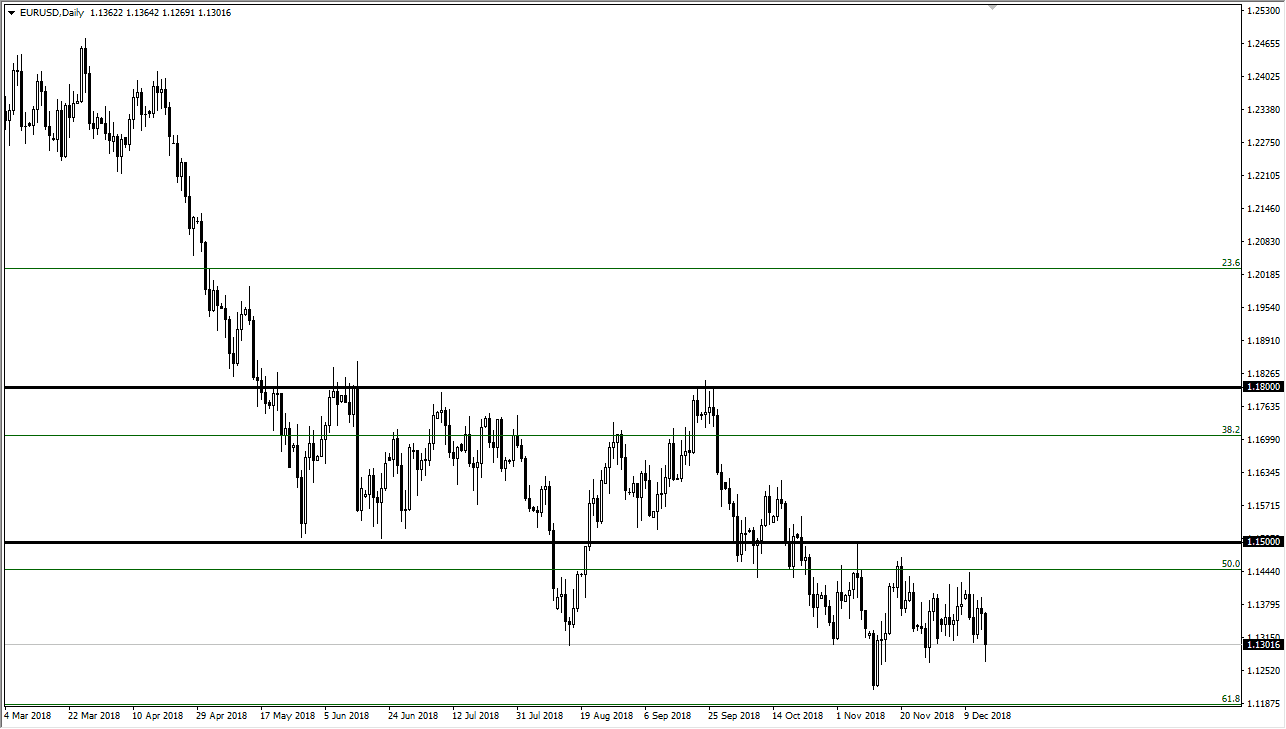

EUR/USD

The Euro fell during trading on Friday, as Mario Draghi was a bit more dovish than anticipated. We have broken below a symmetric triangle though, so in theory we could go lower. I think at this point what we are looking at is more consolidation until New Year’s Day. However, I think there is more of a negative bias to this pair, at least in the short term as there are so many concerns in the European Union, as opposed to the known quantity in the United States, higher interest rates coming. The 1.15 level above should offer massive resistance, so if we were to break above and I think that would be an event to pay attention to, as it could send the Euro higher. Otherwise, the market will continue to be choppy with a lower slant, perhaps down to the 61.8% Fibonacci retracement level below, somewhere near the 1.12 handle.

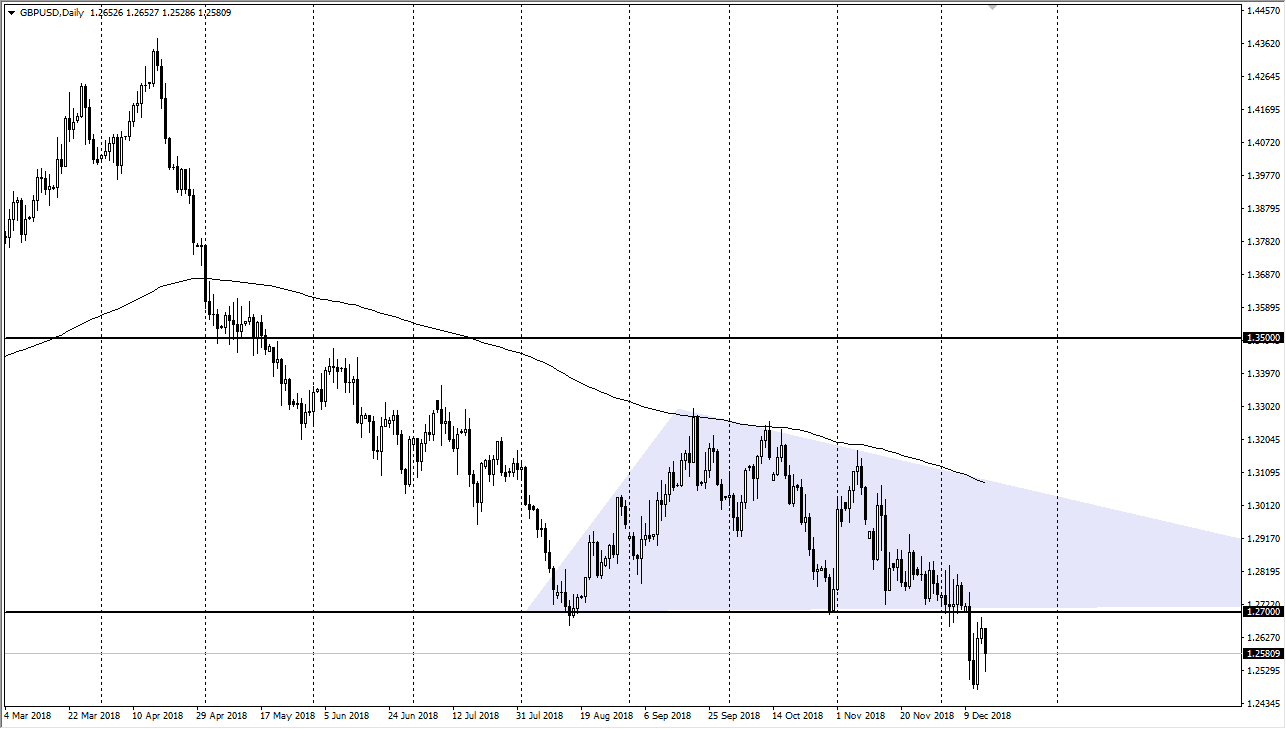

GBP/USD

The British pound fell again during the day on Friday, but I think a bit of short covering ahead of the weekend may have saved it from fall even further. We have failed at the 1.27 level though, so I do think we go lower from here. That was the bottom of the previous descending triangle, and while I did cover much of my shorts, I have one small position ahead of the weekend, so that I can take advantage of any gap lower, or at the very least not get hurt much by a gap higher if good news comes. I think at this point, the British pound simply doesn’t have enough going for it to rally from here, at least not for anything more than a quick bounce. I believe that we continue to see sellers.