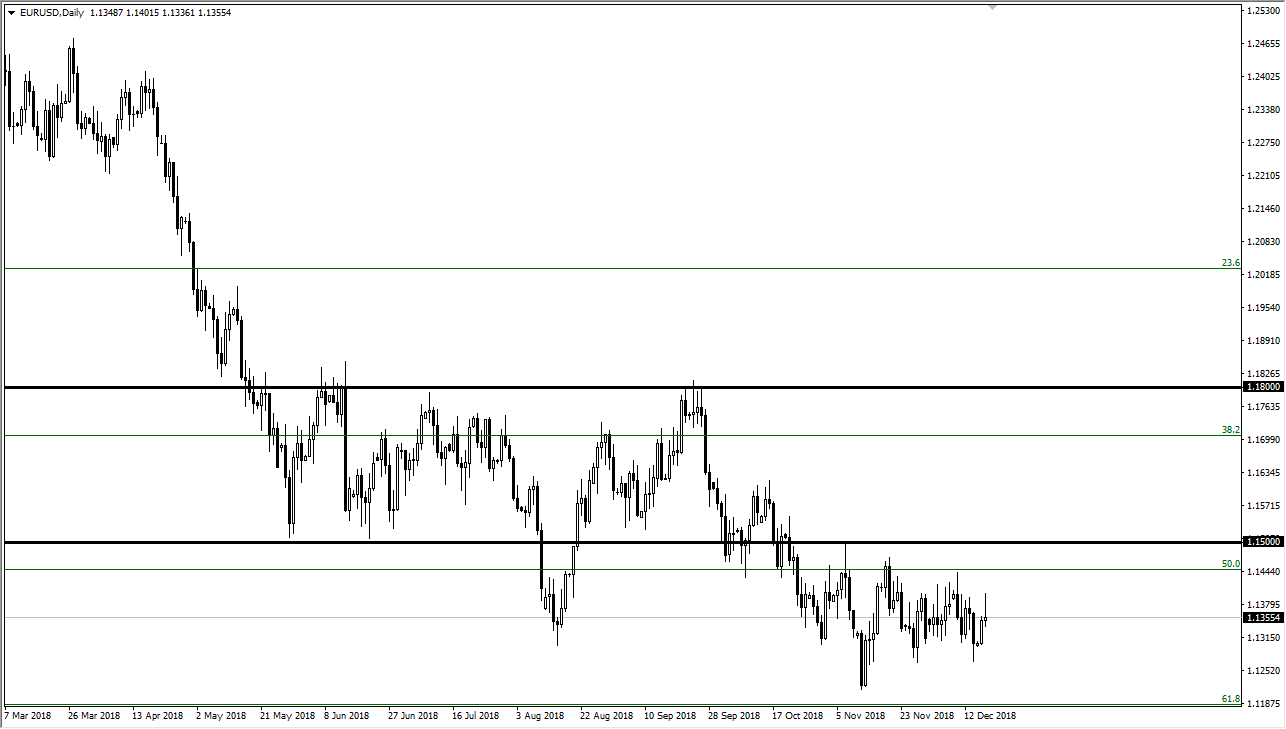

EUR/USD

The Euro rallied initially during trading on Tuesday but gave back quite a bit of gains as the 1.14 level has offered so much in the way of resistance. There is a lot of resistance between there and the 1.15 handle, and as the markets anticipate the Federal Reserve interest rate announcement, it’s likely that although we are going to have an interest rate hike, the reality is that people will be paying more attention to the statement. If the Federal Reserve seems “data dependent” which would be thought of as being dovish, that will send this pair higher. However, if they are bit more hawkish, we will probably turn around and fall from here. Either way, I think that there is high potential for a bit of volatility, but I think the Federal Reserve will probably try to “split hairs”, essentially making the markets it in the same range it has been in for some time.

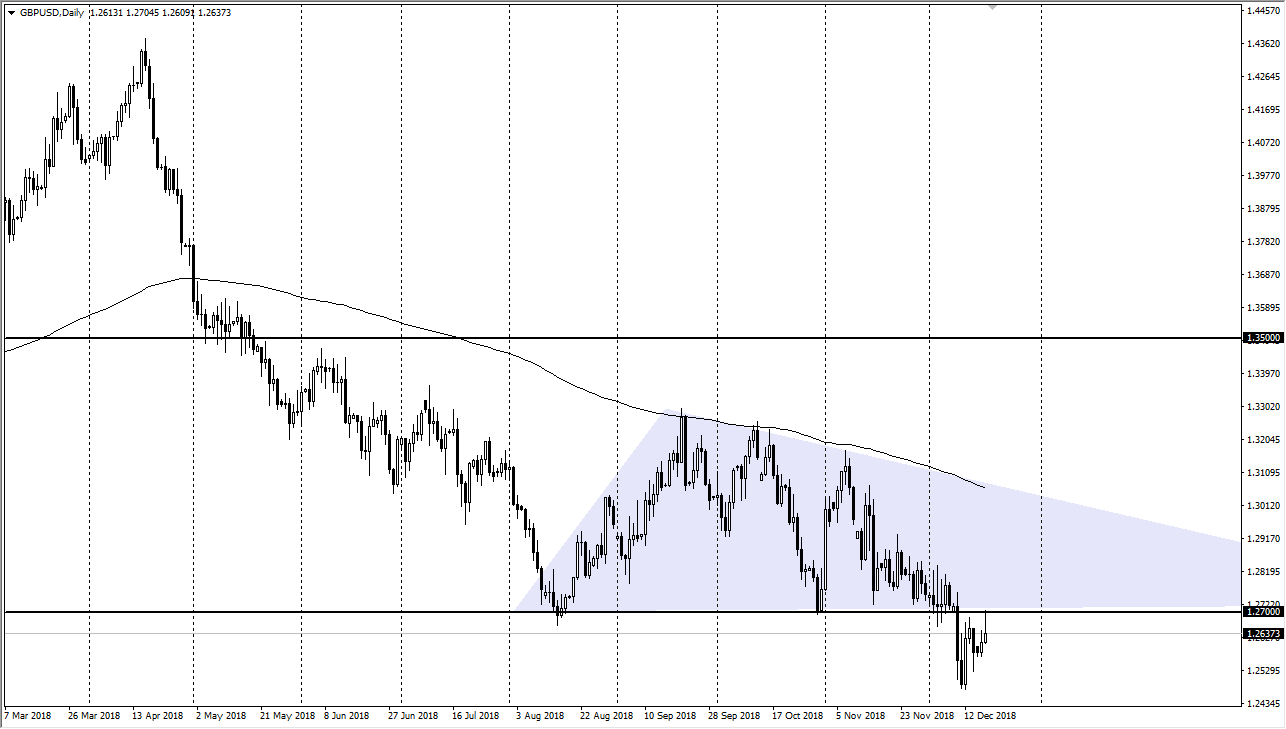

GBP/USD

The British pound initially tried to rally during the trading session on Tuesday as well, but also ran into a lot of resistance at the 1.27 handle. Because of this, the market is very likely to see a lot of volatility but I still think that we will more than likely go lower given enough time. I recognize that the Federal Reserve interest statement will course be paid much attention to during the day on Wednesday, but I think ultimately the Brexit is going to continue to cause issues. That is going to continue to be the main thing that people pay attention to, so I think there is much more concern on the British pound than anything else. Based upon the descending triangle, we should be reaching towards the 1.22 level longer-term.