The US dollar has broken down significantly during the trading session against most currencies around the world on Thursday, and of course the Mexican peso wasn’t any different. What’s truly ironic about this is that we have seen a massive selloff in the crude oil market, but the peso has continued to show signs of strength. This is because most of the reaction that we are seeing then this chart is due to the President Donald Trump not willing to sign a continuing resolution to fund the government. This is a temporary thing, as it always is, but I think it could lead to a short-term break down.

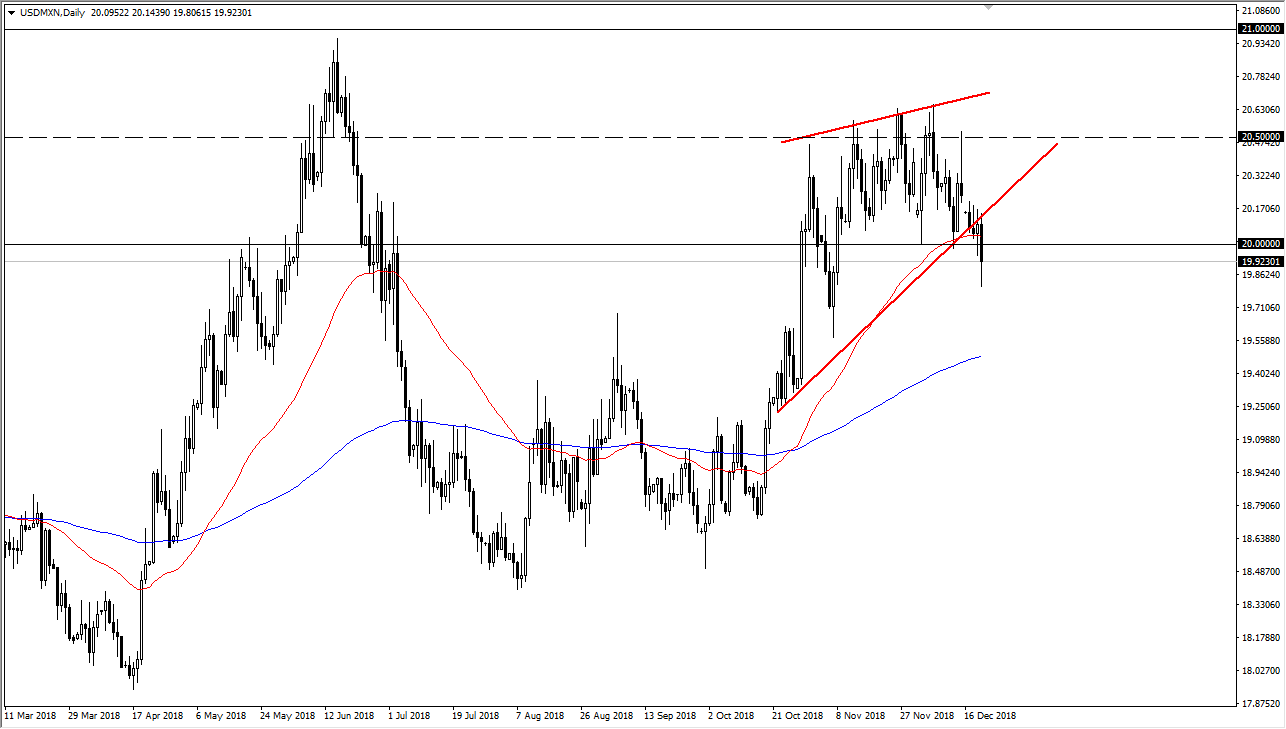

The US dollar will continue to fall again some other currencies, but it’s quite ironic that the Mexican peso is one of the gainers. This is because the biggest issue that the President has signing the continuing resolution is a lack of border security with that country. Looking at this chart, we have broken through the 50 day EMA, and I think at this point we could go looking towards the 19.50 pesos level after that. Now that we are below the 20 pesos level, it makes sense that we will continue to see downward momentum. The 50 day EMA is flattening out, and looking likely to roll over, and the rising wedge is broken now, which is something that I had talked about a few days ago. At this point, the 200 day EMA is close to the ¥19.50 level, so it makes sense that we would see some type of reaction and that area.

If and when we do get the rally going, I suspect that it will be difficult to clear the 20.20 pesos level now that we have seen that support level give way in the rising wedge. I anticipate short-term weakness, perhaps followed by a bounce closer to the 200 EMA. This is mainly because if we are worried about global growth, crude oil will continue to slide, and most certainly Mexico won’t be a place to throw money at.