The New Zealand dollar has the misfortune of being tied to Asia. For quite some time, this has been beneficial for the Kiwi dollar, but I suspect there are probably a lot of painful experiences awaiting the Chinese, not the least of which could come in the form of Donald Trump.

After all, the Chinese aren’t used to dealing with a US Administration that’s willing to push back. This isn’t a political statement, it’s simply a reality. The trade war as of mid-December 2018 doesn’t look like it’s going anywhere, and New Zealand unfortunately is highly levered to Asian growth. When you think of New Zealand, you should think of it as “Asia’s grocery store.” It’s currency is also known to follow commodities in general, and if there is in fact a global slowdown coming, commodity currencies such as the New Zealand dollar will suffer.

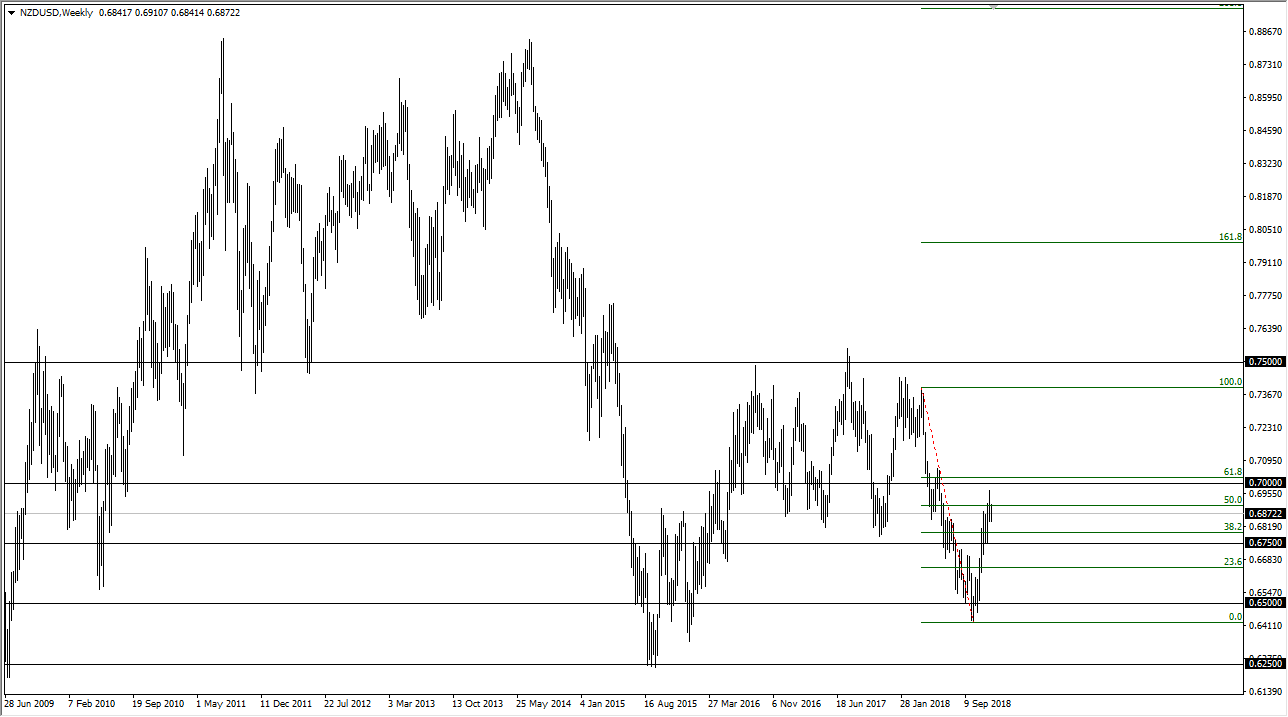

Interestingly enough, as I write this article, the NZD/USD pair is testing the 50% Fibonacci retracement level from a significant drop during the year. I think as trade tensions continue to ratchet up, the New Zealand dollar will fall. I suspect this will continue into the early part of the new year, but the question now will be whether or not the 0.65 level can hold as support, or if we break down to the 0.6250 handle? I think somewhere in that range we will find enough support to turn the market around, but if we get some type of massive global recession, then all bets are off.

At this point, I suspect that a pullback is coming, and probably in the magnitude of several handles over the course of several months. However, somewhere around summer I anticipate that we will find some stability for the Kiwi dollar.