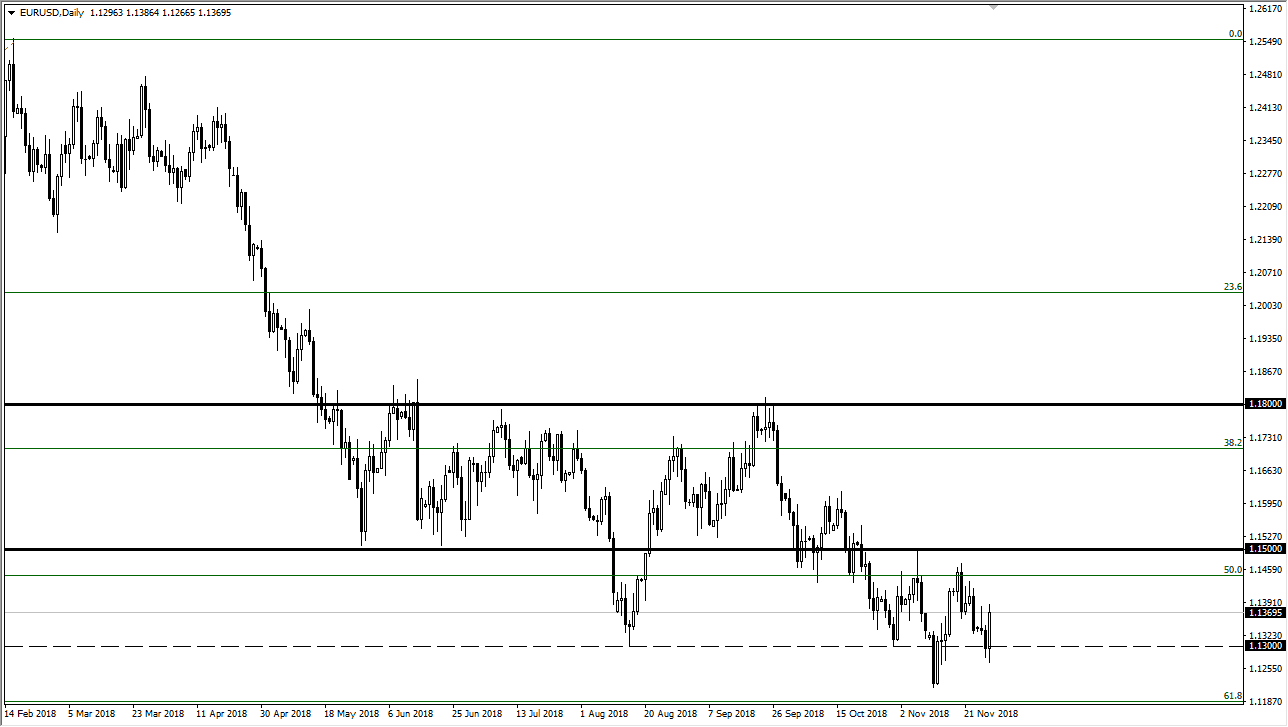

EUR/USD

The Euro rallied rather significantly during trading on Wednesday as Jerome Powell suggested that the Federal Reserve wasn’t set in stone on the idea of multiple interest rate hikes. This of course helped the Euro rallied a bit, but there is still a significant amount of resistance above, so I think that this rally is probably short-lived. After all, there are a lot of reasons to not like the European Union right now as far as the economy is concerned, and I feel it’s only a matter of time before we see more selling pressure. That being said, I would wait for an exhaustive candle to start shorting again as we are already starting to see people on Wall Street question as to whether or not the statement from Jerome Powell was really that dovish.

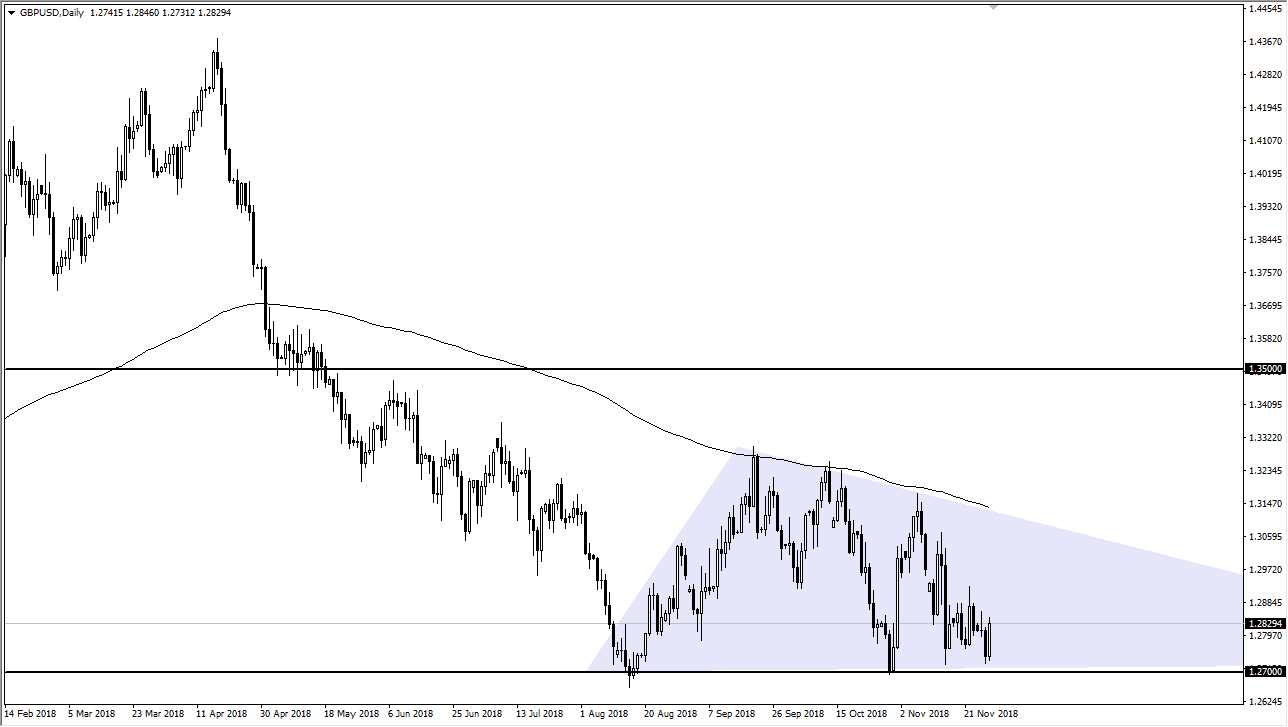

GBP/USD

The British pound rallied as well, and much for the same reason, namely Jerome Powell. We are close to significant support though, so that bounce of course makes sense. The 1.27 level underneath is massive in its importance, and therefore it would not surprise me at all to see a flush if we break down below here. When we do, based upon the triangle which should be something that the entire market is paying attention to, we could go down to the 1.22 handle. At this point, I think that the rallies are still to be sold, even though we’ve had a strong session and of course the Federal Reserve may not be as hawkish as once thought. The 200 day EMA is just above and hugging the downtrend line, so I think that it makes sense that the market will continue to struggle above there.