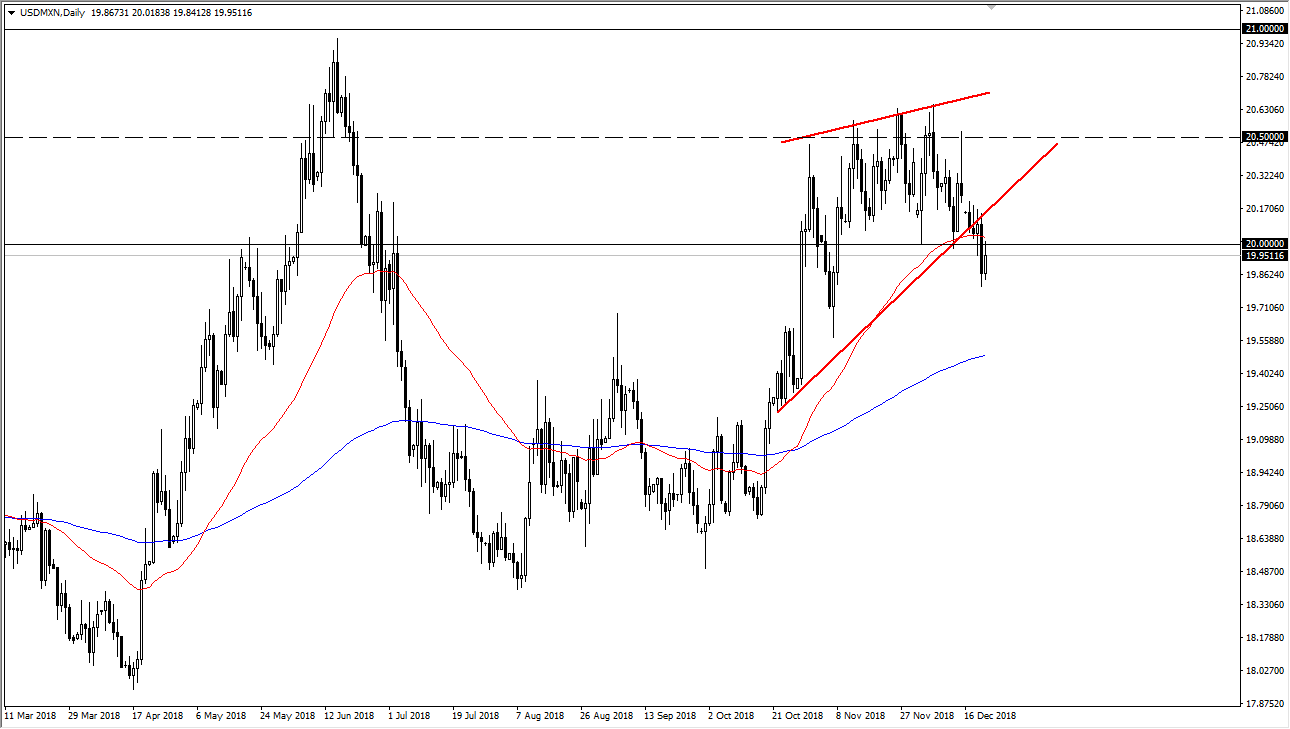

The US dollar popped a bit on Friday and retested a major support level for resistance in the form of 20 pesos. We have pulled back from there, and I would also point out that as the 50 day EMA is just above the 20 pesos level and turning down from there. It looks to me as if we will continue to grind lower from here, perhaps reaching towards the 19.50 pesos level. Beyond that, we have broken through the bottom of a rising wedge, and you could also make an argument that we have been consolidating for quite some time and have simply rolled over from the top. If that’s going to be the case, then we will probably even go down to the 19 pesos level.

That being said, the massive break down during the day on Thursday does suggest that we continue to see trouble. I think the US dollar is in trouble due to a potential government shutdown as well, and I think that will last longer than most people are expecting. Because of that, we may see a bit of a “knock on effect” from the US dollar overall. If that’s going to be the case, then I think rallies will continue to be sold off and I think that the top of the Thursday candle should offer quite a bit of resistance. The 20.20 level above is massive resistance, and if we can break above that, then the US dollar could go looking towards the 20.50 level. That’s an area of that should continue to offer quite a bit of resistance, so a break above that would of course mean something rather significant. If we do get a run down from here, I believe the 200 day EMA will of course offer support as well at the 19.50 level, so breaking through that would expedite that move to 19.