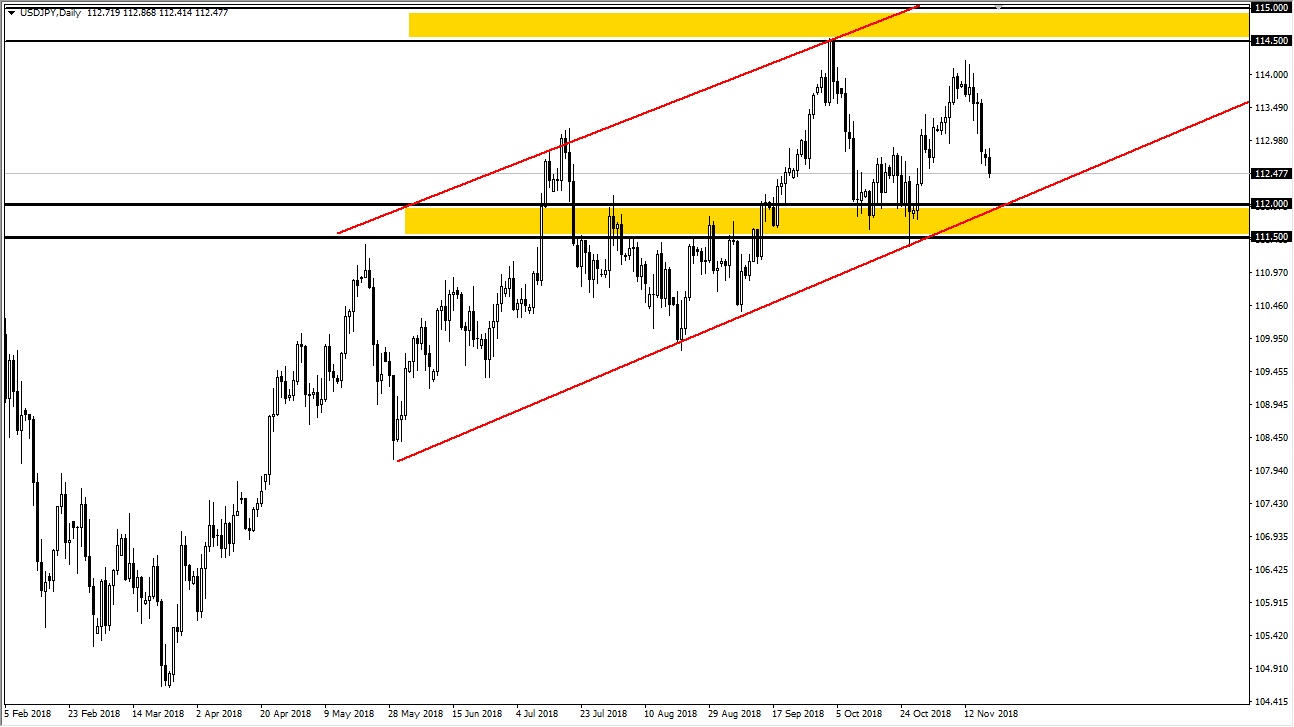

USD/JPY

The US dollar initially tried to rally to kick off the week but then rolled over towards the ¥112.50 level at the end of the day. There is still significant support underneath, based upon the uptrend line, the ¥112 level, and the ¥111.50 level. This is a market that has been an up trending channel for some time, and I think that we will eventually find buyers. Because of this, I’m simply sitting on my hands and waiting for a supportive candle that I can take advantage of. If we do break down below the ¥111.50 level, then I think the market could unwind to the ¥110 level, which would be more than likely in concert with some type of massive amount of negative news as we have so much out there just waiting to happen. At this point though, I believe it’s likely that we are going to find a buying opportunity.

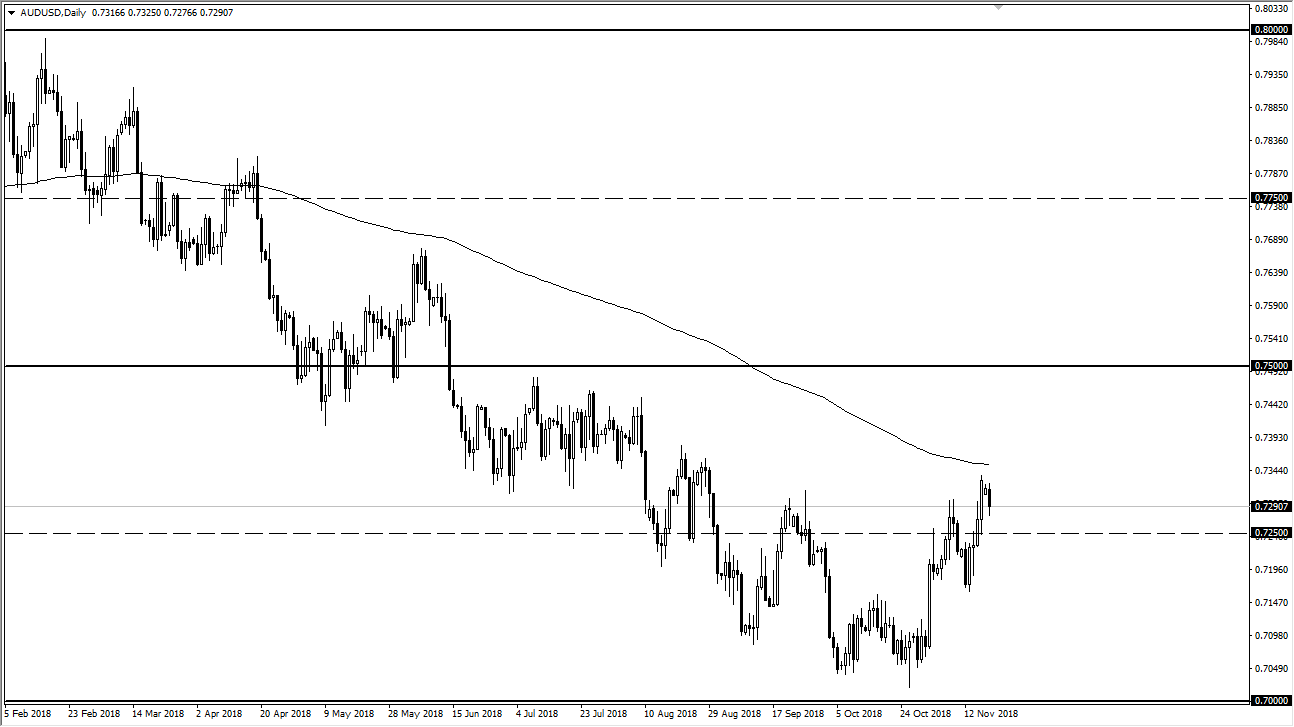

AUD/USD

The Australian dollar fell during the day, falling from the 0.73 level and of course the 200 day EMA plotted on the chart. I think that the Australian dollar will continue to struggle as we have so many issues between the Americans and the Chinese, which seem to be getting worse and not better. At this point it’s likely that we will continue to see some negativity, and even if we were to break above the 200 day EMA, I think that there is a ton of resistance near the 0.75 level. Ultimately, this is a market that I think is flat on its back and has only gotten a bit of a reprieve due to the unfounded hope that something good is going to come out of the meeting in Argentina.