EUR/USD

The Euro rallied initially during the trading session on Wednesday but rolled over to form a bit of a shooting star. The market looks as if it is ready to roll over again, perhaps reaching down to the 1.13 level underneath. That’s an area that has been of interest lately, and I recognize that the market is probably going to continue to see resistance from the 1.1450 level extending to the 1.15 level after that. If we were to break above the 1.15 handle, that would be a very bullish sign. However, I don’t think that’s going to happen and therefore I think we are better off selling short-term rallies that show signs of exhaustion. The very bearish candle stick that we had seen form for the session on Tuesday suggests that we still have plenty of sellers up there. Wednesday seems to have been a confirmation of that.

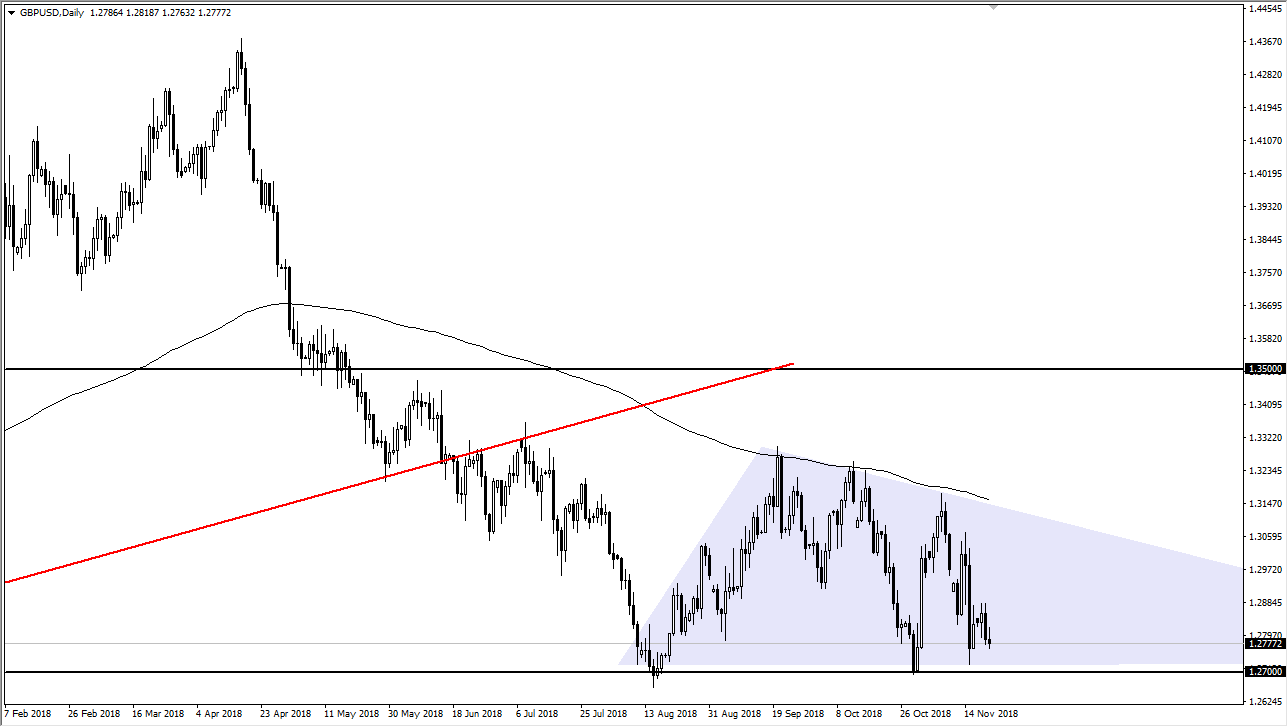

GBP/USD

The British pound initially rallied during the session on Wednesday, but turned around to break a bit lower, reaching towards the 1.2750 level. I think we will reach down to the 1.27 level underneath eventually, and then perhaps even go as low as 1.22 as based upon the shape of the triangle. I think at this point it makes more sense to sell short-term rallies that show signs of failure. I don’t have any interest in trying to buy this pair, at least not until we get some type of resolution to the Brexit issues. I don’t think that’s coming in the short term, so I do think it’s only a matter of time before you break down. That breakdown should be a nice opportunity, and I think more money will go flowing towards the greenback at that point.