EUR/USD

The currency markets were a bit tough to deal with during the trading session on Monday, as traders await the midterm elections in the United States. As both of the currency pairs in this report feature of the greenback, it makes sense that there is a lot of choppiness. I think at this point though, it’s obvious to see that we are in a downtrend, but we have also bounced from a significant floor in the market near the 1.13 level. In general, I believe that this market stays between the 1.13 level and the bottom and the 1.15 level on the top, so right now we are essentially near “fair value.” I like the idea of selling rallies when you show signs of exhaustion, but you will need to look to short-term charts to achieve this. If we break above the 1.15 level on a daily close, then I’m willing to start buying for a little bit bigger move. The same can be said about selling if we close below the 1.13 handle.

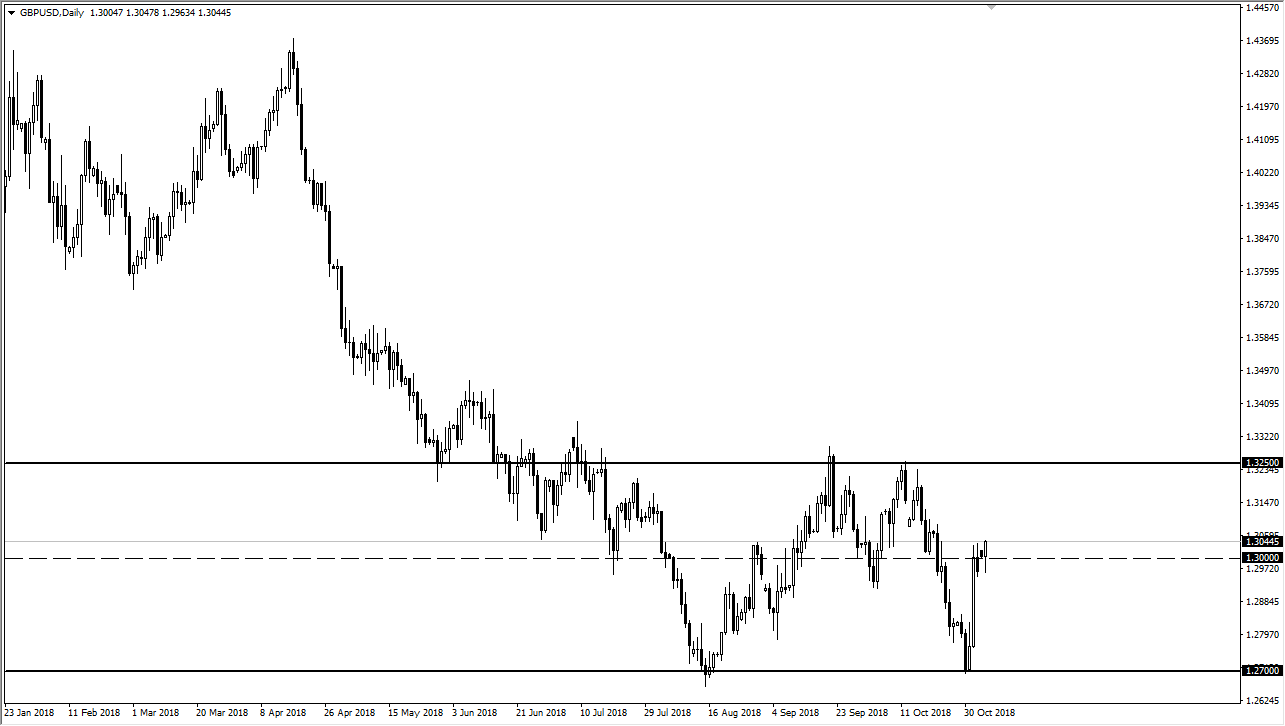

GBP/USD

The British pound initially fell during the day as well but then turned around to rally about 50 pips. This is a market that I think is a bit choppy and difficult to trade, and it is the realm of high-frequency trading at best. We still have problems with headlines coming out on Twitter that cause the British pound move suddenly, so why think that if you are going to trade this market, you need to do so with very little in the way of trading capital. But I think we will probably continue to try to go higher, reaching towards the 1.3250 level, but I also recognize that there is a lot of noise between here and there. Ultimately, if we break down below the lows of the Monday candle, then we could reach down towards the 1.27 level.