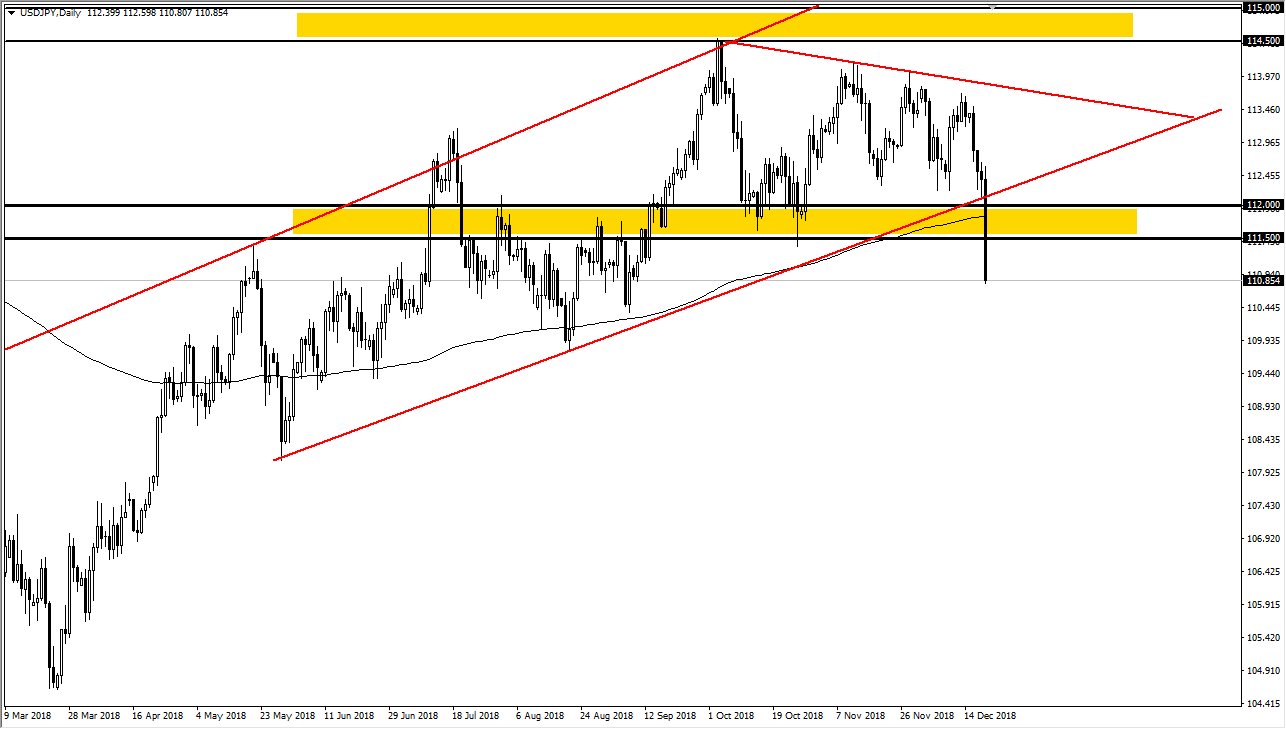

USD/JPY

The US dollar broke down significantly during the trading session on Thursday, as the market digests several different things going on at one time. The Federal Reserve has suggested that it is “data dependent”, and therefore people are starting to speculate that perhaps the Federal Reserve won’t be able to raise interest rates. This has weighed upon the US dollar, but it’s going to be particularly interested in this pair as the Japanese yen is considered to be a safety currency. After that, President Donald Trump suggested that he was not willing to sign a continuing resolution to keep the government open without border security added to it. This has caused a lot of chaos in the greenback, and we have sliced through the 200 day EMA. At this point, it looks like the uptrend in this pair is probably coming to an end.

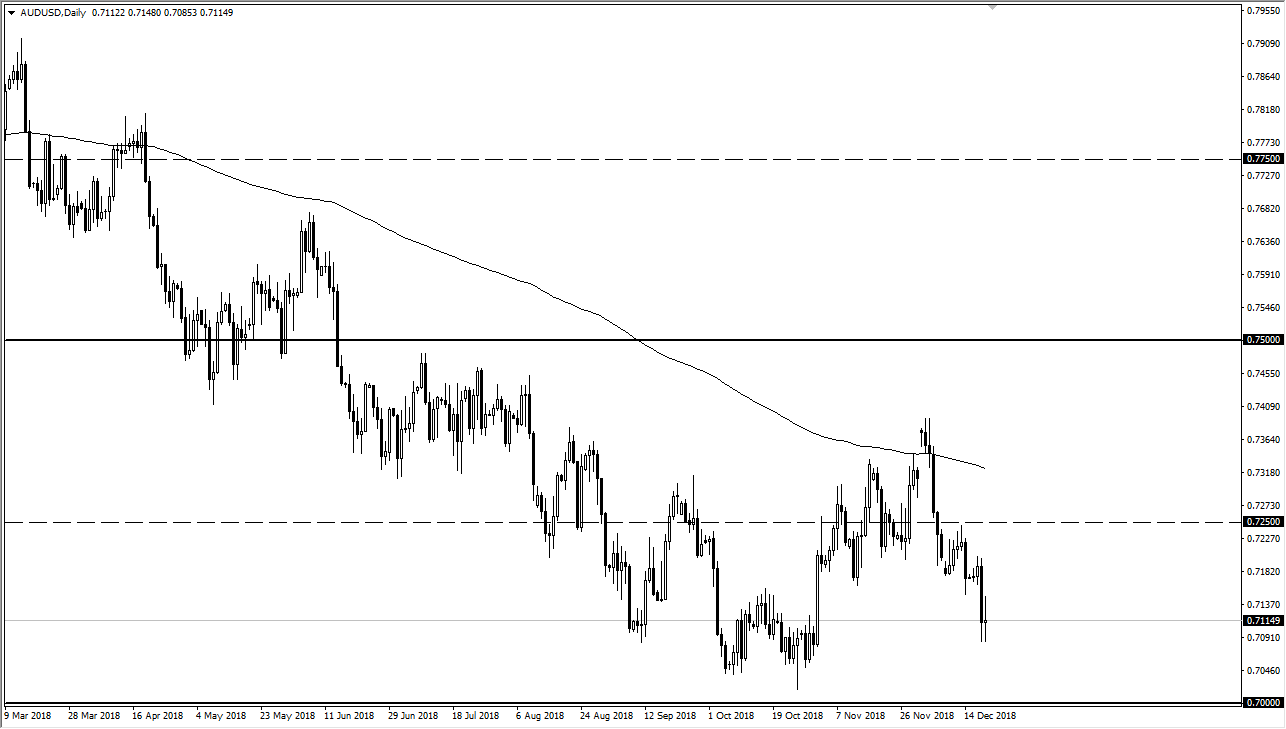

AUD/USD

The Australian dollar has gone back and forth during trading on Thursday, showing a lot of volatility but that’s not a huge surprise considering that the Aussie is so heavily levered to the Chinese economy and the trade situation around the world. Ultimately, this is a market that is going to pay attention to global risk appetite and trade movement, so therefore I think it is going to sell off every time it rallies. I think we will go to the 0.70 level underneath given enough time, and I believe that the 200 day EMA and the 0.7250 level both offers significant resistance. If we break above the 200 day EMA on a daily close, then I could start to entertain the idea of a move towards the 0.75 level above.