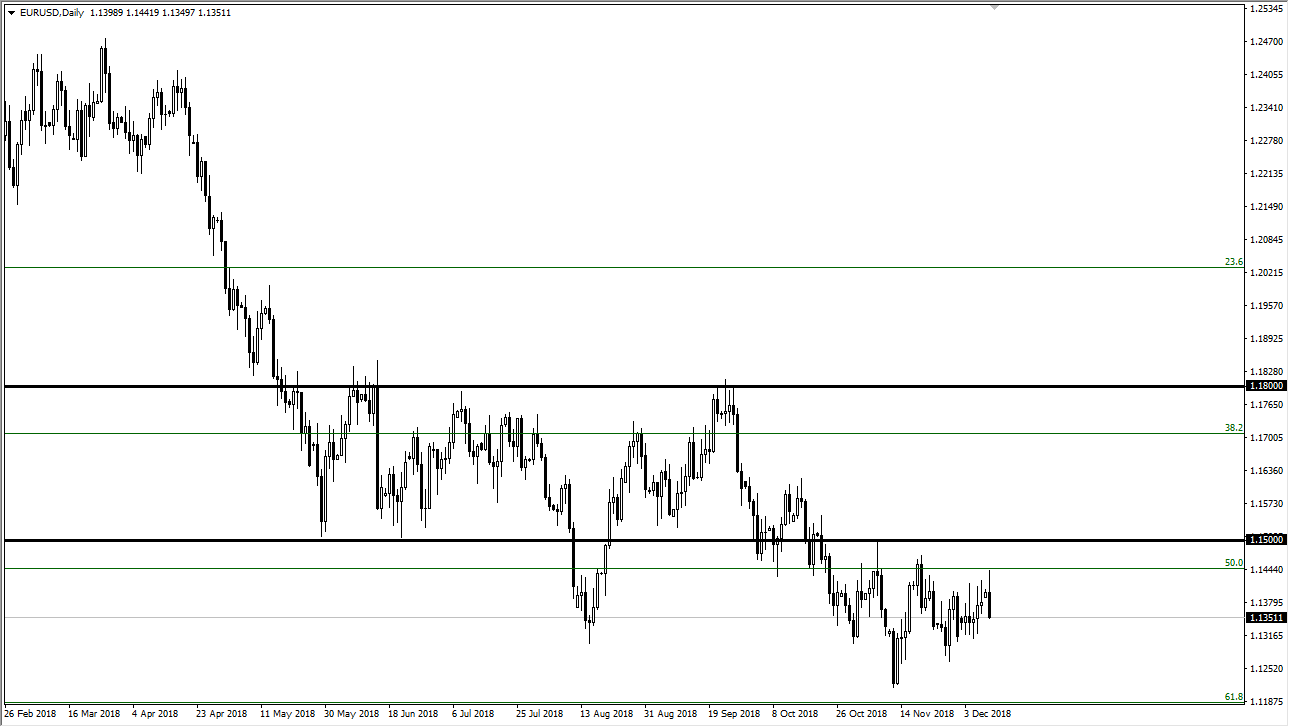

EUR/USD

The Euro initially rallied during the trading session on Monday but found enough resistance at the 1.1450 level to turn things around and fall apart. This of course was in reaction to Teresa May having to step away from voting on the Brexit deal, and that of course is negative for both the EU and the UK. Beyond that, I think that the 1.15 level above is massive resistance, and the candle stick for the day has simply shown yet again. I think the 1.13 level underneath will be supported, but if we break down below there we should go to the 1.11 handle after that. Ultimately, this is a downtrend and I think that continues to be the case, but recently we’ve been sideways, as we try to figure out where to go next. At the end of the year, a lot of traders aren’t willing to put a lot of money to work. Because of this, expect a lot of back and forth.

GBP/USD

The British pound broke down rather significantly during trading on Monday, as Teresa May announced that the Brexit deal wasn’t going to be voted on. By doing so, it shows that the Brexit deal could very well be a thing of imagination, and that of course is going to be very negative for the British pound overall. The down trending line above is the top of the descending triangle, and that means based upon the measurement we could go down to the 1.22 handle after that. I believe that the 1.27 level above is massive resistance as it was previously massive support. I don’t think that it’s going to be able to be bought anytime soon, at least until there’s some type of agreement or at least the semblance of one.