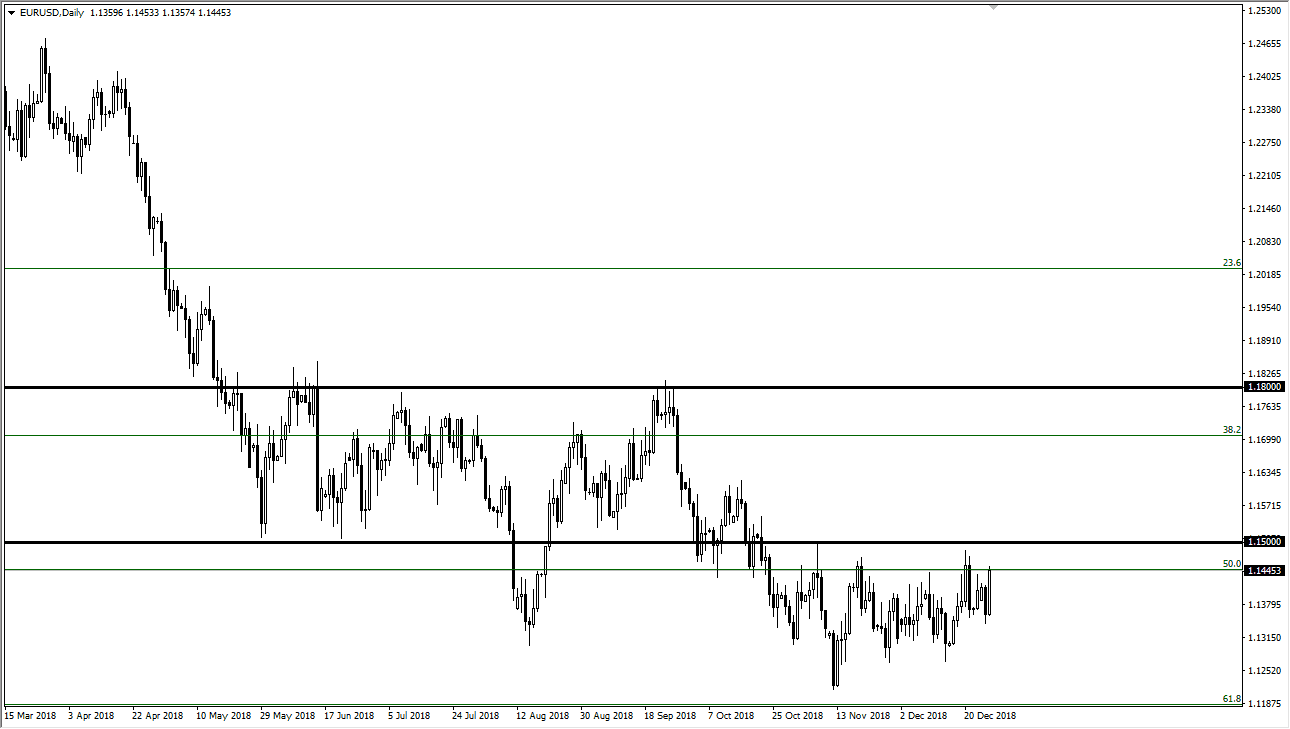

EUR/USD

The Euro rallied significantly against the US dollar during trading in a very strange session. Bond yields fell, meaning that money was flying into the United States at the same time that the US dollar was losing value. The only thing I can write this off to is low liquidity. There is a massive amount of resistance above at the 1.1450 level that extends to the 1.15 handle, so it’s not a big surprise it we failed to break above there. At this point, I think you can expect more of this type of behavior, markets and simply don’t know what to do with themselves. Algorithms are running the market, but the one thing that has been a constant is that the 1.15 level has been too much for the market to overcome. I think that will be very much the case between now and the beginning of next year.

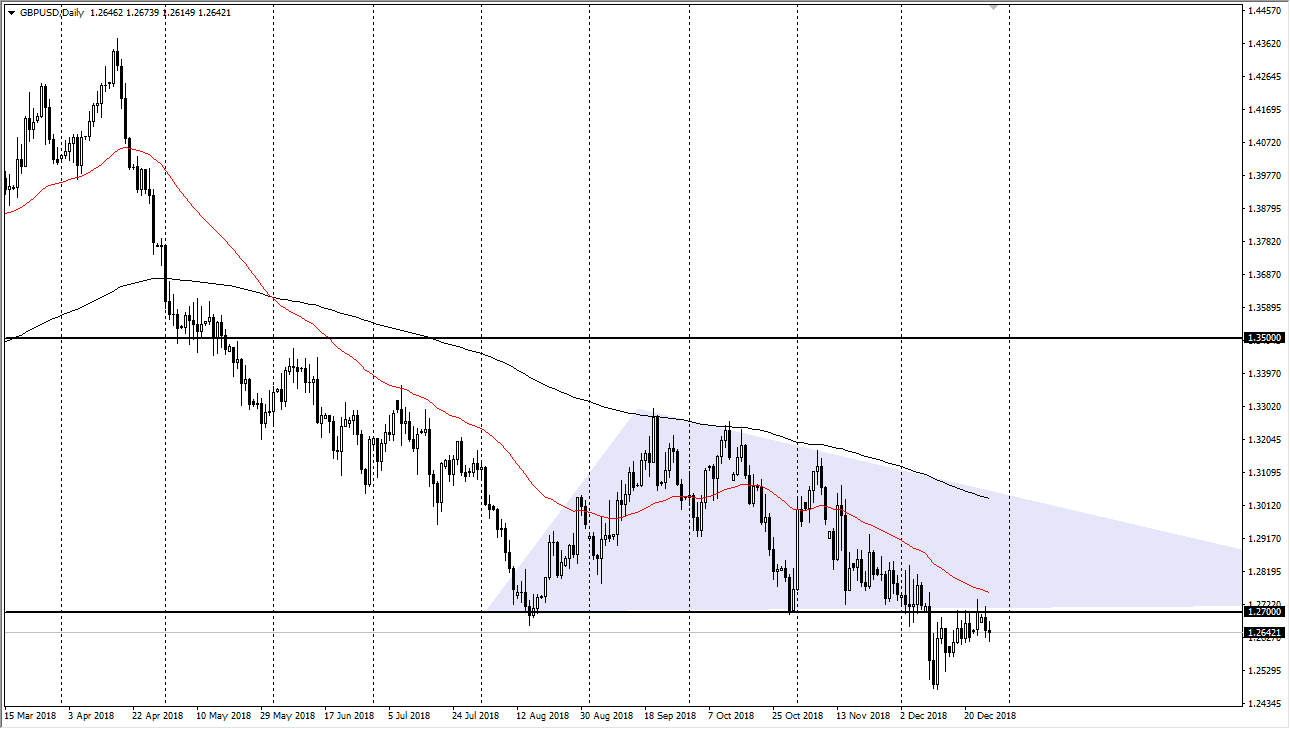

GBP/USD

The British pound has been very choppy during the trading session as well, as we continue to meander below the 1.27 level. That’s an area that of course is going to cause a lot of resistance as it was previous support. Nothing has changed on this chart from what I can see, and we are still worried about the Brexit from what I glean from the chart. The descending triangle signifies that we should be going down to the 1.22 handle given enough time, but it may take some time to get down there. Ultimately, I think that the market will find a way down to that level, via some bad headline or some stupid tweet from somebody in the EU. Ultimately, rallies are to be faded as the 50 day EMA is just above and turning lower, and it’s very likely that we will continue to see a lot of choppiness, but with a downward tilt.