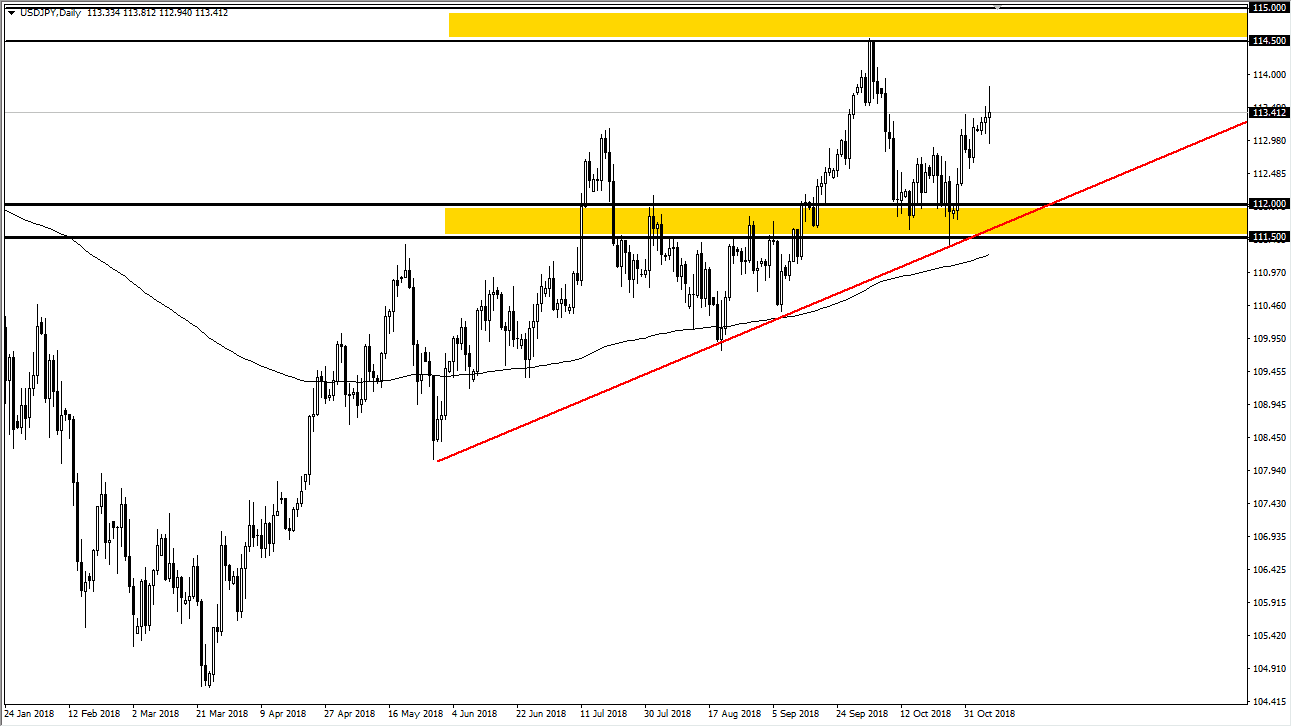

USD/JPY

The US dollar has gone back and forth during the trading session on Wednesday in reaction to the election results, which have been erratic to say the least. Longer-term, we are most certainly in and uptrend and I do think that there is a lot of support underneath. The uptrend line is underneath marked on the chart, and the ¥112 level also offers a lot of support, and I think at this point a pull back to that area should be a nice buying opportunity. If we do break down below the uptrend line, then I think we could go much lower. I think that the ¥114.50 level above is massive resistance, extending to the ¥115 level. Right now, we are basically right in the middle of this area, so I don’t see much of a trade at this particular level.

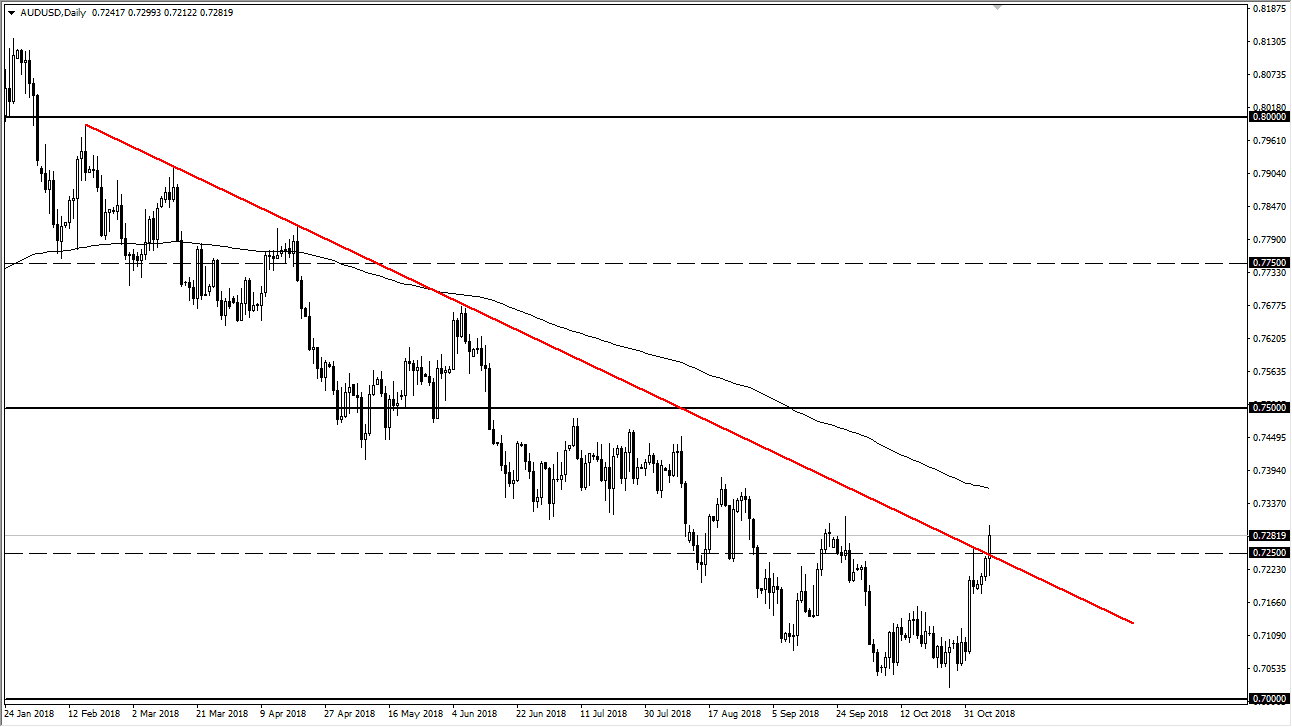

AUD/USD

The Australian dollar initially fell during the trading session on Wednesday, but then turned around to break above the 0.7250 level, and more importantly broke above a downtrend line. I think at this point we could see buyers reenter this market, but I also recognize that all it would take is a headline involving the US/China trade situation that is somewhat negative to turn this market right back around. I think at this point it’s likely that the markets are at least trying to change things, but the 200 day moving average is just above as well, so although I would be willing to buy a pullback that show signs of support at the 0.7250 level, I would keep my position small because these type of trend reversals can often be very noisy. If we break down below the 0.7225 handle, then I think we probably go down to the 0.70 level again.