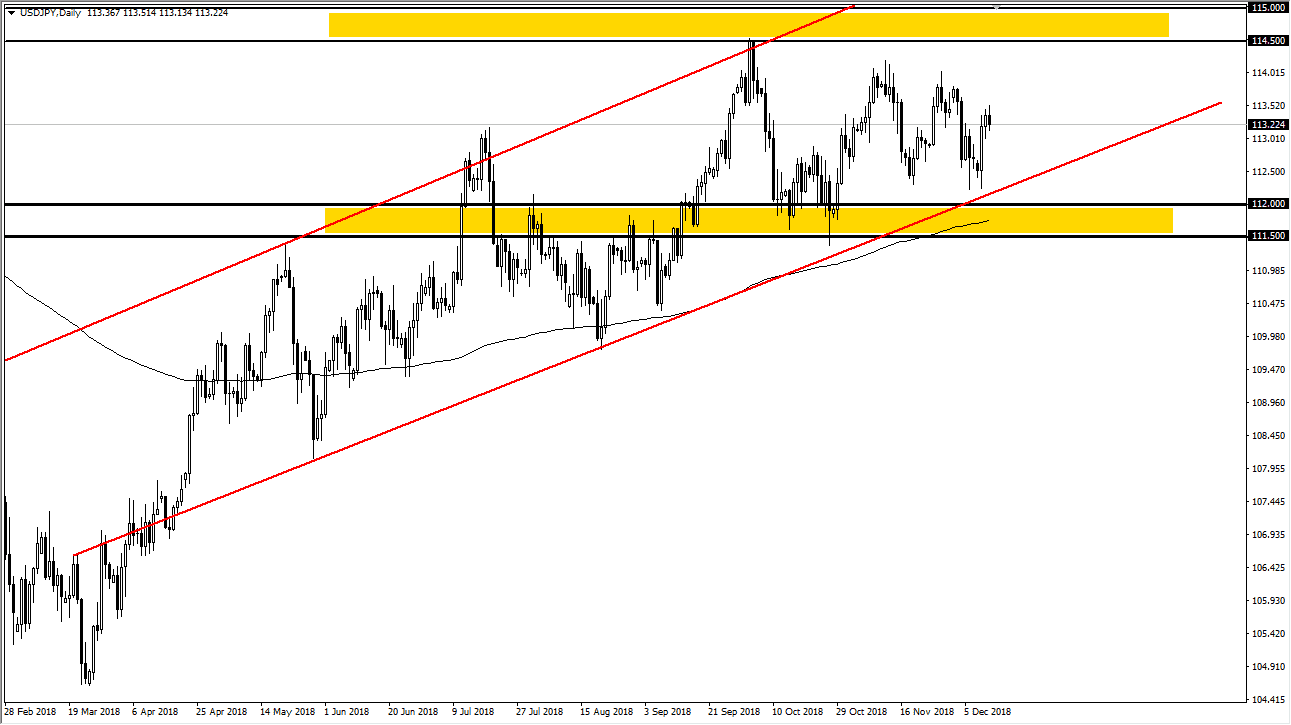

USD/JPY

The US dollar has gone back and forth in very choppy trading during the trading session on Wednesday, as we continue to struggle to extend gains. At the same time, it’s very likely that the support underneath will continue to hold, as we have a nice uptrend line and of course the 200 day exponential moving average just underneath it. I think between now and the end of the year, we will continue to bounce around between ¥112.50, and ¥114. This will be especially true as we get into next week, because we are getting dangerously close to the holidays, and liquidity will just drop off a cliff. If we do break down below the 200 day exponential moving average and the ¥111.50 level, then that would be the beginning of something rather nasty to the downside. Ultimately, a move above the ¥115 level would be very bullish.

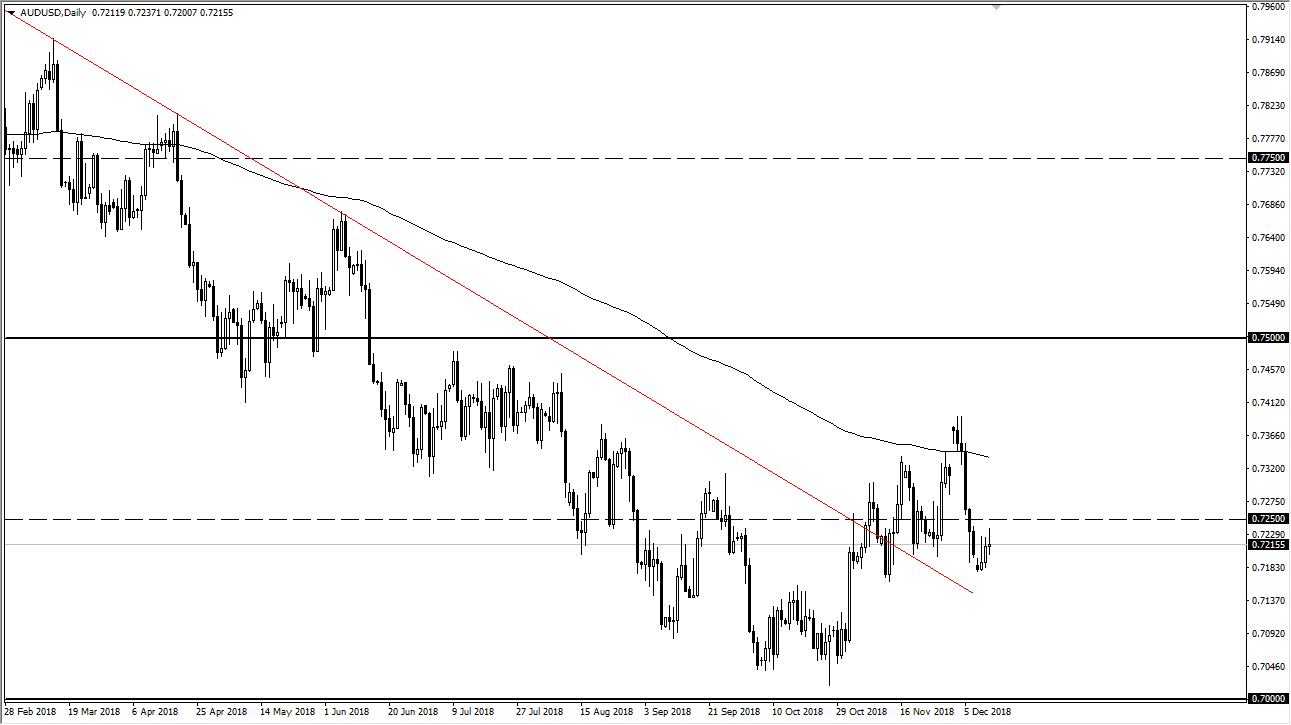

AUD/USD

The Australian dollar continues to struggle to hang onto gains, as we reached towards the 0.75 level, only to turn things around again. I think that selling rallies will continue to be the way forward for the Aussie, as we continue to worry about the US/China trade relations, and even though they are somewhat better at the moment, things are still very tenuous and it’s likely that people will be nervous until we get some type of deal settled, or at least the opportunity to make that deal. I think we are going to have several weeks if not months of trouble in this pair, so I think the 0.75 level above is essentially the “ceiling” for the longer-term outlook of this market. The fact that we cannot hang onto gains speaks volumes at this point.