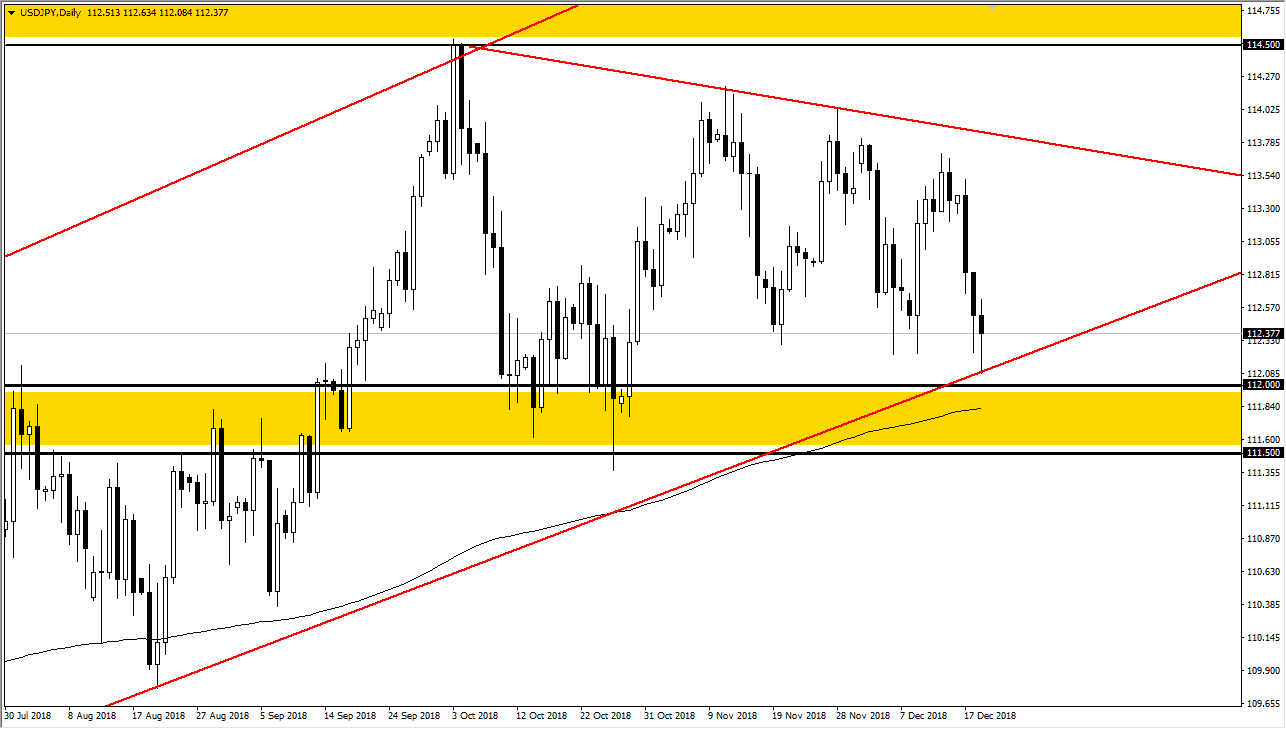

USD/JPY

The US dollar has fallen against the Japanese yen during the trading session on Wednesday, testing the uptrend line before bouncing a bit. After the Federal Reserve statement, the market seems to be simply back to where we started. With this being the case, I have no interest in looking to short this pair until we break down through the significant support, below the 200 EMA, and perhaps even the ¥112 support region. If we do bounce from here, I anticipate that the market will find sellers closer to the downtrend line above, as we continue to go back and forth. Now that we have gotten past the interest rate announcement and the statement, I believe that we could get reasonably quiet markets, unless of course we break down through the crucial support. As far as breaking out to the upside, I think the opportunity of that happening between now and the end of the year is almost 0.

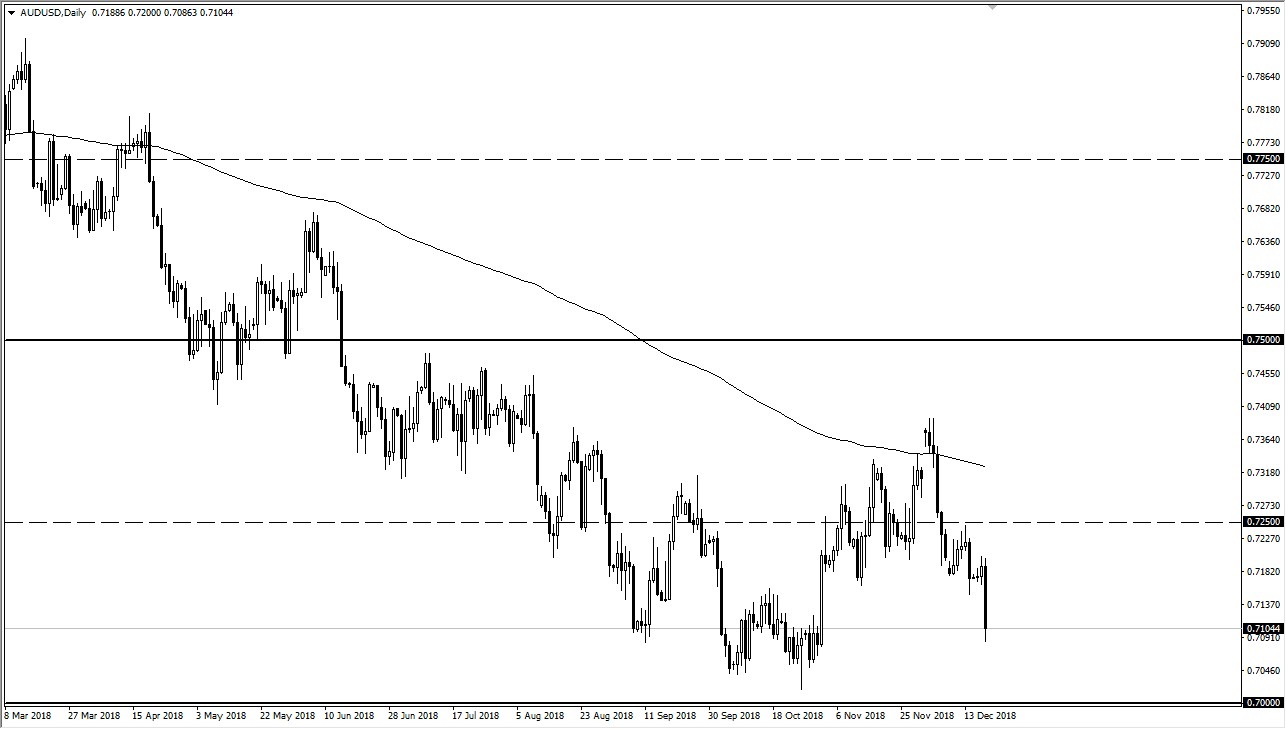

AUD/USD

The Australian dollar fell a bit during the trading session on Wednesday in reaction to a less than dovish anticipated Federal Reserve, and of course a continuation of the tariff or between the United States and China. While things have not necessarily gotten worse on that front, the fact that the Federal Reserve didn’t pull back drastically from its hiking policy has put some downward pressure on commodities in general. With that being the case, it’s likely that the Aussie dollar will eventually go looking towards the 0.70 level, but I also recognize that the 0.7250 level above should be resistance. At this point, I believe that selling short-term rallies should continue to work in this market.