EUR/USD

The Euro initially rallied during the day on Friday, but then broke down rather significantly as a major “risk off” attitude came into play. Ultimately, this bearish candle stick suggests that we are stuck in consolidation, and I think we will continue to see a lot of chop back and forth, and quite frankly this was a very negative looking candle for the end of the year. Typically, you would see some type of short covering rally as we have been so negative for so long going into New Year’s, but the fact that we didn’t tells me that we could very well continue to see a lot of volatility. The 1.12 level underneath is support, while the 1.15 level above is massive resistance. I think at this point, short-term back and forth trading is probably the best way to approach this market.

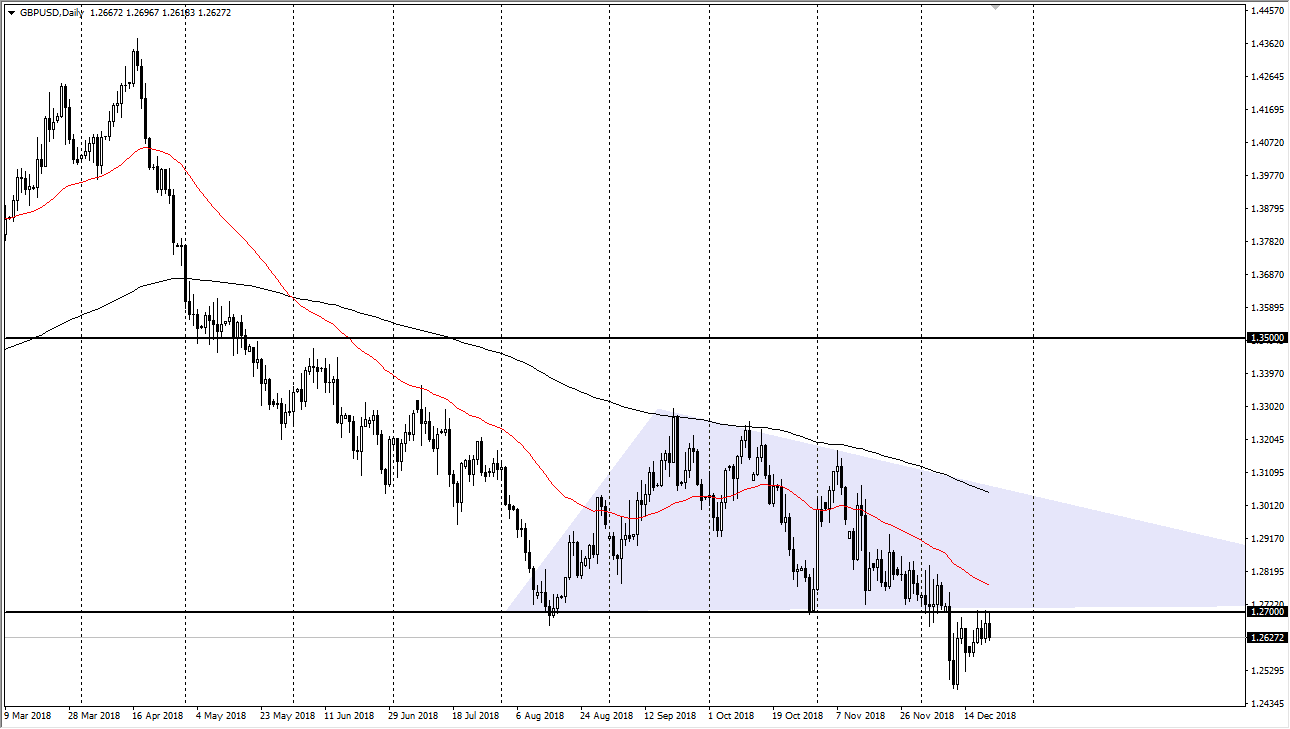

GBP/USD

The British pound held up better than the Euro did during the day but continues to see a lot of resistance at the 1.27 handle. By showing signs of failure at that level again, it continues to show just how difficult it’s going to be for the marketplace to continue going higher than that level. The 50 day EMA is starting to turn to the downside, and I think at this point it’s very likely that we will eventually see sellers step into this market place and push much lower. Based upon the daily chart, we had seen a descending triangle that measures for a move to the 1.22 level, an area that just happens to coincide quite nicely with a structurally important and supportable level on longer-term charts. At this point, I don’t have any interest in buying the pound as long as we still have the Brexit concerns.