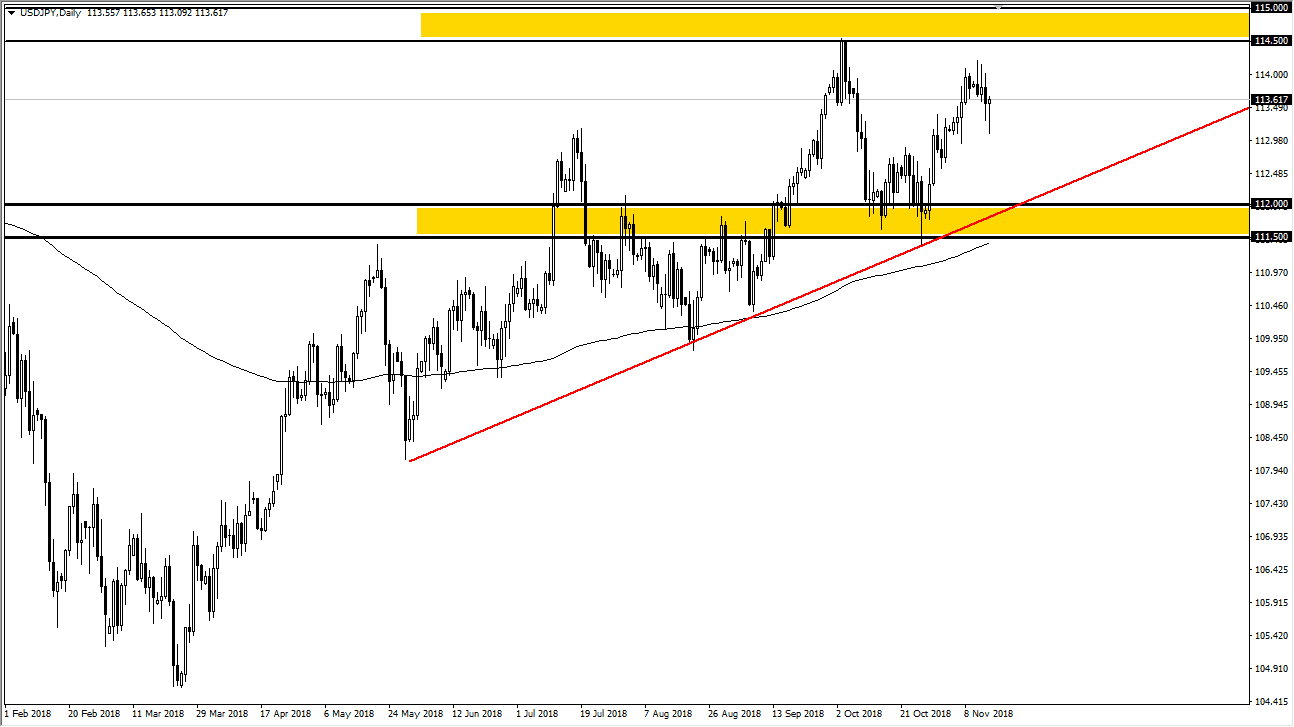

USD/JPY

The US dollar fell initially during trading on Thursday but bounced significantly from the ¥113 level to form a bit of a hammer. It looks as if the market is still trying to fight, and perhaps save itself from breaking down. I do think that there are buyers underneath anyway, and I don’t think that even though we have had a major turnaround over the last several days, I think that the market certainly will favor the US dollar longer-term due to the interest rate differential. However, we have bounced quite hard and there is a certain amount of risk appetite that’s attached to this market. The uptrend line continues offer support, just as the ¥112 level and the 200 day EMA do. Ultimately, I like the idea of buying pullbacks, as we will need to build up a significant amount of momentum to break through the massive resistance above that extends to the ¥115 level.

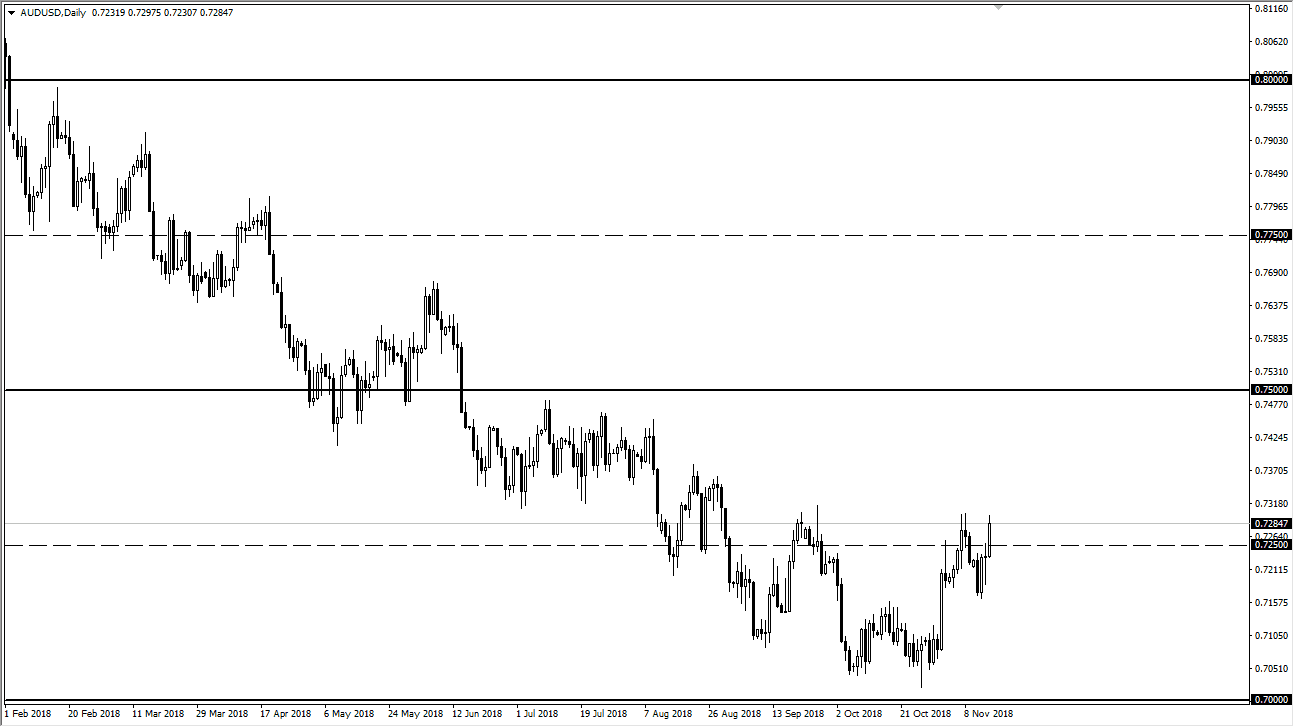

AUD/USD

The Australian dollar has rallied significantly during Thursday as well but continues to struggle with the 0.73 level. We got good employment figures out of Australia, which of course helped the market. We have seen a bit of a more “risk on” move in general later in the day, so that helps the Australian dollar as well. I believe this point the market is still hovering around the 0.7250 level as a general rule, and I recognize that the 0.73 level above is significant resistance. If we were to break above that level, then I think we could go to the 0.75 handle. Overall, if we pull back from here, I think that the 0.7150 level would probably offer support. I also recognize that a break down below there could have this market looking towards the 0.70 level. Without a doubt, the most important thing for this pair is going to be the trade war between the United States and China, so keep an eye on those headlines.