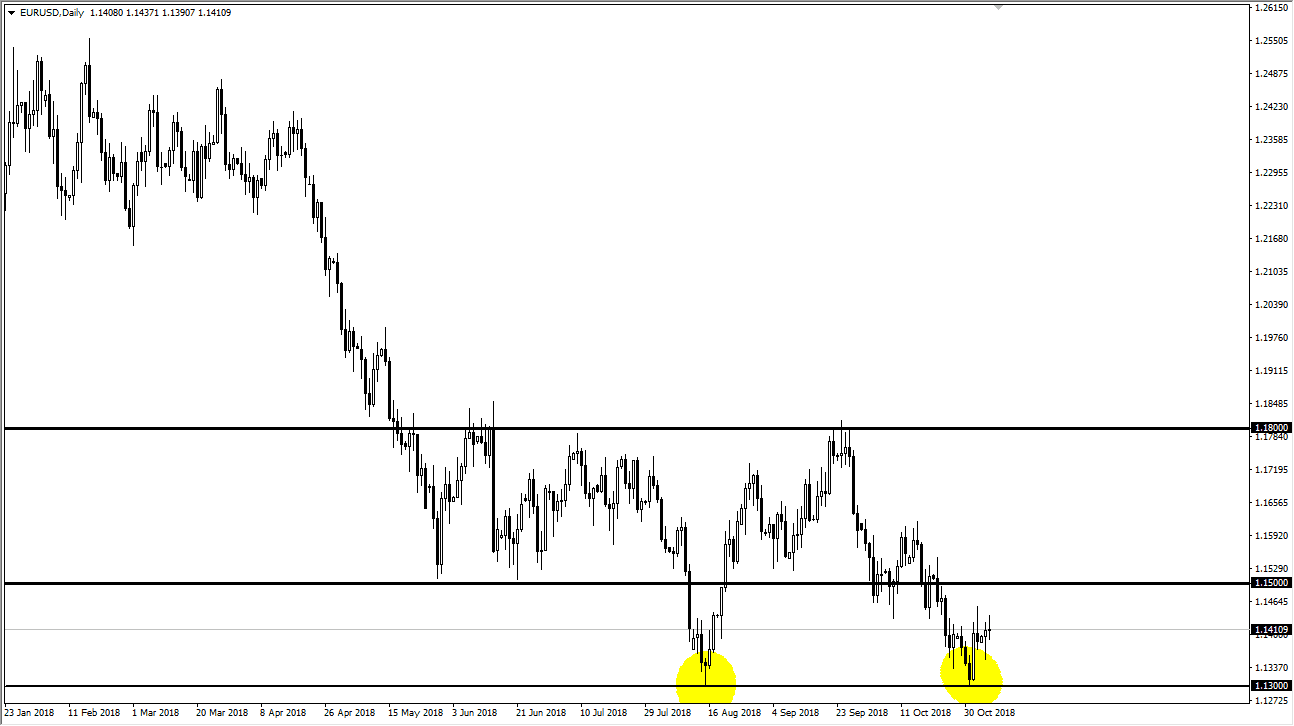

EUR/USD

The Euro has gone back and forth during the trading session on Tuesday, as we have no true directionality until we can get several questions answered when it comes to Italy and the EU, and of course the election results have not come out yet. Overall, we are essentially in the middle of a major consolidation area, which extends from 1.13 on the bottom to the 1.15 level on the top. Looking at this chart, I think that the 1.15 level above should be rather resistive, so even if we do rally from here I think we will struggle. Ultimately, if we did break above the 1.15 level that would be a very bullish sign. I don’t expect that though, and I think we are simply looking for a reason to rollover.

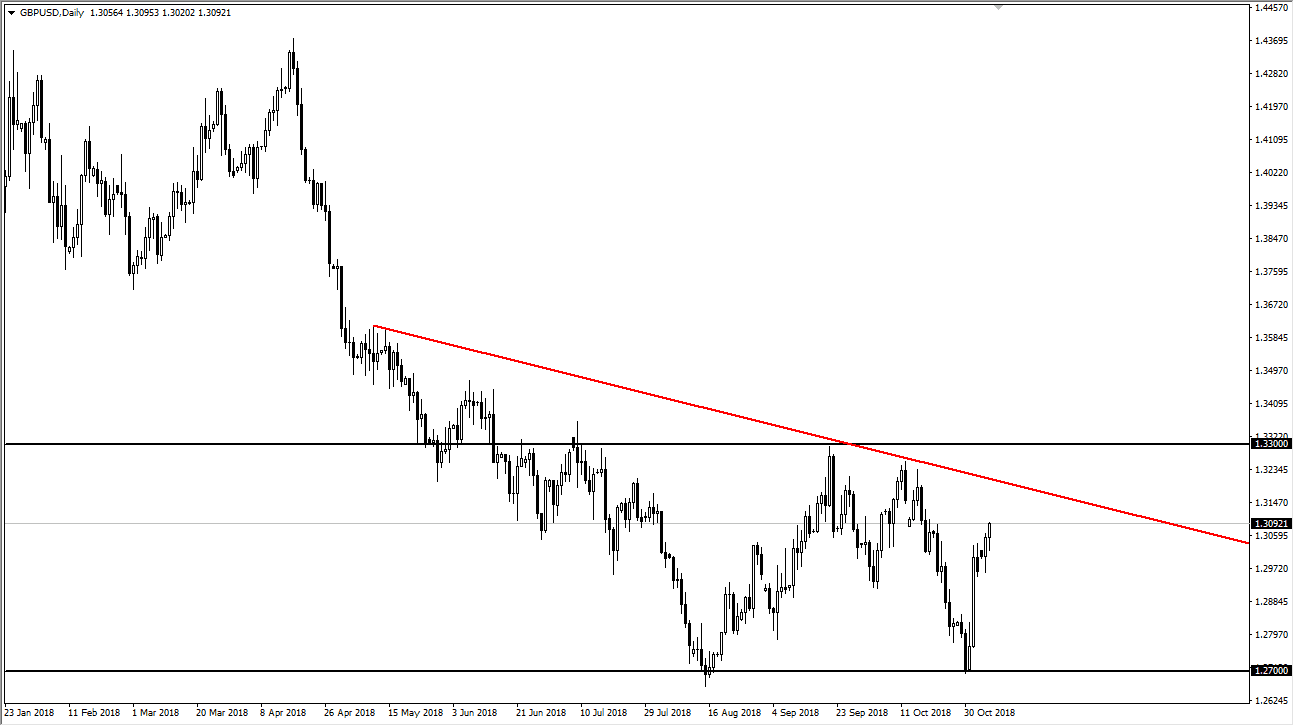

GBP/USD

The British pound continues to be very noisy, as we continue to see a lot of back-and-forth questioning of the Brexit and the overall direction as to where we are going. When we look at the daily chart, we clearly have a downtrend line that should come into play, especially near the 1.32 level where I would expect sellers to come in and push lower. There are a lot of problems with Twitter right now, as headlines have been throwing Algo traders into a tizzy. I think at this point we have gotten so far ahead of ourselves that it’s time to start selling once we get some type of exhaustion. However, if we can break above the 1.33 handle, then that could change enough to send this market much higher, perhaps reaching towards the 1.35 level after that. I do believe that the 1.27 level will hold as support though.