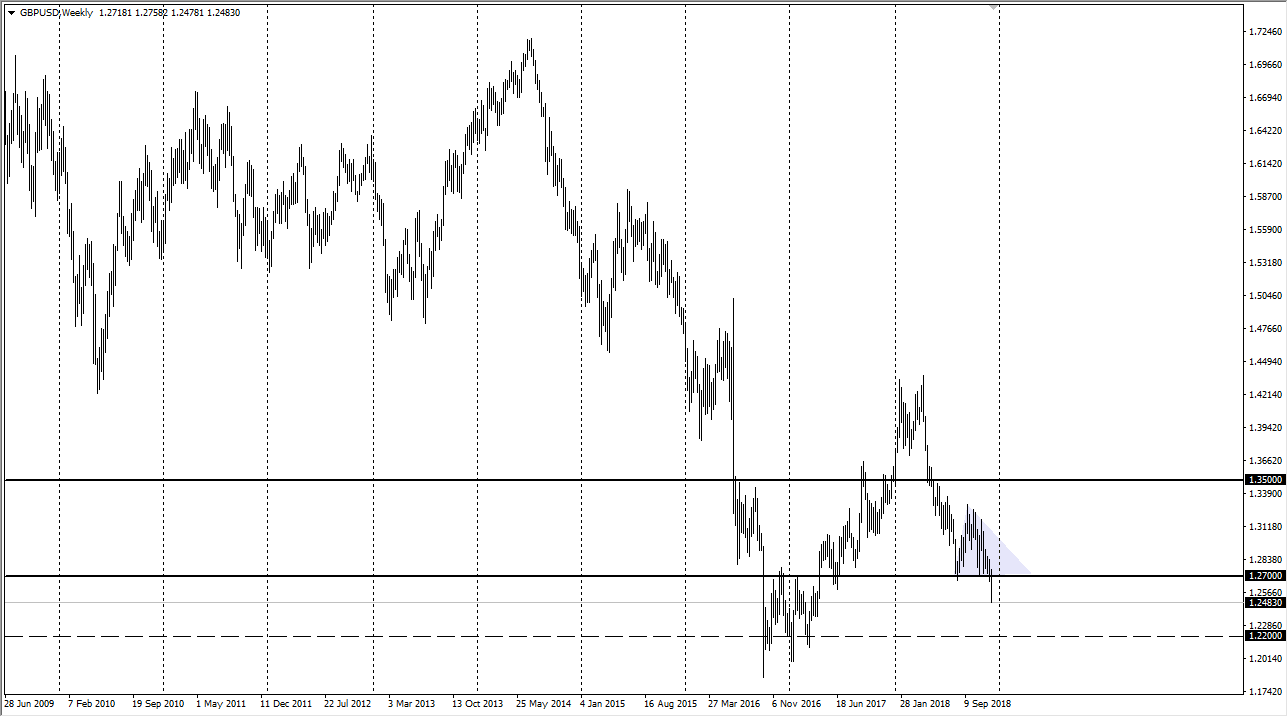

Out of all of the yearly forecasts that I am doing for Daily Forex, this is probably the most difficult to get my head around. I think that will continue to be a major theme of Sterling for the beginning part of 2019. Because of this, I think that it won’t be surprising at all to start the year closer to the 1.22 handle, based upon a descending triangle that was just broken down.

The question then is whether or not we can hold the 1.20 level. That’s an area that has been historically important going back decades, and it was where we bounced from in March 2016. Now that we have the Brexit coming, I think what we are looking at is the market trying to figure out whether or not it is going to be a “no deal Brexit” or not. As things stand in December 2018, it looks very likely that will be the outcome. However, this pair is probably setting up for the trade of a lifetime sometime in 2019.

Once the Brexit is done, and especially if it is a “hard Brexit”, I’m going to keep this screen up on my computer and pay attention to it from a weekly timeframe. I believe somewhere near the 1.20 level we will start to see buyers come back in. These could be the lowest level we see the British pound for years. This is because the initial impulse of the hard Brexit would be to sell this pair. However, if the Federal Reserve steps away from raising interest rates, and perhaps if the world sees the European struggle intensified, the Pound may get a bit of a rally simply for dodging a bullet by being part of the EU. Either way, when you look at this pair over the last four years, you can see that we have dropped from 1.72 down to the 1.20 level. We are massively overextended at this point, and only those who feel that the United Kingdom is going to disintegrate will be left short this market after the breakup. I anticipate that shortly after the breakup is concluded, in theory being handled in March, we will get several weeks of volatility followed by value hunters coming in to pick up the British pound.

If history is any indication, I suspect that at the point in time where it seems like the United Kingdom is going to go into the dustbin of history, at least in the mind of traders, that’s when you should start to initiate small positions to the upside in this pair, adding every time we clear another handle to build a monster position over the second half of the year.