GBP/USD

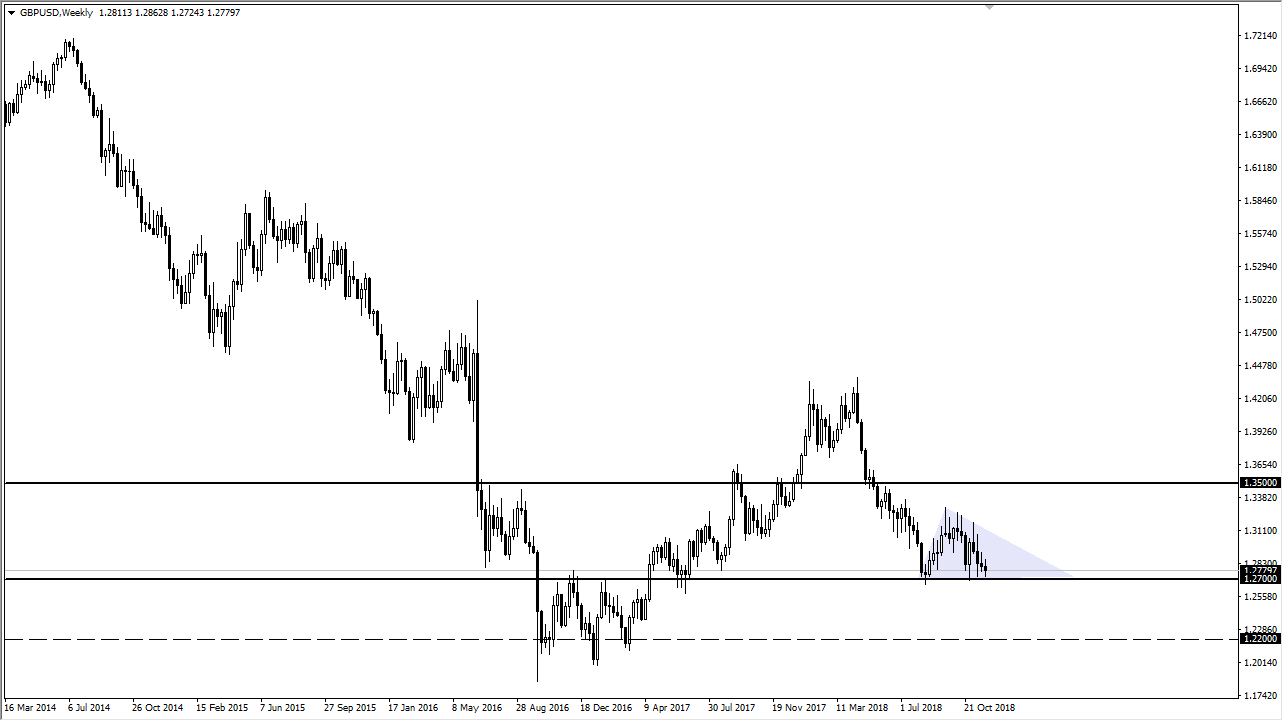

The British pound went back and forth over the last couple of weeks in November, but the one thing that you can see is that we are clearly pressing against major support underneath at the 1.27 level. There is the possibility that we are forming a bit of a descending triangle, which would bode well with the idea of a “no deal Brexit.” After all, Teresa May has come back to London with an agreement with the European Union, but the British Parliament looks as if it has no interest in passing that agreement. She has backpedaled sense, but now we have a situation where the European Union won’t be likely to bend. In other words, the odds of the United Kingdom leaving in March without a deal have it greatly increased.

The potential descending triangle measures for a move down to the 1.22 handle, and I think we could very well see that happen sometime during the month of December. That’s because there is the vote coming out of Parliament early in the month, and if it doesn’t go through, it’s very likely that will be the catalyst to break this thing down. The alternate scenario of course is that there is some type of deal, and I suspect that as soon as there is something signed, the British pound will skyrocket.

This will be helped by the fact that the Federal Reserve suddenly looks as if it’s willing to be a bit more flexible about its interest rate hikes, so therefore the greenback may soften a bit in relation to what it’s been doing over the last several months. This is all about the Brexit and you simply will trade in whichever direction that turns out.