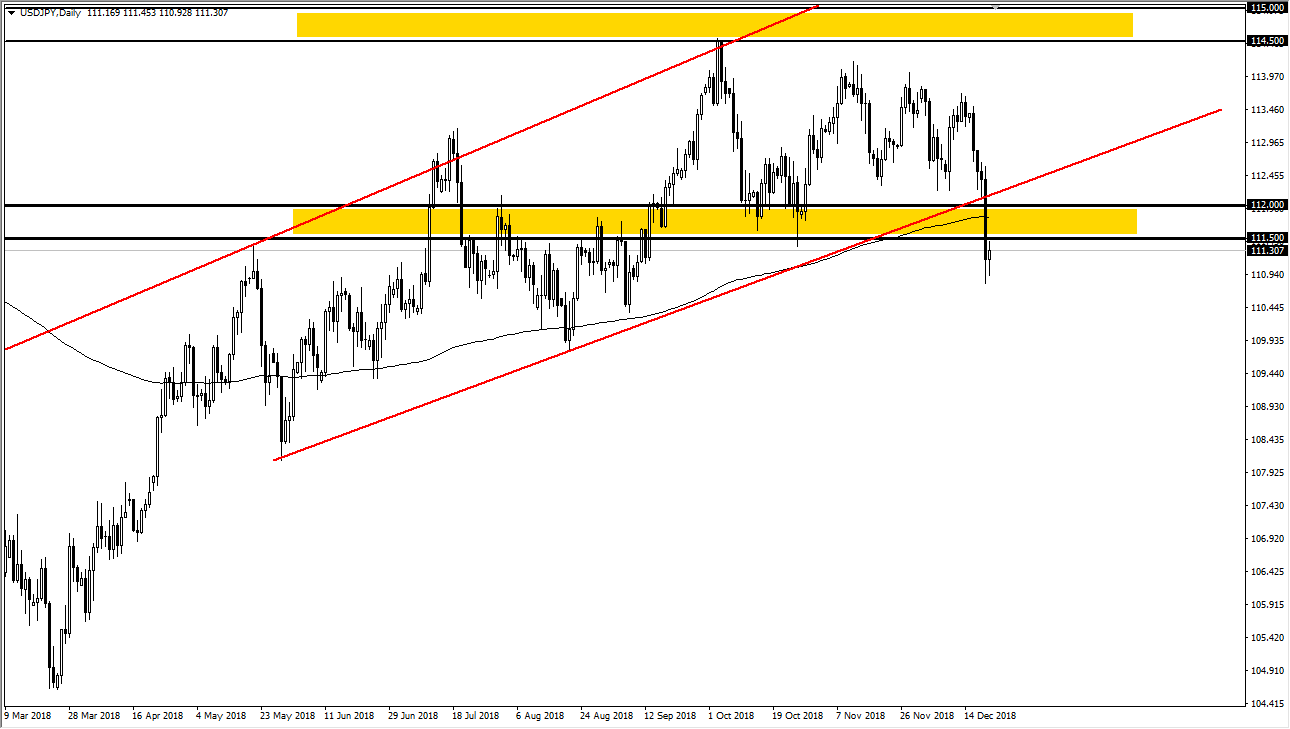

USD/JPY

The US dollar has bounced a slightly during the trading session on Friday, as traders are focusing more on the holidays than anything else, but we have broken significantly below the 200 day EMA after Thursday’s brutality, and not only that have broken down below major support. At this point, I believe that rallies will be sold on signs of exhaustion, and I will treat them as potential selling opportunities when they happen. It’s not until we break above the highs from Thursday that I would feel comfortable buying this pair, but most analysts that I talk to these days believe that the Japanese yen will pick up strength, and it makes sense considering that the ¥114.50 level has offered so much in the way of resistance. Given enough time, I think we will probably go looking towards the ¥110 level.

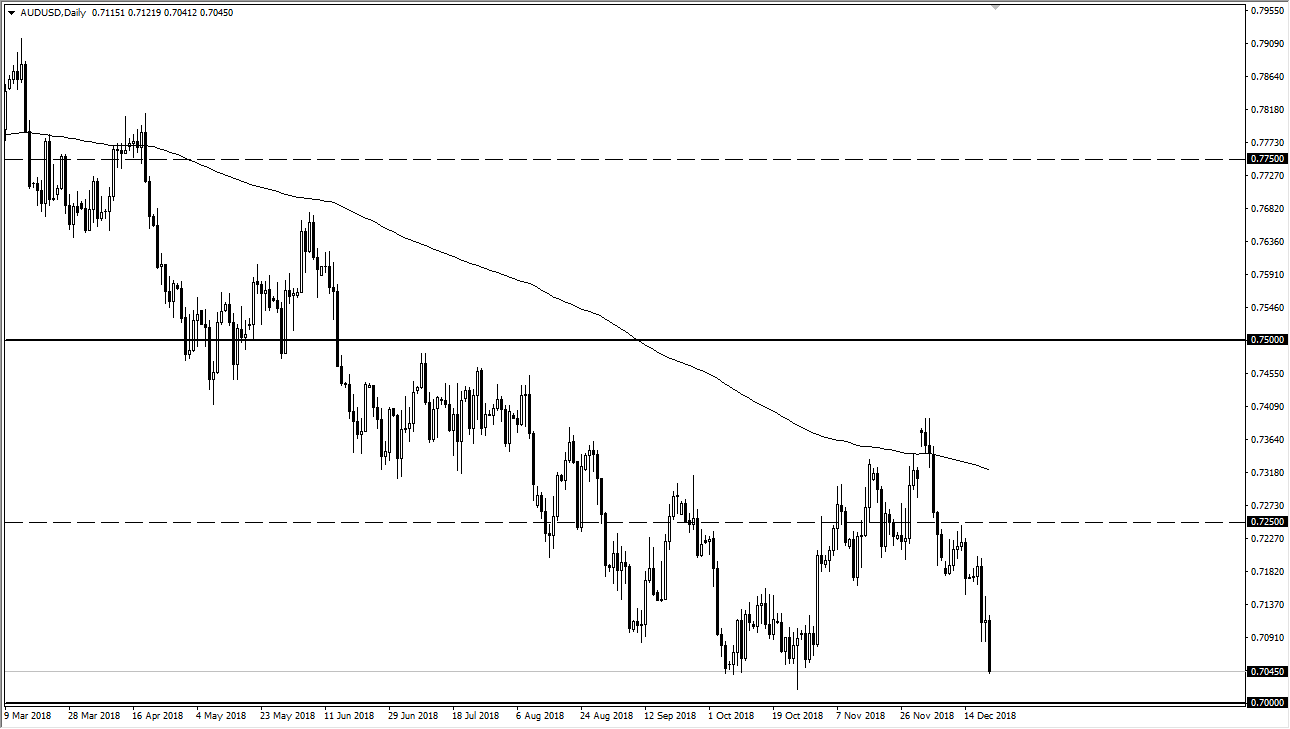

AUD/USD

The Australian dollar has fallen rather significantly during the trading session on Friday as risk continues to come out of the markets. The Australian dollar is highly sensitive to the US/Chinese trade situation, and of course we have major issues in the stock markets and global growth going forward. That means that the Australian dollar will probably continue to suffer at the hands of traders. I believe that rallies at this point should be selling opportunities as the Aussie is associated with a growing economy and of course commodities which need global growth to expand and value. I think that if we break down below the 0.70 level, something that looks very likely to happen going forward, we will probably reach towards the 0.68 handle, and then possibly even lower than that. At this point, I believe that the 0.7250 level will offer a bit of a “ceiling” in this market.