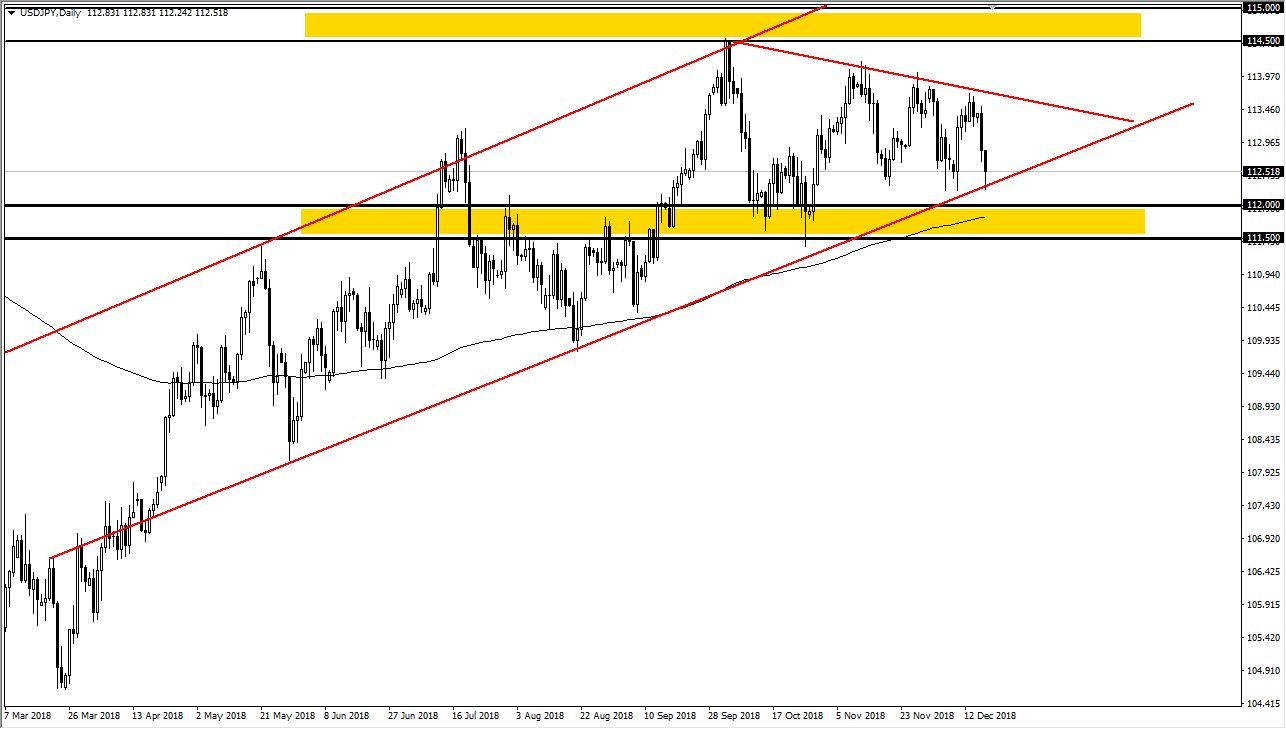

USD/JPY

The US dollar has fallen against the Japanese yen during trading on Tuesday, bouncing from a significant trend line that I have been following for some time. We also have a descending trend line above, so I think at this point we are at a serious point of inflection. Beyond that, there is the 200 day EMA just below, and of course the ¥112 level which has been important support. Above we have the ¥114.50 level, extending towards the ¥115 level. In general, I believe that the market is ready to go back and forth but the statement by Jerome Powell after the interest rate hike will be parsed for clues as to where the Federal Reserve may go in the future. If he sounds dovish, we could get a trend change and start breaking down significantly. Otherwise, if he seems hell-bent on three interest rate hikes next year, then we could make a serious attempt at trying to break above the ¥115 level.

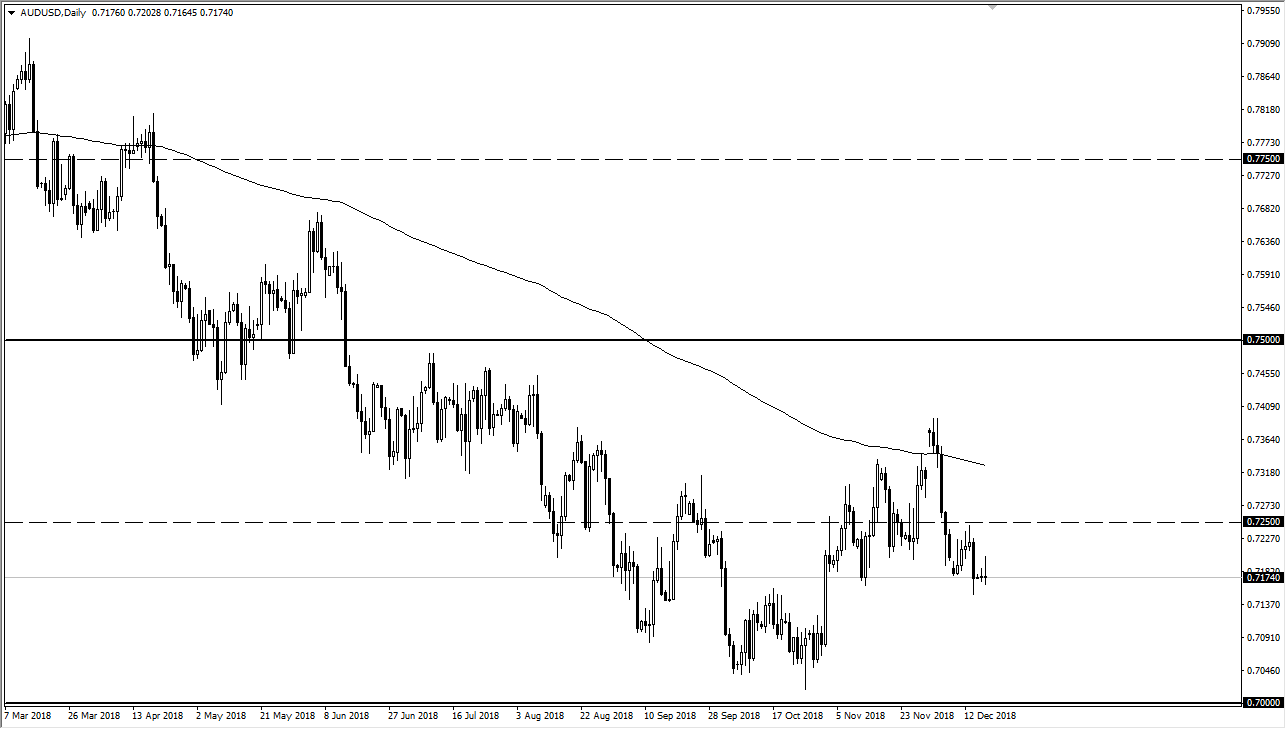

AUD/USD

The Australian dollar has initially rallied during the session on Tuesday but turned around to show signs of exhaustion. At this point, it looks as if rallies will continue to be sold, but of course the statement from Jerome Powell will be much more important, at least as far as where we go in the short term. Beyond that though, we also have the trade war concerns between the United States and China which quite frankly haven’t gotten any better. With the Australian dollar being a proxy for growth in China, and of course poor economic numbers coming out of the country, it makes sense that the Aussie dollar struggles. At this point, I still prefer to fade rallies if I get the opportunity. Otherwise, if we can break above the 200 day EMA, then perhaps the buyers may push towards 0.75 above.