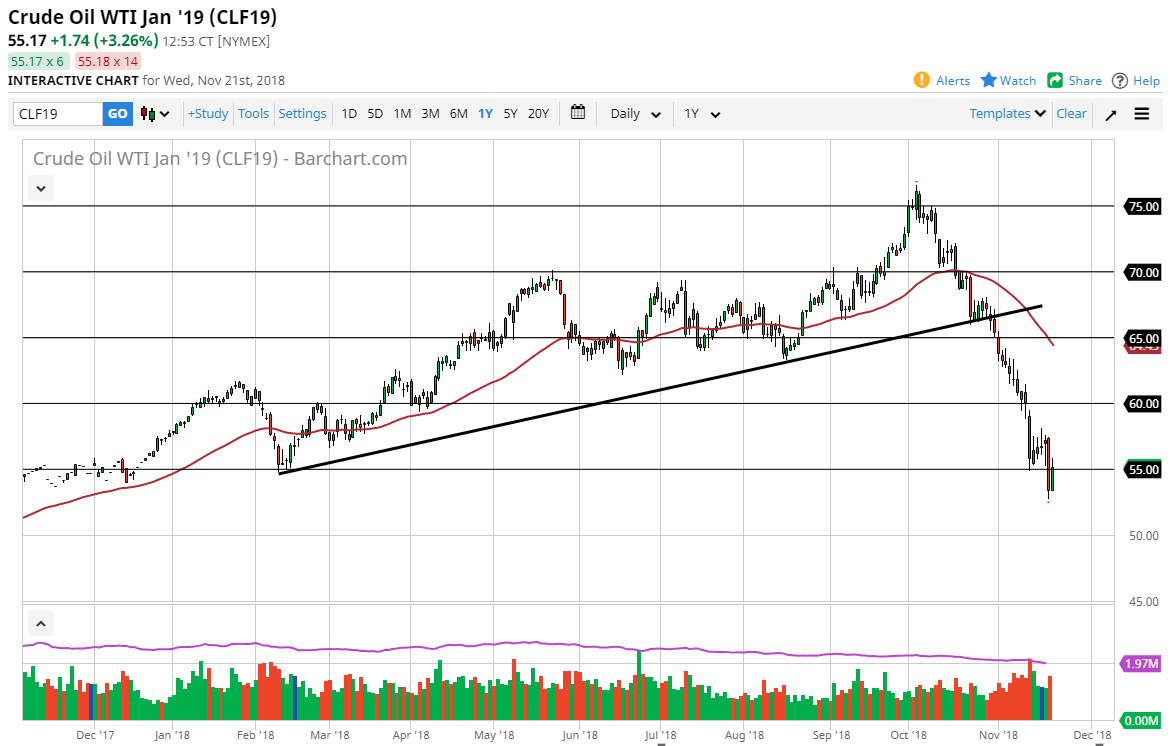

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Wednesday, as we reached towards the $55 level. This is a market that had seen a lot of support at that level, and it now looks like it’s offering a bit of resistance. The massive negative candle on Tuesday is of course assigned that we will probably continue to go lower. If we can break above the top of the Tuesday candle, then the market could go towards the gap just below the $60 level. I think at this point, it’s very likely that WTI Crude Oil markets go down to the $50 level. I believe that part of the rally was probably due to the fact that we were heading into the Thanksgiving holiday, and that liquidity would be drying up overall.

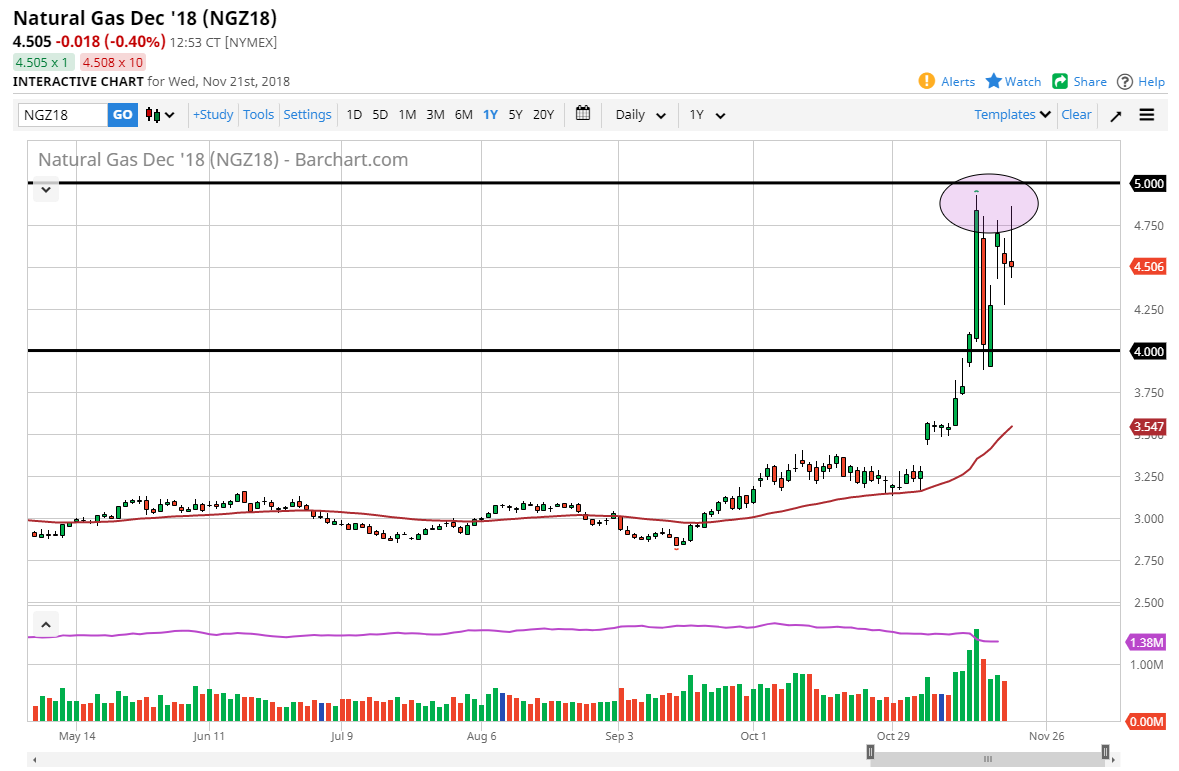

Natural Gas

The natural gas markets rallied initially during the trading session on Wednesday but found plenty of resistance just below the $5.00 level, rolling over to form a nice-looking shooting star. I think that you can only sell this market, on short-term rallies. I think at this point it’s likely that the market will go looking towards the $4.00 level, an area that has offered support more than once. The natural gas markets have gotten far ahead of themselves, and I do believe that there will be plenty of suppliers out there willing to jump into the market and sell at these extraordinarily high levels. I recognize that it is historically a seasonably strong time but given enough time I think that we will go back down to the lower levels. I would sell short-term rallies that show signs of exhaustion, expecting several opportunities.