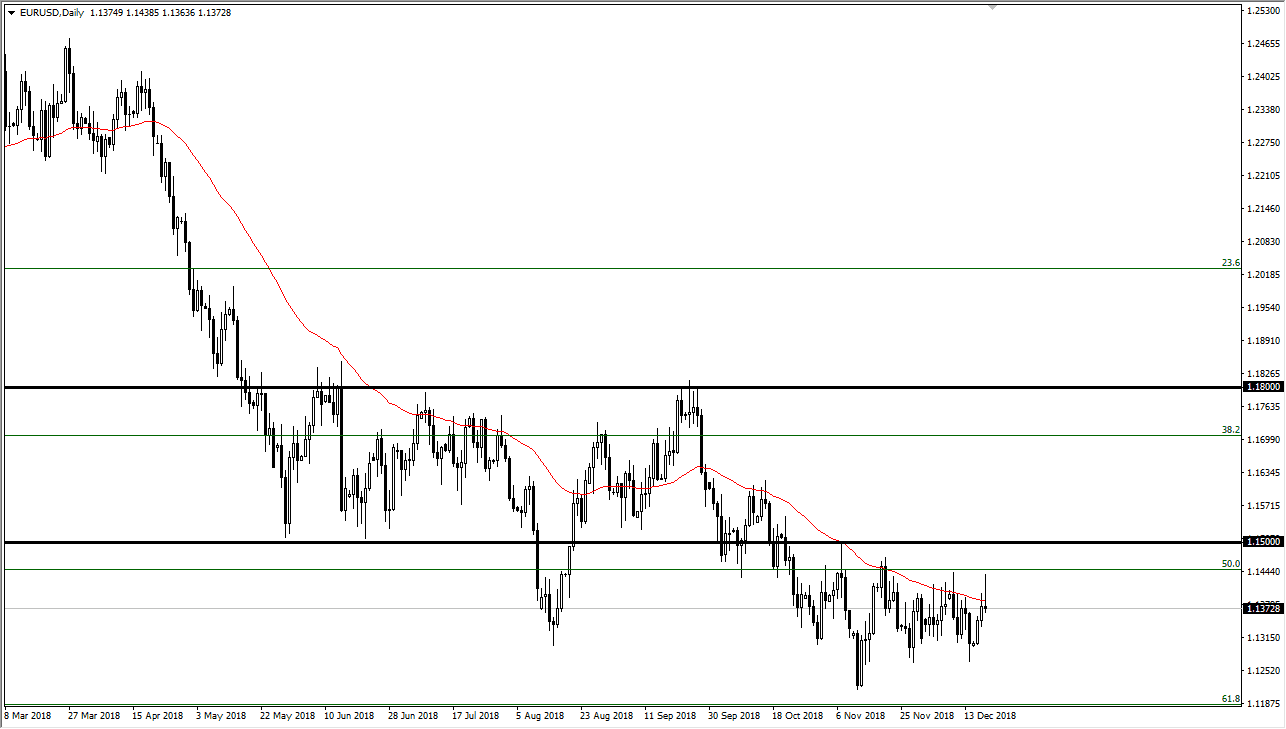

EUR/USD

The Euro initially shot higher during the trading session on Wednesday but turned around of form a massive shooting star after the Federal Reserve came out and tightened interest rates by 0.25%, and also we got the statement that suggested a bit of ambiguity. It looks as if the Euro is going to continue to drop from here, but I don’t expect anything major. I think we are simply underwhelmed at this point and will continue to go back and forth. There are a lot of problems in the European Union, so of course that continues to weigh upon this market as well. As it is the end of the year, it’s very likely that we will go back and forth in a relatively erratic and tight range, simply showing us more of the same that we have seen for a couple of weeks.

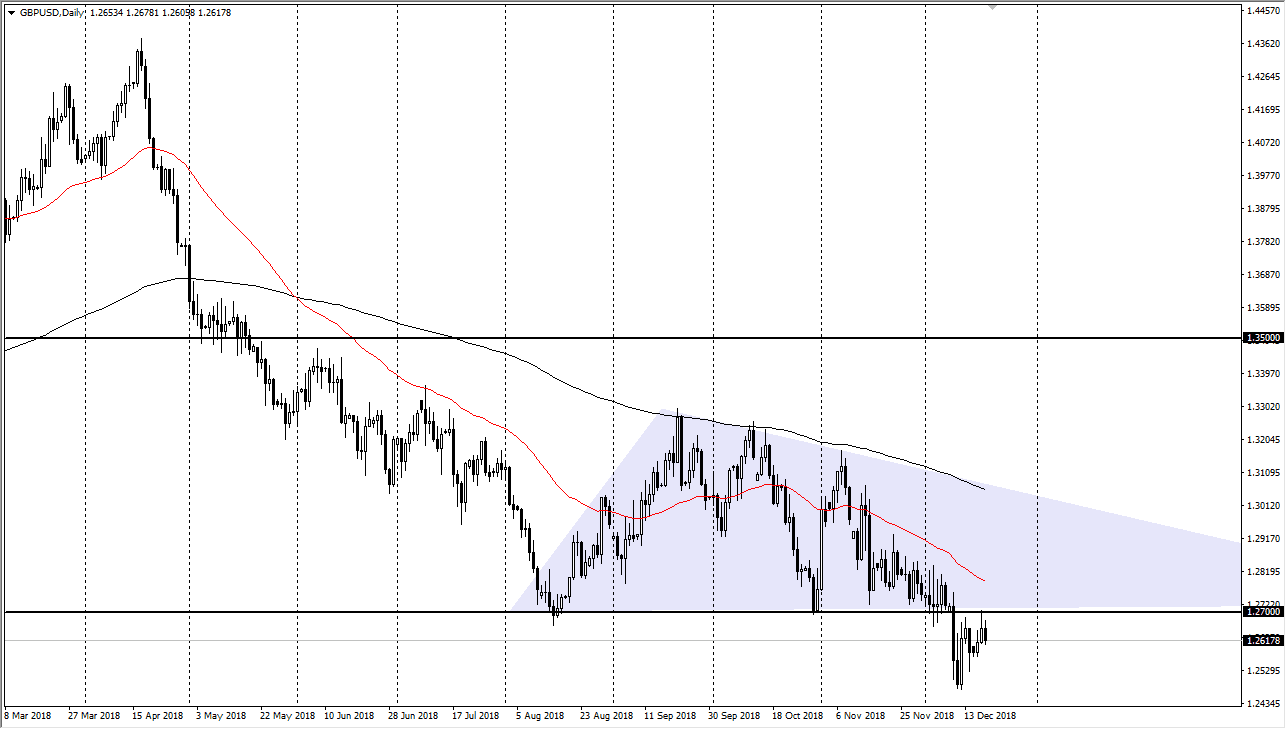

GBP/USD

The British pound fell during the trading session, as we continue to see the 1.27 level offer significant resistance. That resistance was previous support for the massive triangle that we had been in, and that triangle measures for a move down to the 1.22 handle. I think that we will continue to sell rallies, and I believe that it’s only a matter of time before we reach that 1.22 handle. I suspect that will probably be based upon some type of headline shock when it comes to the Brexit, so it will be very sudden. I’m already short of the British pound and have stop losses a bit above the 1.27 handle. If we break above the 1.28 handle, that would clear the 50 day EMA, which would be very bullish, perhaps sending the market towards the 200 day EMA, the black one on the chart.